Volume profile reading reveals key price levels by analyzing traded volume at various price points, highlighting areas of support and resistance. Order flow focuses on real-time transaction data to track buyer and seller activity, providing insights into market sentiment and short-term price movements. Explore these techniques to enhance your trading strategy and market understanding.

Why it is important

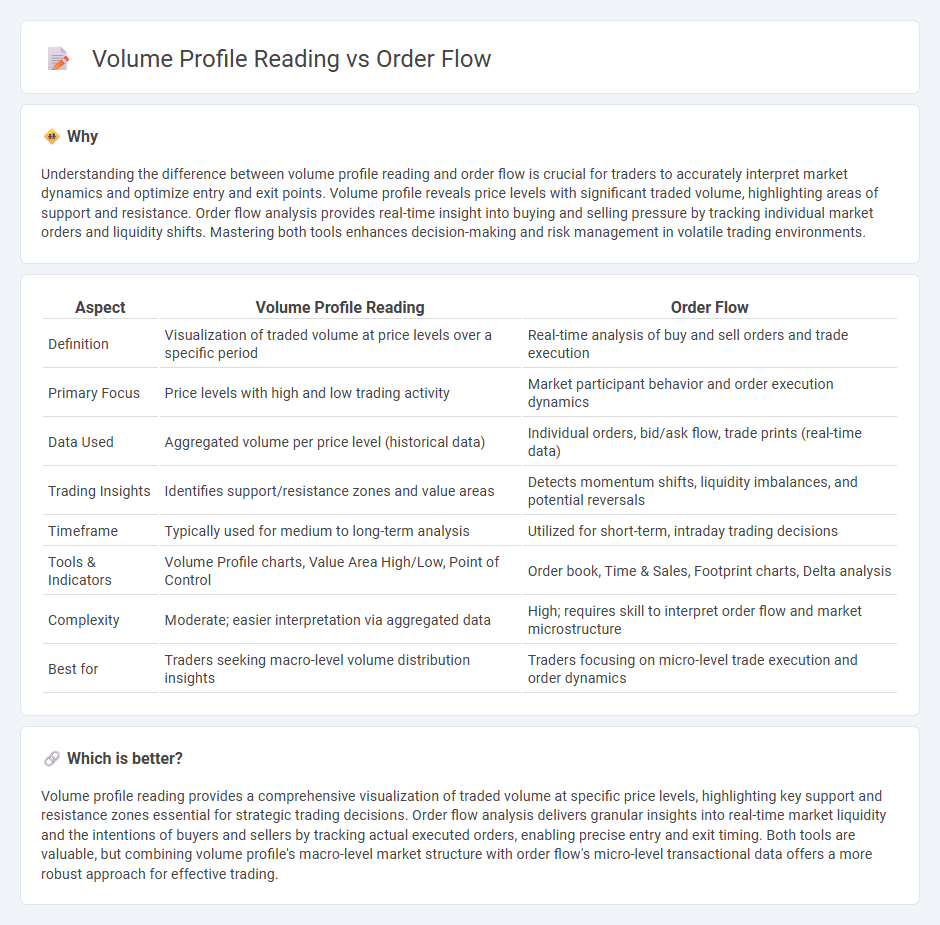

Understanding the difference between volume profile reading and order flow is crucial for traders to accurately interpret market dynamics and optimize entry and exit points. Volume profile reveals price levels with significant traded volume, highlighting areas of support and resistance. Order flow analysis provides real-time insight into buying and selling pressure by tracking individual market orders and liquidity shifts. Mastering both tools enhances decision-making and risk management in volatile trading environments.

Comparison Table

| Aspect | Volume Profile Reading | Order Flow |

|---|---|---|

| Definition | Visualization of traded volume at price levels over a specific period | Real-time analysis of buy and sell orders and trade execution |

| Primary Focus | Price levels with high and low trading activity | Market participant behavior and order execution dynamics |

| Data Used | Aggregated volume per price level (historical data) | Individual orders, bid/ask flow, trade prints (real-time data) |

| Trading Insights | Identifies support/resistance zones and value areas | Detects momentum shifts, liquidity imbalances, and potential reversals |

| Timeframe | Typically used for medium to long-term analysis | Utilized for short-term, intraday trading decisions |

| Tools & Indicators | Volume Profile charts, Value Area High/Low, Point of Control | Order book, Time & Sales, Footprint charts, Delta analysis |

| Complexity | Moderate; easier interpretation via aggregated data | High; requires skill to interpret order flow and market microstructure |

| Best for | Traders seeking macro-level volume distribution insights | Traders focusing on micro-level trade execution and order dynamics |

Which is better?

Volume profile reading provides a comprehensive visualization of traded volume at specific price levels, highlighting key support and resistance zones essential for strategic trading decisions. Order flow analysis delivers granular insights into real-time market liquidity and the intentions of buyers and sellers by tracking actual executed orders, enabling precise entry and exit timing. Both tools are valuable, but combining volume profile's macro-level market structure with order flow's micro-level transactional data offers a more robust approach for effective trading.

Connection

Volume profile reading reveals the distribution of traded volumes at various price levels, highlighting areas of high market interest and potential support or resistance zones. Order flow analysis tracks real-time buy and sell orders, providing insight into market participants' intentions and the balance between supply and demand. Together, volume profile and order flow enable traders to identify price levels with significant liquidity and anticipate market moves based on active order execution patterns.

Key Terms

Bid-Ask Imbalance

Order flow analysis highlights real-time Bid-Ask imbalance by tracking the exact number of executed buy and sell orders, offering granular insights into market sentiment and immediate price direction. Volume Profile reading aggregates traded volume at price levels over a specified period, revealing key support and resistance zones but lacking intraday order execution details. Explore more to master Bid-Ask dynamics for precise trading decisions.

Volume Nodes (High/Low Volume Areas)

Volume Nodes, representing High and Low Volume Areas, are crucial for understanding market liquidity and potential support or resistance zones within Volume Profile analysis. Order Flow offers real-time transaction data revealing the aggressiveness of buyers and sellers, helping traders anticipate price direction near these volume concentration points. Explore deeper insights on combining Volume Nodes with Order Flow for enhanced trading precision.

Source and External Links

Technical Analysis vs. Order Flow: Techniques and Tools for Traders - Order flow analysis involves observing and interpreting the real-time flow of buy and sell orders, including their size and aggressiveness, to predict price movements by reading the order book and analyzing volume clusters as support or resistance zones.

Lesson 1 - The Basics of Order Flow - Jigsaw Trading - Order flow is analyzed by tracking market and limit orders, where aggressive market orders consume liquidity and push prices up or down depending on whether bids or offers are taken, forming the basis of order flow analysis.

Order Flow Trading & Volumetric Bars | NinjaTrader - Order flow trading tools visualize buying and selling pressure in fine detail through volumetric bars, volume profiles, VWAP, and cumulative delta indicators to identify market strength, support/resistance levels, and confirm trends.

dowidth.com

dowidth.com