Dark pool aggregation consolidates multiple private trading venues to enhance liquidity and reduce market impact, offering institutional investors discreet transaction opportunities. OTC trading involves direct negotiation between parties, bypassing centralized exchanges, which can lead to customized deals but less price transparency. Explore the distinctions between dark pool aggregation and OTC markets to optimize your trading strategies.

Why it is important

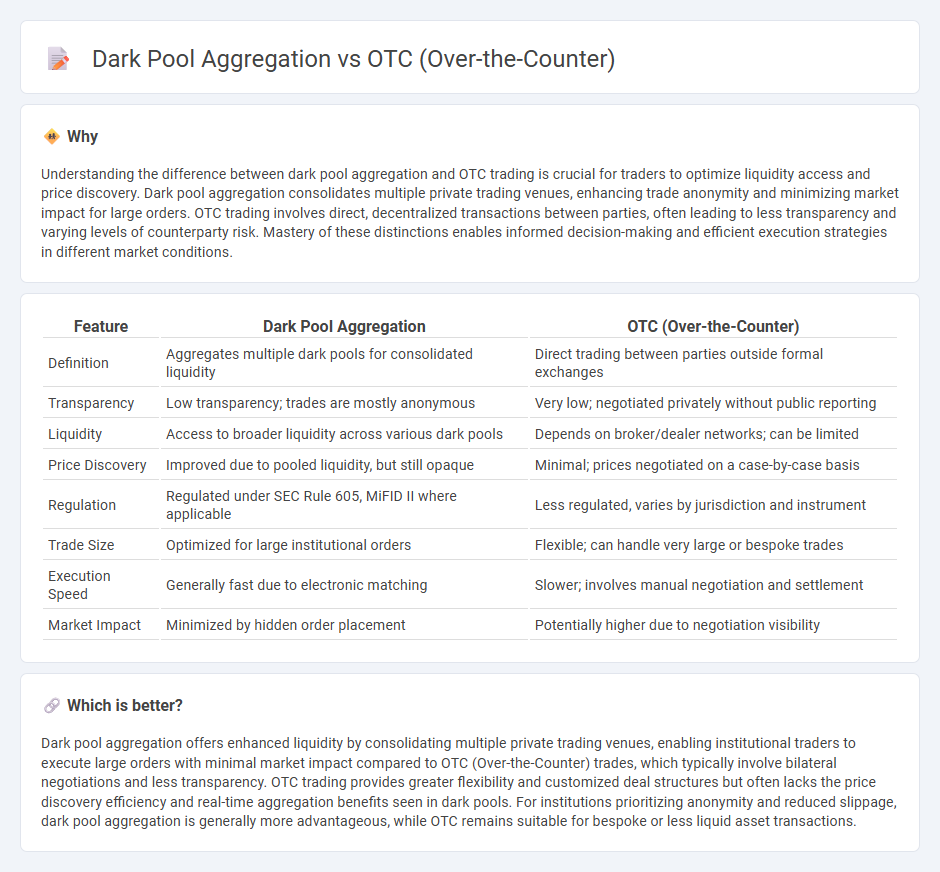

Understanding the difference between dark pool aggregation and OTC trading is crucial for traders to optimize liquidity access and price discovery. Dark pool aggregation consolidates multiple private trading venues, enhancing trade anonymity and minimizing market impact for large orders. OTC trading involves direct, decentralized transactions between parties, often leading to less transparency and varying levels of counterparty risk. Mastery of these distinctions enables informed decision-making and efficient execution strategies in different market conditions.

Comparison Table

| Feature | Dark Pool Aggregation | OTC (Over-the-Counter) |

|---|---|---|

| Definition | Aggregates multiple dark pools for consolidated liquidity | Direct trading between parties outside formal exchanges |

| Transparency | Low transparency; trades are mostly anonymous | Very low; negotiated privately without public reporting |

| Liquidity | Access to broader liquidity across various dark pools | Depends on broker/dealer networks; can be limited |

| Price Discovery | Improved due to pooled liquidity, but still opaque | Minimal; prices negotiated on a case-by-case basis |

| Regulation | Regulated under SEC Rule 605, MiFID II where applicable | Less regulated, varies by jurisdiction and instrument |

| Trade Size | Optimized for large institutional orders | Flexible; can handle very large or bespoke trades |

| Execution Speed | Generally fast due to electronic matching | Slower; involves manual negotiation and settlement |

| Market Impact | Minimized by hidden order placement | Potentially higher due to negotiation visibility |

Which is better?

Dark pool aggregation offers enhanced liquidity by consolidating multiple private trading venues, enabling institutional traders to execute large orders with minimal market impact compared to OTC (Over-the-Counter) trades, which typically involve bilateral negotiations and less transparency. OTC trading provides greater flexibility and customized deal structures but often lacks the price discovery efficiency and real-time aggregation benefits seen in dark pools. For institutions prioritizing anonymity and reduced slippage, dark pool aggregation is generally more advantageous, while OTC remains suitable for bespoke or less liquid asset transactions.

Connection

Dark pool aggregation and OTC trading are interconnected through their roles in facilitating large, discreet transactions away from public exchanges. Dark pool aggregators consolidate liquidity from multiple dark pools, enhancing trade execution efficiency for institutional investors seeking anonymity. OTC markets complement this by enabling direct trading between parties, reducing market impact and providing alternative avenues for executing sizable trades.

Key Terms

Transparency

OTC and dark pool aggregation both facilitate large-scale securities trading outside traditional exchanges, but OTC markets offer more direct negotiation transparency while dark pools prioritize anonymity to reduce market impact. Transparency in OTC trading helps reveal pricing and volume information to participants, enhancing market efficiency and regulatory oversight. Explore deeper insights into how transparency shapes trading strategies and market dynamics between OTC and dark pools.

Liquidity

OTC trading offers direct liquidity through bilateral deals, often suited for large blocks with price negotiation flexibility, while dark pool aggregation consolidates liquidity from multiple private venues, enhancing anonymity and minimizing market impact. Both methods aim to optimize trade execution but differ in transparency and access to diverse liquidity sources. Discover how these mechanisms shape trading strategies and market efficiency by exploring their distinct liquidity profiles further.

Counterparty

OTC trading enables direct transactions between counterparties, offering enhanced privacy and customized contract terms, while dark pool aggregation consolidates orders across multiple private venues to improve liquidity and minimize market impact. Counterparty risk in OTC trades is mitigated through bilateral agreements and credit assessments, whereas dark pools rely on anonymous, algorithm-driven matching that often obscures the identity of counterparties. Explore more about how counterparty dynamics influence trading strategies and risk management in these alternative trading systems.

Source and External Links

Over-the-counter drug - OTC drugs are medicines sold directly to consumers without a prescription, regulated to ensure they are safe and effective for self-use without a healthcare provider's oversight.

Over-the-Counter Medicines - OTC medicines treat minor ailments like aches, coughs, and allergies and can be bought without prescriptions, but users should follow label instructions carefully and be aware of possible interactions and risks.

Over-the-Counter (OTC) Allowance Benefits - Some health plans include an OTC allowance benefit that lets members purchase eligible non-prescription health and wellness products, often through mail order or network retailers, with potential rollover of unused funds.

dowidth.com

dowidth.com