Tokenized assets represent ownership through digital tokens on a blockchain, enabling faster, more transparent trading compared to traditional physical commodities like gold or oil, which require storage and logistical management. Tokenization enhances liquidity and accessibility by fractionalizing high-value assets, reducing barriers for investors worldwide. Explore how tokenized assets are revolutionizing trading and investment strategies in modern markets.

Why it is important

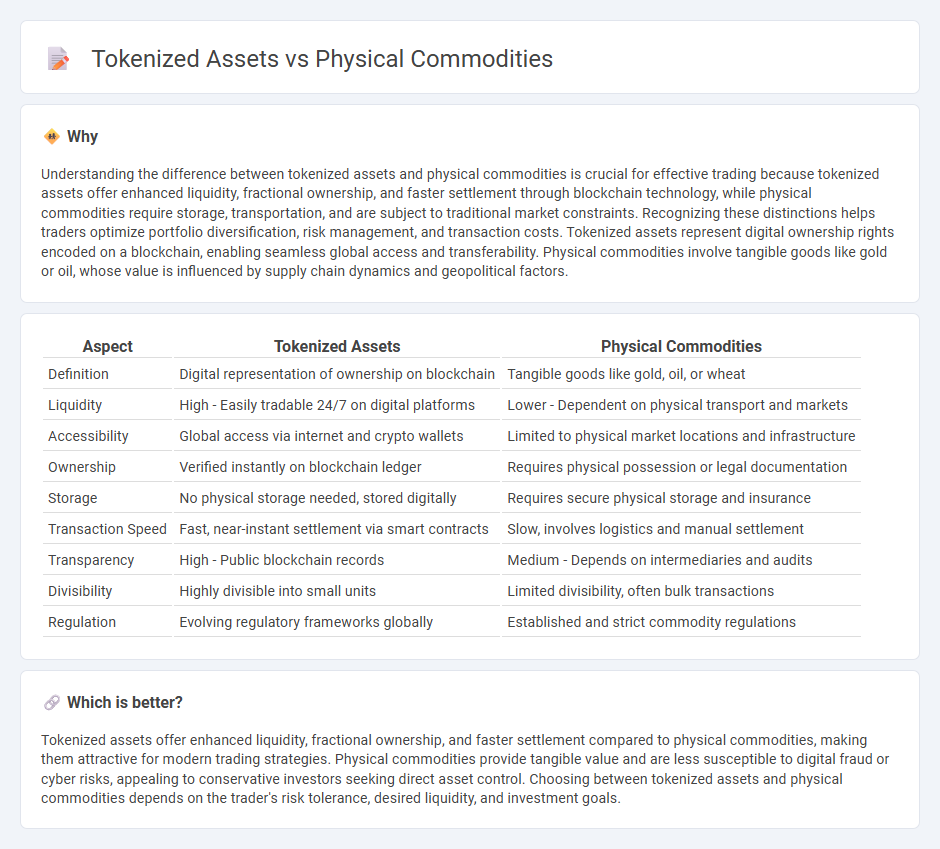

Understanding the difference between tokenized assets and physical commodities is crucial for effective trading because tokenized assets offer enhanced liquidity, fractional ownership, and faster settlement through blockchain technology, while physical commodities require storage, transportation, and are subject to traditional market constraints. Recognizing these distinctions helps traders optimize portfolio diversification, risk management, and transaction costs. Tokenized assets represent digital ownership rights encoded on a blockchain, enabling seamless global access and transferability. Physical commodities involve tangible goods like gold or oil, whose value is influenced by supply chain dynamics and geopolitical factors.

Comparison Table

| Aspect | Tokenized Assets | Physical Commodities |

|---|---|---|

| Definition | Digital representation of ownership on blockchain | Tangible goods like gold, oil, or wheat |

| Liquidity | High - Easily tradable 24/7 on digital platforms | Lower - Dependent on physical transport and markets |

| Accessibility | Global access via internet and crypto wallets | Limited to physical market locations and infrastructure |

| Ownership | Verified instantly on blockchain ledger | Requires physical possession or legal documentation |

| Storage | No physical storage needed, stored digitally | Requires secure physical storage and insurance |

| Transaction Speed | Fast, near-instant settlement via smart contracts | Slow, involves logistics and manual settlement |

| Transparency | High - Public blockchain records | Medium - Depends on intermediaries and audits |

| Divisibility | Highly divisible into small units | Limited divisibility, often bulk transactions |

| Regulation | Evolving regulatory frameworks globally | Established and strict commodity regulations |

Which is better?

Tokenized assets offer enhanced liquidity, fractional ownership, and faster settlement compared to physical commodities, making them attractive for modern trading strategies. Physical commodities provide tangible value and are less susceptible to digital fraud or cyber risks, appealing to conservative investors seeking direct asset control. Choosing between tokenized assets and physical commodities depends on the trader's risk tolerance, desired liquidity, and investment goals.

Connection

Tokenized assets represent physical commodities through blockchain technology, enabling fractional ownership, enhanced liquidity, and transparent trading on digital platforms. This integration allows commodities such as gold, oil, and real estate to be traded more efficiently without the need for traditional intermediaries. Tokenization bridges the gap between tangible assets and digital markets, fostering increased accessibility and real-time settlement.

Key Terms

Custody

Custody of physical commodities requires secure storage facilities, insurance, and logistics management to protect tangible assets like gold, oil, or agricultural products. Tokenized assets leverage blockchain technology, enabling digital custody solutions that enhance transparency, reduce intermediaries, and offer real-time auditability through decentralized ledgers. Explore in-depth comparisons of custody methods and their impact on asset security and liquidity.

Settlement

Physical commodities involve tangible goods such as gold, oil, or agricultural products and require complex logistics for settlement, including transportation, storage, and regulatory compliance. Tokenized assets represent these commodities on blockchain platforms, enabling faster, transparent, and more efficient settlement through digital ownership transfers without physical movement. Explore the benefits and challenges of tokenized settlements to understand their impact on commodity markets.

Liquidity

Physical commodities often face liquidity challenges due to storage costs, transportation hurdles, and market accessibility limitations. Tokenized assets enhance liquidity by enabling fractional ownership, instant transfers, and 24/7 trading on digital platforms. Explore how tokenization is transforming liquidity dynamics in commodity markets to gain deeper insights.

Source and External Links

Physical Commodities Explained: The Backbone of Global Trade - Physical commodities are tangible raw materials or agricultural products like crude oil, gold, wheat, and copper, essential for global trade and industrial use, and traded mainly through spot and futures markets on exchanges such as CME and LME.

Physical vs. Virtual Commodity Markets: Key Differences - Vesper - Physical commodity markets involve the direct buying and delivery of tangible goods often outside exchanges, in contrast to virtual markets where financial contracts linked to commodities are traded on exchanges for hedging or speculation.

Commodity - Wikipedia - A commodity is a fungible economic good, usually a raw material or primary agricultural product, traded widely with prices determined by overall market supply and demand, including examples like crude oil, sugar, and grains.

dowidth.com

dowidth.com