Trade journaling software offers advanced data analytics, real-time performance tracking, and seamless integration with trading platforms, enhancing the accuracy and efficiency of recording trades. In contrast, paper trading apps focus on simulating market conditions without risking real capital, providing a safe environment to practice strategies and assess potential outcomes. Explore the benefits of both tools to optimize your trading discipline and strategy refinement.

Why it is important

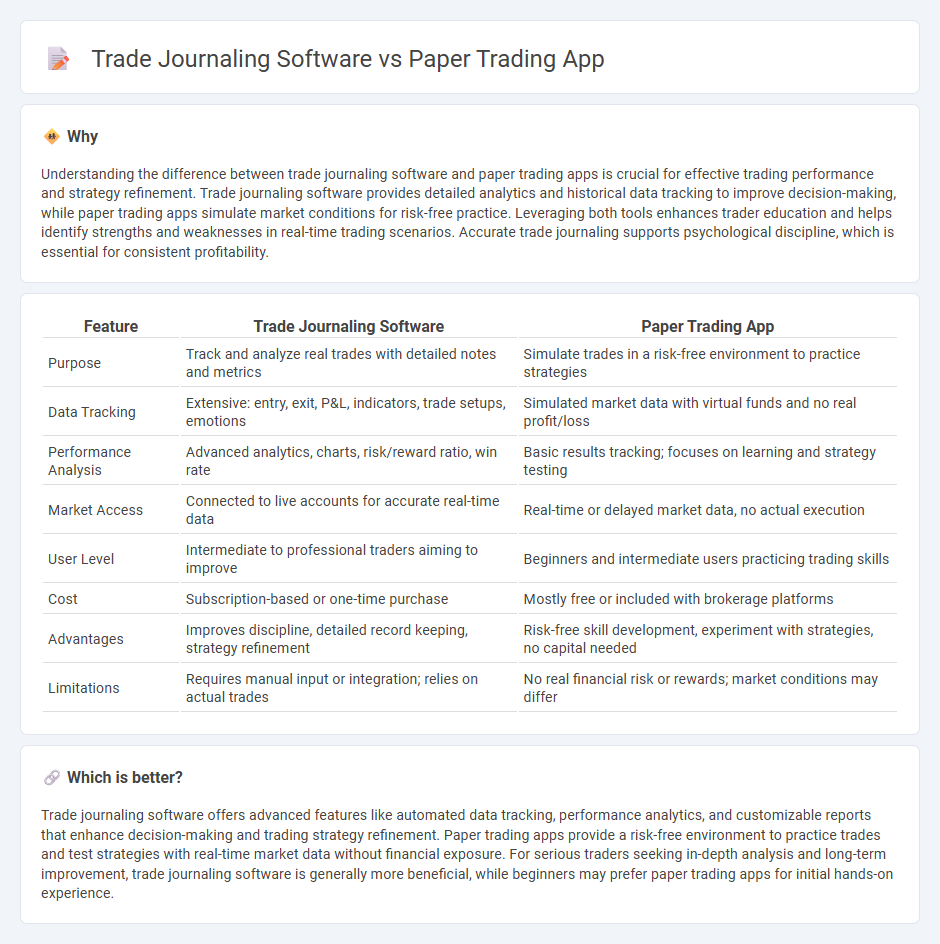

Understanding the difference between trade journaling software and paper trading apps is crucial for effective trading performance and strategy refinement. Trade journaling software provides detailed analytics and historical data tracking to improve decision-making, while paper trading apps simulate market conditions for risk-free practice. Leveraging both tools enhances trader education and helps identify strengths and weaknesses in real-time trading scenarios. Accurate trade journaling supports psychological discipline, which is essential for consistent profitability.

Comparison Table

| Feature | Trade Journaling Software | Paper Trading App |

|---|---|---|

| Purpose | Track and analyze real trades with detailed notes and metrics | Simulate trades in a risk-free environment to practice strategies |

| Data Tracking | Extensive: entry, exit, P&L, indicators, trade setups, emotions | Simulated market data with virtual funds and no real profit/loss |

| Performance Analysis | Advanced analytics, charts, risk/reward ratio, win rate | Basic results tracking; focuses on learning and strategy testing |

| Market Access | Connected to live accounts for accurate real-time data | Real-time or delayed market data, no actual execution |

| User Level | Intermediate to professional traders aiming to improve | Beginners and intermediate users practicing trading skills |

| Cost | Subscription-based or one-time purchase | Mostly free or included with brokerage platforms |

| Advantages | Improves discipline, detailed record keeping, strategy refinement | Risk-free skill development, experiment with strategies, no capital needed |

| Limitations | Requires manual input or integration; relies on actual trades | No real financial risk or rewards; market conditions may differ |

Which is better?

Trade journaling software offers advanced features like automated data tracking, performance analytics, and customizable reports that enhance decision-making and trading strategy refinement. Paper trading apps provide a risk-free environment to practice trades and test strategies with real-time market data without financial exposure. For serious traders seeking in-depth analysis and long-term improvement, trade journaling software is generally more beneficial, while beginners may prefer paper trading apps for initial hands-on experience.

Connection

Trade journaling software and paper trading apps are connected through their shared focus on improving trading performance by enabling users to track and analyze simulated trades without risking real capital. Trade journaling software records detailed trade data, including entry and exit points, trade rationale, and outcomes, which can be imported from paper trading apps to evaluate strategy effectiveness. This integration allows traders to refine techniques, identify patterns, and make informed decisions before applying strategies in live markets.

Key Terms

Simulation (for paper trading app)

Paper trading apps offer real-time market simulation, allowing users to practice trading strategies without financial risk by using virtual money and live market data. These platforms provide an immersive experience, replicating actual trading conditions to refine decision-making skills. Explore how simulation functions in paper trading apps can enhance your overall trading performance.

Performance Tracking (for trade journaling software)

Paper trading apps simulate real market conditions without financial risk, enabling traders to practice strategies and track real-time performance metrics. Trade journaling software excels in performance tracking by offering detailed analytics, trade history logs, and customizable metrics to identify strengths, weaknesses, and patterns over time. Explore comprehensive features of trade journaling tools to enhance your trading performance analysis.

Execution (for paper trading app)

Paper trading apps simulate real market execution by providing virtual orders and real-time price data to practice trade execution without financial risk. Trade journaling software, however, focuses on post-trade analysis by recording entry and exit points, trade rationale, and performance metrics to improve future strategies. Explore the differences further to determine which tool best enhances your trading skills.

Source and External Links

8 Best Brokers for Paper Trading of 2025 - Interactive Brokers offers the best paper trading platform with access to all securities and $1,000,000 in virtual cash, while Webull provides unlimited virtual money; other top apps include Schwab, Moomoo, and TradeStation.

What Is the Best Paper Trading Platform ? Top Picks for 2025 - ProRealTime's paper trading simulator is highly recommended for unlimited free access and powerful chart trading tools, with Thinkorswim noted for advanced stock screening but a less intuitive interface.

Paper Trading - Schwab's thinkorswim platform offers the paperMoney virtual trading experience with $100,000 virtual buying power for trading equities, options, futures, and forex using real-time market data without financial risk.

dowidth.com

dowidth.com