High-frequency trading leverages advanced algorithms and high-speed data networks to execute thousands of orders in milliseconds, capitalizing on minuscule price discrepancies across markets. Arbitrage involves simultaneously buying and selling assets in different markets to exploit price differences, ensuring risk-free profits with minimal exposure. Explore the nuanced strategies and technologies driving these sophisticated trading methods.

Why it is important

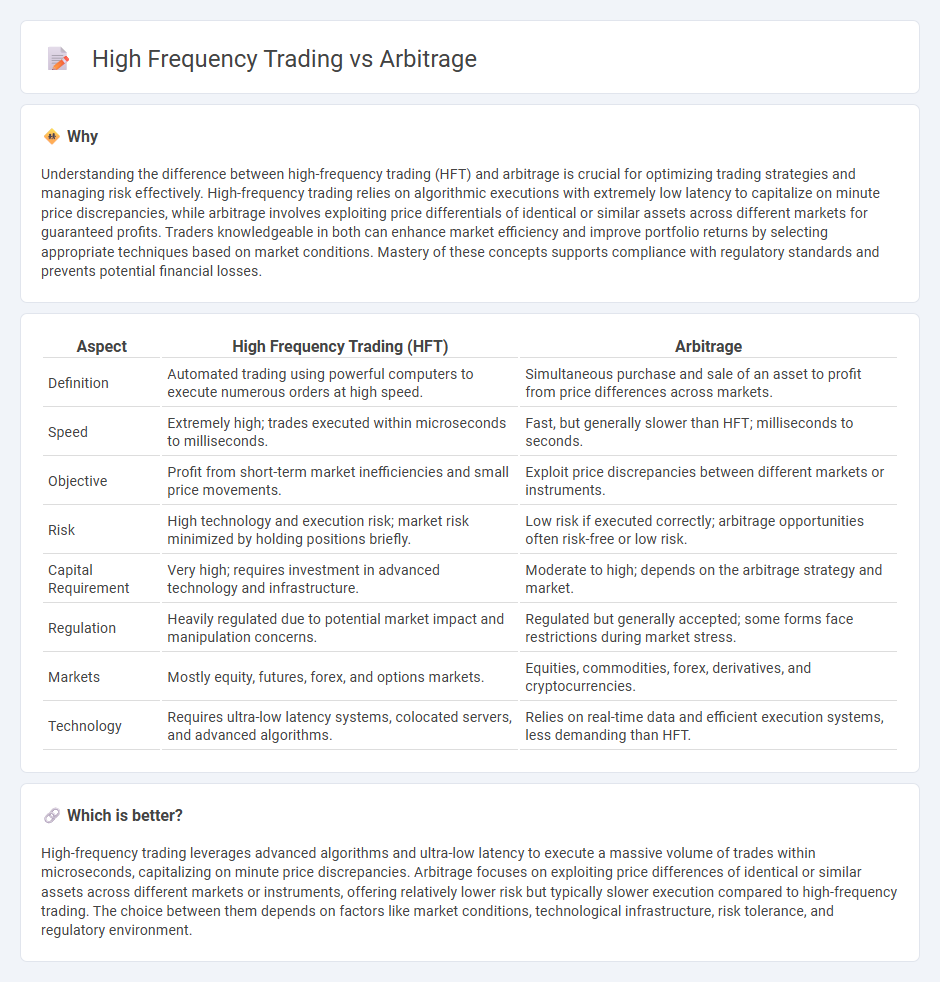

Understanding the difference between high-frequency trading (HFT) and arbitrage is crucial for optimizing trading strategies and managing risk effectively. High-frequency trading relies on algorithmic executions with extremely low latency to capitalize on minute price discrepancies, while arbitrage involves exploiting price differentials of identical or similar assets across different markets for guaranteed profits. Traders knowledgeable in both can enhance market efficiency and improve portfolio returns by selecting appropriate techniques based on market conditions. Mastery of these concepts supports compliance with regulatory standards and prevents potential financial losses.

Comparison Table

| Aspect | High Frequency Trading (HFT) | Arbitrage |

|---|---|---|

| Definition | Automated trading using powerful computers to execute numerous orders at high speed. | Simultaneous purchase and sale of an asset to profit from price differences across markets. |

| Speed | Extremely high; trades executed within microseconds to milliseconds. | Fast, but generally slower than HFT; milliseconds to seconds. |

| Objective | Profit from short-term market inefficiencies and small price movements. | Exploit price discrepancies between different markets or instruments. |

| Risk | High technology and execution risk; market risk minimized by holding positions briefly. | Low risk if executed correctly; arbitrage opportunities often risk-free or low risk. |

| Capital Requirement | Very high; requires investment in advanced technology and infrastructure. | Moderate to high; depends on the arbitrage strategy and market. |

| Regulation | Heavily regulated due to potential market impact and manipulation concerns. | Regulated but generally accepted; some forms face restrictions during market stress. |

| Markets | Mostly equity, futures, forex, and options markets. | Equities, commodities, forex, derivatives, and cryptocurrencies. |

| Technology | Requires ultra-low latency systems, colocated servers, and advanced algorithms. | Relies on real-time data and efficient execution systems, less demanding than HFT. |

Which is better?

High-frequency trading leverages advanced algorithms and ultra-low latency to execute a massive volume of trades within microseconds, capitalizing on minute price discrepancies. Arbitrage focuses on exploiting price differences of identical or similar assets across different markets or instruments, offering relatively lower risk but typically slower execution compared to high-frequency trading. The choice between them depends on factors like market conditions, technological infrastructure, risk tolerance, and regulatory environment.

Connection

High frequency trading (HFT) and arbitrage are connected through their reliance on rapid execution of trades to exploit price inefficiencies across markets. HFT algorithms detect arbitrage opportunities by scanning multiple exchanges for discrepancies in asset prices, enabling traders to buy low and sell high within fractions of a second. This synergy maximizes profits while minimizing market risk through swift transactions and advanced technological infrastructure.

Key Terms

Price Discrepancy

Arbitrage exploits price discrepancies between different markets or instruments to generate risk-free profits by simultaneously buying and selling assets. High-frequency trading (HFT) leverages advanced algorithms and ultra-low latency technology to capitalize on very short-lived price opportunities, often including arbitrage but also market making and momentum strategies. Explore the detailed distinctions between arbitrage strategies and high-frequency trading techniques to enhance your trading approach.

Latency

Arbitrage exploits price differences across markets, where latency--measured in microseconds--determines the speed of identifying and executing trades to capture risk-free profits. High frequency trading (HFT) relies on ultra-low latency technology, including co-location and FPGA hardware, to execute thousands of trades per second with minimal delay for market making and momentum strategies. Explore the impact of latency on trading edge and technology evolution to understand how these strategies compete in milliseconds.

Execution Speed

Execution speed is the critical factor distinguishing arbitrage from high-frequency trading, with the latter relying on ultra-low latency systems to capitalize on millisecond price discrepancies. Arbitrage strategies exploit price differences across markets but may operate on a broader timescale, focusing on reliability rather than maximum speed. Explore our detailed analysis to understand how cutting-edge technology shapes these trading approaches.

Source and External Links

Arbitrage - Wikipedia - Arbitrage is the practice of simultaneously buying and selling an asset in different markets to profit from price differences, typically offering risk-free profit opportunities when transaction costs are considered.

What Is Arbitrage? 3 Strategies to Know - Arbitrage is an investment strategy involving buying and selling assets across markets simultaneously to capture price discrepancies, with common forms including pure, merger, and convertible arbitrage, often used by hedge funds.

What is arbitrage and how does it work in financial markets | StoneX - Arbitrage involves exploiting price differences of the same asset in multiple markets through strategies like pure arbitrage, merger arbitrage, and triangular arbitrage, providing opportunities to earn profits from small market inefficiencies.

dowidth.com

dowidth.com