Proprietary firm challenges offer traders a structured path to access firm capital by meeting specific profit targets and risk management rules. Managed accounts allow investors to allocate funds to professional traders who execute strategies on their behalf, typically for a fee or profit share. Explore the differences to determine which trading approach aligns best with your goals.

Why it is important

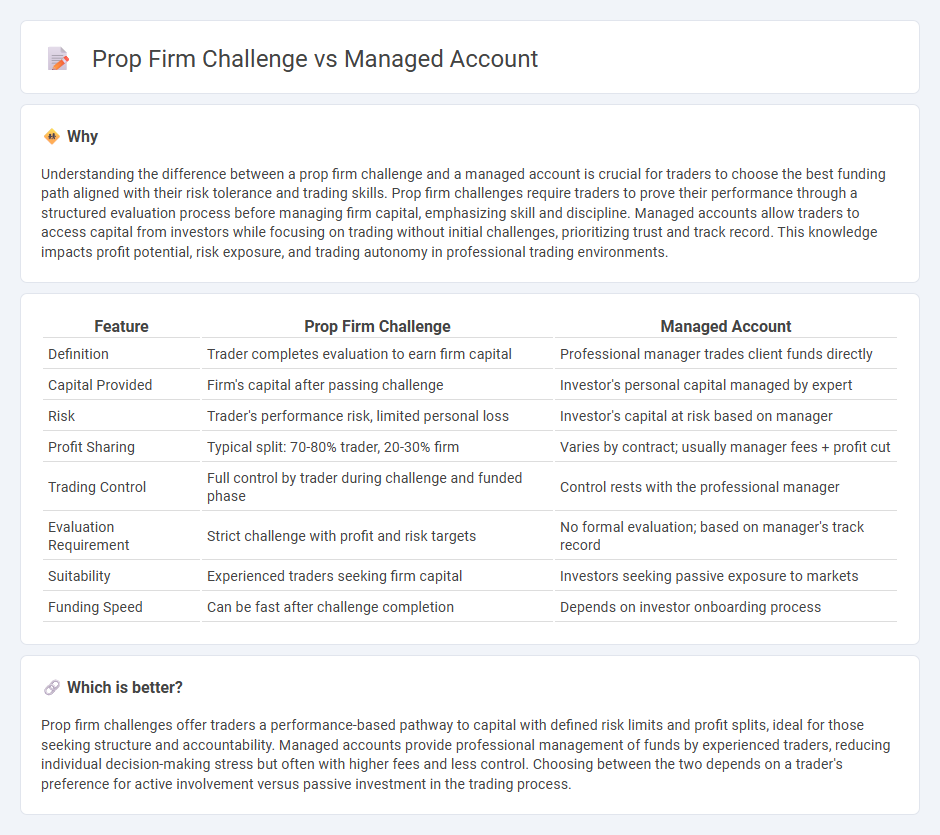

Understanding the difference between a prop firm challenge and a managed account is crucial for traders to choose the best funding path aligned with their risk tolerance and trading skills. Prop firm challenges require traders to prove their performance through a structured evaluation process before managing firm capital, emphasizing skill and discipline. Managed accounts allow traders to access capital from investors while focusing on trading without initial challenges, prioritizing trust and track record. This knowledge impacts profit potential, risk exposure, and trading autonomy in professional trading environments.

Comparison Table

| Feature | Prop Firm Challenge | Managed Account |

|---|---|---|

| Definition | Trader completes evaluation to earn firm capital | Professional manager trades client funds directly |

| Capital Provided | Firm's capital after passing challenge | Investor's personal capital managed by expert |

| Risk | Trader's performance risk, limited personal loss | Investor's capital at risk based on manager |

| Profit Sharing | Typical split: 70-80% trader, 20-30% firm | Varies by contract; usually manager fees + profit cut |

| Trading Control | Full control by trader during challenge and funded phase | Control rests with the professional manager |

| Evaluation Requirement | Strict challenge with profit and risk targets | No formal evaluation; based on manager's track record |

| Suitability | Experienced traders seeking firm capital | Investors seeking passive exposure to markets |

| Funding Speed | Can be fast after challenge completion | Depends on investor onboarding process |

Which is better?

Prop firm challenges offer traders a performance-based pathway to capital with defined risk limits and profit splits, ideal for those seeking structure and accountability. Managed accounts provide professional management of funds by experienced traders, reducing individual decision-making stress but often with higher fees and less control. Choosing between the two depends on a trader's preference for active involvement versus passive investment in the trading process.

Connection

Prop firm challenges serve as performance evaluations that traders must pass to gain access to funded accounts, which are then managed by the firm. Successfully completing these challenges demonstrates trading skills and risk management, allowing traders to operate managed accounts with the firm's capital. Managed accounts offer traders the opportunity to trade larger sums under professional oversight, directly linking their challenge results to trading capital and profit sharing.

Key Terms

Account Ownership

Managed accounts offer investors direct ownership and control over their trading capital, allowing personalized strategy implementation and transparent fund management. Proprietary firm challenges require traders to demonstrate skill through specific performance metrics before gaining access to firm capital, without initially owning the account. Explore the distinctions in account ownership and benefits between managed accounts and prop firm challenges to choose the best fit for your trading goals.

Risk Management

Managed accounts prioritize strict risk management by allowing professional portfolio managers to control asset allocation and implement tailored risk limits, which often results in more consistent, long-term growth. Prop firm challenges emphasize trader skill under defined risk parameters, requiring participants to demonstrate disciplined risk adherence while aiming for rapid profit targets. Discover how mastering risk management strategies can improve your trading success in both managed accounts and prop firm challenges.

Profit Split

Managed accounts typically offer a profit split ranging from 70/30 to 80/20 in favor of the trader, ensuring consistent earnings while minimizing risk exposure. Prop firm challenges often require traders to pass evaluation phases and may provide profit splits between 70% to 90%, but with stringent drawdown and time constraints. Explore detailed comparisons to determine which structure maximizes your trading profit potential.

Source and External Links

What Is a Managed Account? (Advantages and Disadvantages) - A managed account is an investment portfolio overseen by a financial expert who autonomously makes decisions to meet the client's investment goals, typically involving assets such as stocks, bonds, cash, and property titles, with benefits including professional expertise and potential for higher earnings but with fees and minimum investment requirements.

Managed Account - Overview, Pros and Cons - A managed account is a portfolio of stocks, bonds, or both, managed by a professional investment manager who has discretionary authority to make decisions tailored to the investor's goals, asset size, and risk tolerance, providing active oversight in response to market changes.

Managed account - Wikipedia - In banking, a managed account is a fee-based investment product mainly for high-net-worth individuals offering professional management, high customization, greater tax efficiency, and advantages such as transparency, liquidity, and control, with evolving forms like separately managed accounts and unified managed accounts.

dowidth.com

dowidth.com