Altcoin sniping involves strategically purchasing newly listed altcoins immediately upon market launch to capitalize on potential price surges, while front-running refers to placing orders ahead of known pending transactions to gain an advantage. These trading tactics leverage timing and market insights to maximize profits in highly volatile cryptocurrency markets. Explore detailed strategies and risk management techniques to master altcoin sniping and front-running effectively.

Why it is important

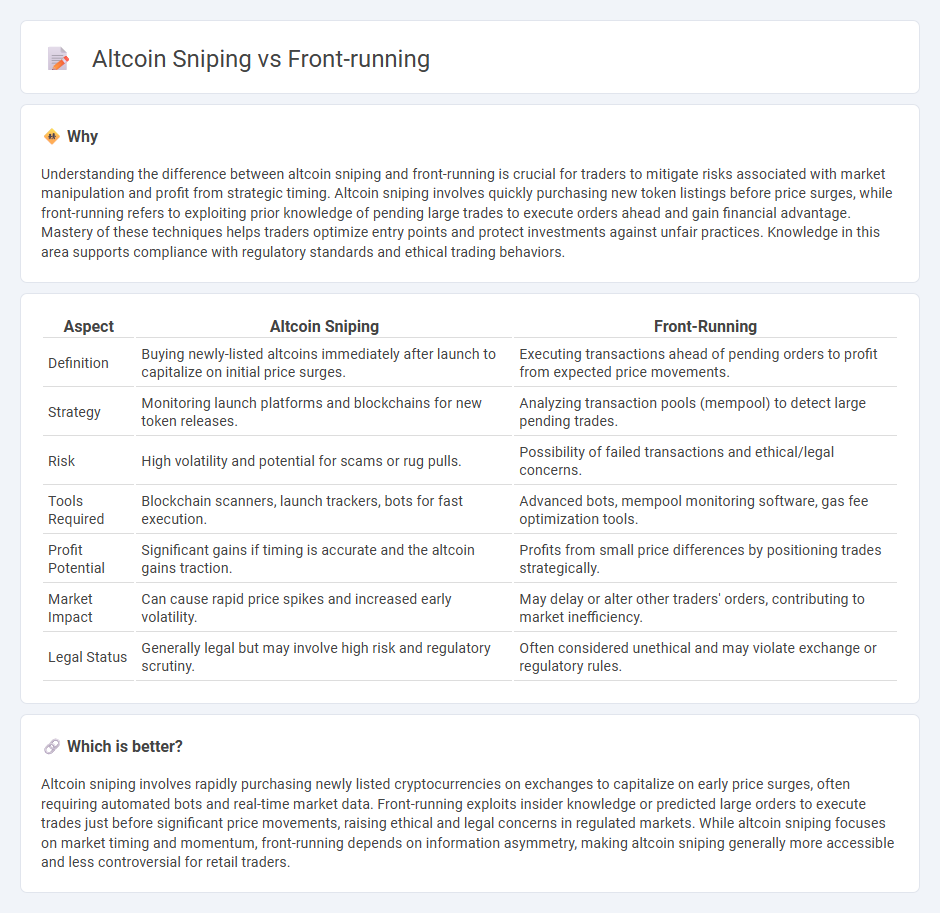

Understanding the difference between altcoin sniping and front-running is crucial for traders to mitigate risks associated with market manipulation and profit from strategic timing. Altcoin sniping involves quickly purchasing new token listings before price surges, while front-running refers to exploiting prior knowledge of pending large trades to execute orders ahead and gain financial advantage. Mastery of these techniques helps traders optimize entry points and protect investments against unfair practices. Knowledge in this area supports compliance with regulatory standards and ethical trading behaviors.

Comparison Table

| Aspect | Altcoin Sniping | Front-Running |

|---|---|---|

| Definition | Buying newly-listed altcoins immediately after launch to capitalize on initial price surges. | Executing transactions ahead of pending orders to profit from expected price movements. |

| Strategy | Monitoring launch platforms and blockchains for new token releases. | Analyzing transaction pools (mempool) to detect large pending trades. |

| Risk | High volatility and potential for scams or rug pulls. | Possibility of failed transactions and ethical/legal concerns. |

| Tools Required | Blockchain scanners, launch trackers, bots for fast execution. | Advanced bots, mempool monitoring software, gas fee optimization tools. |

| Profit Potential | Significant gains if timing is accurate and the altcoin gains traction. | Profits from small price differences by positioning trades strategically. |

| Market Impact | Can cause rapid price spikes and increased early volatility. | May delay or alter other traders' orders, contributing to market inefficiency. |

| Legal Status | Generally legal but may involve high risk and regulatory scrutiny. | Often considered unethical and may violate exchange or regulatory rules. |

Which is better?

Altcoin sniping involves rapidly purchasing newly listed cryptocurrencies on exchanges to capitalize on early price surges, often requiring automated bots and real-time market data. Front-running exploits insider knowledge or predicted large orders to execute trades just before significant price movements, raising ethical and legal concerns in regulated markets. While altcoin sniping focuses on market timing and momentum, front-running depends on information asymmetry, making altcoin sniping generally more accessible and less controversial for retail traders.

Connection

Altcoin sniping and front-running are connected through their exploitation of blockchain transaction mechanics to gain profit by anticipating and acting on other users' trades. Sniping targets newly listed altcoins immediately at launch to execute quick buy or sell orders, while front-running involves placing orders ahead of known pending transactions to capitalize on price movements. Both practices rely on high-speed trading bots and real-time network monitoring to outperform regular traders and maximize returns.

Key Terms

Transaction Ordering

Transaction ordering is crucial in both front-running and altcoin sniping, where miners or bots prioritize transactions based on gas fees and timing to maximize profits. Front-running exploits the visibility of pending transactions to execute trades just before others, while altcoin sniping targets new token launches by quickly placing buy orders immediately after listing. Explore detailed strategies and the impact of transaction ordering on these practices to understand their nuances and risks.

Mempool

Front-running exploits the mempool by detecting pending transactions to execute trades ahead, capitalizing on price movements before confirmation. Altcoin sniping leverages mempool data to identify newly listed tokens on decentralized exchanges, enabling users to buy at launch prices before others. Explore mempool strategies in-depth to refine your trading edge and maximize profit potential.

Automated Trading Bots

Automated trading bots utilize front-running strategies by detecting large pending transactions on the blockchain to execute trades milliseconds before them, maximizing potential profit margins. Altcoin sniping bots specialize in swiftly purchasing new token listings at launch to capitalize on initial price surges, often relying on precise timing algorithms and low-latency connections. Explore the cutting-edge methodologies behind these automated trading bots for deeper insight into their market impact.

Source and External Links

Front Running Explained: What Is It, Examples, Is It Legal? | SoFi - Front running is when a broker trades a financial asset based on non-public information about a large upcoming order that will influence the asset price, allowing the broker to profit ahead of the client's trade, which is illegal and unethical.

Front running - Wikipedia - Front running, also known as tailgating, is a form of market manipulation where a trader uses advance nonpublic knowledge of a large pending transaction to execute personal trades ahead of it for profit, typically involving brokers or firms exploiting insider information.

FRONT-RUNNING definition | Cambridge English Dictionary - Front-running is the illegal act of a broker placing trades for their own account before fulfilling a large customer order, profiting from the anticipated price movement resulting from that order.

dowidth.com

dowidth.com