Volume profile reading provides a detailed view of market activity by displaying the amount of volume traded at specific price levels, revealing key support and resistance zones. Price action analysis focuses on interpreting candlestick patterns and market structure to understand trader sentiment and potential price movements. Explore how combining volume profile with price action can enhance your trading strategy for more precise entries and exits.

Why it is important

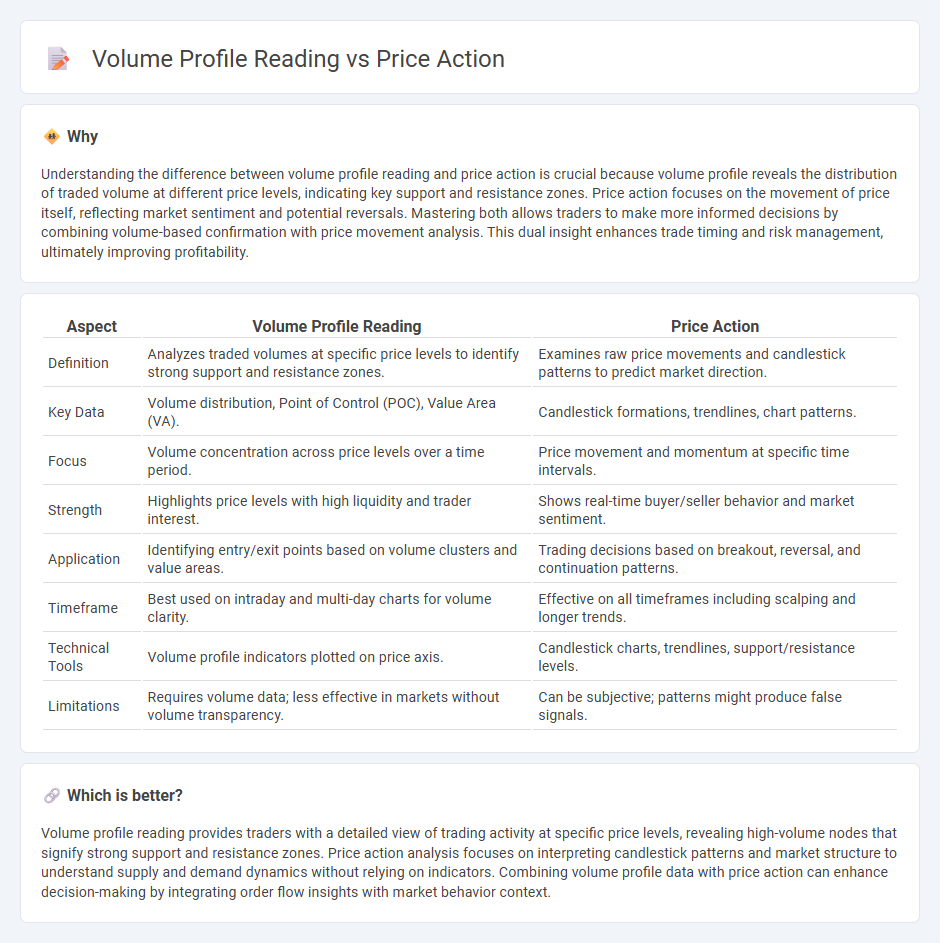

Understanding the difference between volume profile reading and price action is crucial because volume profile reveals the distribution of traded volume at different price levels, indicating key support and resistance zones. Price action focuses on the movement of price itself, reflecting market sentiment and potential reversals. Mastering both allows traders to make more informed decisions by combining volume-based confirmation with price movement analysis. This dual insight enhances trade timing and risk management, ultimately improving profitability.

Comparison Table

| Aspect | Volume Profile Reading | Price Action |

|---|---|---|

| Definition | Analyzes traded volumes at specific price levels to identify strong support and resistance zones. | Examines raw price movements and candlestick patterns to predict market direction. |

| Key Data | Volume distribution, Point of Control (POC), Value Area (VA). | Candlestick formations, trendlines, chart patterns. |

| Focus | Volume concentration across price levels over a time period. | Price movement and momentum at specific time intervals. |

| Strength | Highlights price levels with high liquidity and trader interest. | Shows real-time buyer/seller behavior and market sentiment. |

| Application | Identifying entry/exit points based on volume clusters and value areas. | Trading decisions based on breakout, reversal, and continuation patterns. |

| Timeframe | Best used on intraday and multi-day charts for volume clarity. | Effective on all timeframes including scalping and longer trends. |

| Technical Tools | Volume profile indicators plotted on price axis. | Candlestick charts, trendlines, support/resistance levels. |

| Limitations | Requires volume data; less effective in markets without volume transparency. | Can be subjective; patterns might produce false signals. |

Which is better?

Volume profile reading provides traders with a detailed view of trading activity at specific price levels, revealing high-volume nodes that signify strong support and resistance zones. Price action analysis focuses on interpreting candlestick patterns and market structure to understand supply and demand dynamics without relying on indicators. Combining volume profile data with price action can enhance decision-making by integrating order flow insights with market behavior context.

Connection

Volume profile reading reveals the distribution of traded volume at specific price levels, highlighting areas of support and resistance that are key to price action analysis. Price action reflects the market's response to these volume clusters, showing how buyers and sellers interact at critical zones. Understanding this connection enables traders to anticipate potential reversals or continuations based on volume-supported price movements.

Key Terms

Support and Resistance

Price action and volume profile reading each offer valuable insights into support and resistance levels, with price action emphasizing candlestick patterns and market sentiment, while volume profile highlights the distribution of traded volume at specific price points, revealing strong areas of buying and selling interest. Combining these methods provides a more comprehensive understanding of market dynamics and potential reversal zones. Explore deeper to master support and resistance analysis through integrated price action and volume profile strategies.

Order Flow

Order flow analysis integrates price action and volume profile readings to reveal real-time market participant behavior, helping traders identify supply and demand zones with precision. Volume profile complements price action by mapping traded volume at specific price levels, enhancing understanding of market liquidity and potential reversals. Explore how mastering order flow techniques can refine your trading strategy and optimize entry and exit points.

Value Area

Value Area in volume profile reading highlights the price range where approximately 70% of trading volume occurs, providing key insights into market acceptance and liquidity zones. Price action analysis focuses on price movements and patterns without volume context, which may overlook these critical value-based support and resistance areas. Explore how integrating Value Area with price action can enhance trading strategy precision and market understanding.

Source and External Links

What is Price Action? (2025) A Complete Trader's Guide - Price action is the analysis of raw price movements over time, providing traders with insights into market supply and demand, sentiment, and potential future trends without relying on lagging indicators, thus helping in precise trade timing and decision-making.

What Is Price Action? - Price Action Trading Introduction - Price action trading is a method focusing solely on the actual price movements over time, ignoring fundamental factors and derivative indicators, to predict the future direction of securities in highly liquid and volatile markets.

Price Action Trading Explained - Learn To Trade The Market - Price Action Trading (PAT) means making all trading decisions based exclusively on price charts without lagging indicators, as price movements reflect all factors including economic data and news, enabling traders to devise high-probability strategies from pure market data.

dowidth.com

dowidth.com