Proprietary trading firms require traders to meet strict performance benchmarks and risk management criteria, often placing high pressure on consistency and discipline. Trading competitions focus on short-term gains and often encourage aggressive strategies to maximize profits within limited time frames. Explore the key differences and challenges between prop firms and trading contests to enhance your trading approach.

Why it is important

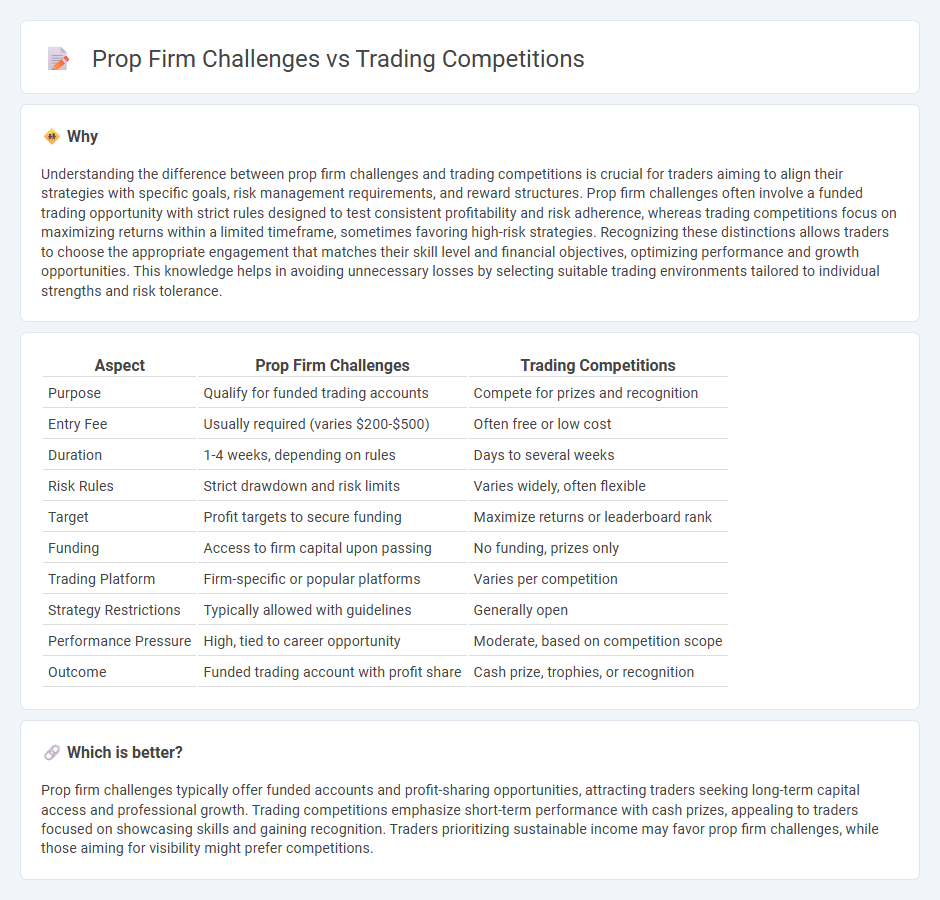

Understanding the difference between prop firm challenges and trading competitions is crucial for traders aiming to align their strategies with specific goals, risk management requirements, and reward structures. Prop firm challenges often involve a funded trading opportunity with strict rules designed to test consistent profitability and risk adherence, whereas trading competitions focus on maximizing returns within a limited timeframe, sometimes favoring high-risk strategies. Recognizing these distinctions allows traders to choose the appropriate engagement that matches their skill level and financial objectives, optimizing performance and growth opportunities. This knowledge helps in avoiding unnecessary losses by selecting suitable trading environments tailored to individual strengths and risk tolerance.

Comparison Table

| Aspect | Prop Firm Challenges | Trading Competitions |

|---|---|---|

| Purpose | Qualify for funded trading accounts | Compete for prizes and recognition |

| Entry Fee | Usually required (varies $200-$500) | Often free or low cost |

| Duration | 1-4 weeks, depending on rules | Days to several weeks |

| Risk Rules | Strict drawdown and risk limits | Varies widely, often flexible |

| Target | Profit targets to secure funding | Maximize returns or leaderboard rank |

| Funding | Access to firm capital upon passing | No funding, prizes only |

| Trading Platform | Firm-specific or popular platforms | Varies per competition |

| Strategy Restrictions | Typically allowed with guidelines | Generally open |

| Performance Pressure | High, tied to career opportunity | Moderate, based on competition scope |

| Outcome | Funded trading account with profit share | Cash prize, trophies, or recognition |

Which is better?

Prop firm challenges typically offer funded accounts and profit-sharing opportunities, attracting traders seeking long-term capital access and professional growth. Trading competitions emphasize short-term performance with cash prizes, appealing to traders focused on showcasing skills and gaining recognition. Traders prioritizing sustainable income may favor prop firm challenges, while those aiming for visibility might prefer competitions.

Connection

Prop firm challenges serve as qualifying rounds for traders to prove their skills and risk management abilities under predefined rules, often leading to funded accounts. Trading competitions simulate real-market conditions where participants compete based on profitability, discipline, and consistency metrics, providing performance benchmarks. Both avenues emphasize skill validation, discipline, and risk control, making them interconnected pathways for traders aiming to establish credibility and access capital.

Key Terms

**Trading Competitions:**

Trading competitions offer traders the chance to showcase skills on simulated or real markets, often with cash prizes or recognition. These contests emphasize strategy, risk management, and quick decision-making under pressure, attracting both beginners and experienced traders globally. Explore more to understand how trading competitions can sharpen your market expertise.

Leaderboard

Trading competitions and prop firm challenges both emphasize leaderboard rankings to motivate participants and track performance metrics such as win rates, profit margins, and risk management skills. Leaderboards in trading competitions often highlight daily or weekly gains, promoting aggressive strategies for short-term success, whereas prop firm challenges prioritize consistency and adherence to risk rules over longer periods to qualify for funded accounts. Explore comprehensive insights on how leaderboard dynamics influence trading approaches and success rates.

Prizes

Trading competitions often feature substantial cash rewards and exclusive trading tools, designed to attract top traders and encourage high-volume participation. Prop firm challenges typically offer the chance to secure funded accounts with profit splits, providing a pathway to professional trading without initial capital risk. Explore detailed comparisons to understand which option maximizes your potential prizes and career growth.

Source and External Links

Join the Trading Competition 2025 by RebelsFunding and Win Big! - RebelsFunding organizes a global trading competition with significant cash prizes and trading program accounts for top ranks, allowing traders to compete live and see real-time leaderboard updates.

World Cup Trading Championships: Home - The World Cup Trading Championships(r) is a longstanding trading contest since 1983 where traders use their own strategies in futures and forex, aiming to post the highest net returns in a flexible and respected competition.

Free Trading Contests - Forex Competitions & More - PrimeXBT - PrimeXBT offers free, risk-free trading contests using virtual funds that allow traders to win real money prizes and even create branded contests for their own audiences, with easy signup and continuous competition participation.

dowidth.com

dowidth.com