Quantitative trading signals leverage statistical models and historical price data to identify patterns and execute trades with precision and speed. Macroeconomic forecasting analyzes broad economic indicators such as GDP growth, unemployment rates, and inflation to predict market trends and guide investment strategies. Discover how combining these approaches can enhance trading performance and risk management.

Why it is important

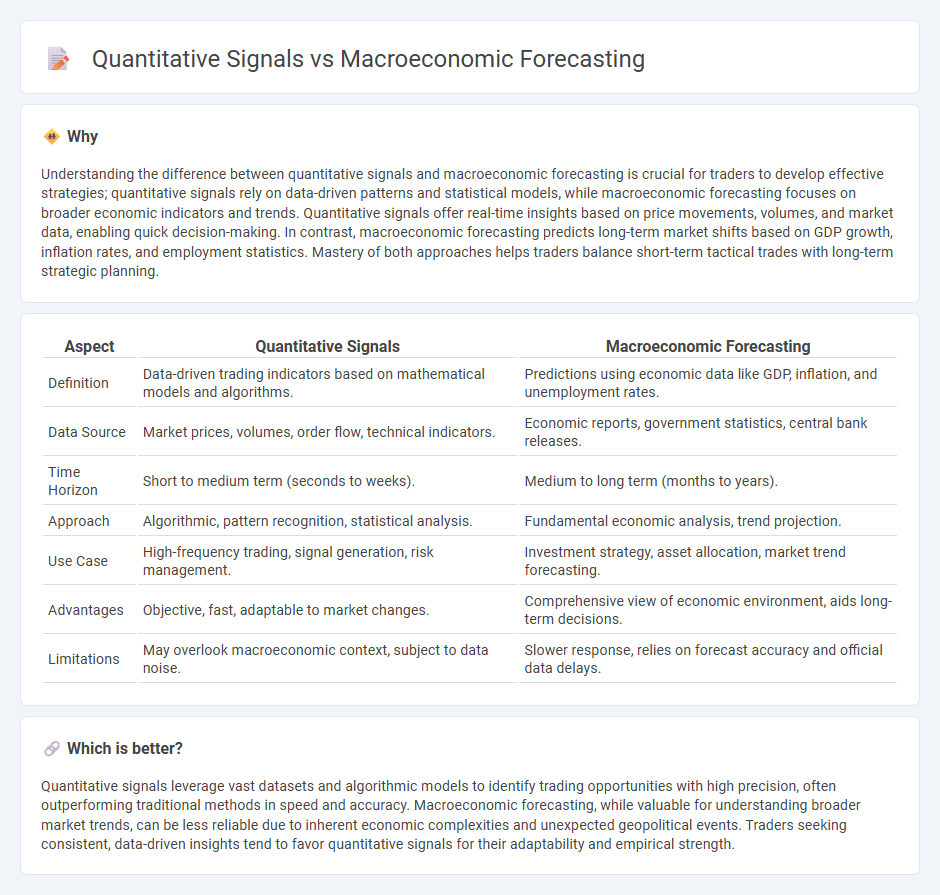

Understanding the difference between quantitative signals and macroeconomic forecasting is crucial for traders to develop effective strategies; quantitative signals rely on data-driven patterns and statistical models, while macroeconomic forecasting focuses on broader economic indicators and trends. Quantitative signals offer real-time insights based on price movements, volumes, and market data, enabling quick decision-making. In contrast, macroeconomic forecasting predicts long-term market shifts based on GDP growth, inflation rates, and employment statistics. Mastery of both approaches helps traders balance short-term tactical trades with long-term strategic planning.

Comparison Table

| Aspect | Quantitative Signals | Macroeconomic Forecasting |

|---|---|---|

| Definition | Data-driven trading indicators based on mathematical models and algorithms. | Predictions using economic data like GDP, inflation, and unemployment rates. |

| Data Source | Market prices, volumes, order flow, technical indicators. | Economic reports, government statistics, central bank releases. |

| Time Horizon | Short to medium term (seconds to weeks). | Medium to long term (months to years). |

| Approach | Algorithmic, pattern recognition, statistical analysis. | Fundamental economic analysis, trend projection. |

| Use Case | High-frequency trading, signal generation, risk management. | Investment strategy, asset allocation, market trend forecasting. |

| Advantages | Objective, fast, adaptable to market changes. | Comprehensive view of economic environment, aids long-term decisions. |

| Limitations | May overlook macroeconomic context, subject to data noise. | Slower response, relies on forecast accuracy and official data delays. |

Which is better?

Quantitative signals leverage vast datasets and algorithmic models to identify trading opportunities with high precision, often outperforming traditional methods in speed and accuracy. Macroeconomic forecasting, while valuable for understanding broader market trends, can be less reliable due to inherent economic complexities and unexpected geopolitical events. Traders seeking consistent, data-driven insights tend to favor quantitative signals for their adaptability and empirical strength.

Connection

Quantitative signals utilize mathematical models and statistical techniques to analyze market data, providing actionable insights for trading strategies. Macroeconomic forecasting integrates economic indicators, such as GDP growth, inflation rates, and employment statistics, to predict broad market trends that influence asset prices. The connection lies in how quantitative signals incorporate these macroeconomic forecasts to enhance the accuracy of market predictions and optimize portfolio risk management.

Key Terms

**Macroeconomic Forecasting:**

Macroeconomic forecasting involves analyzing aggregate economic indicators such as GDP growth rates, inflation trends, and unemployment figures to predict future economic conditions and guide policy decisions. This approach leverages models like vector autoregressions (VAR) and dynamic stochastic general equilibrium (DSGE) to capture complex interactions between economic variables. Explore deeper insights into macroeconomic forecasting methodologies and their impact on financial markets and policy frameworks.

GDP

Macroeconomic forecasting relies on comprehensive models incorporating historical GDP data, unemployment rates, and inflation trends to predict economic growth. Quantitative signals use statistical indicators such as stock market trends, consumer spending patterns, and manufacturing output to provide more immediate, data-driven insights into GDP fluctuations. Explore the methodologies behind these approaches to better understand how GDP forecasts shape economic decisions.

Inflation Rate

Macroeconomic forecasting relies on comprehensive models analyzing broad economic indicators such as GDP growth, unemployment rates, and fiscal policies to predict inflation trends. Quantitative signals utilize real-time data like market prices, interest rates, and commodity trends to provide immediate insights into inflationary pressures. Explore detailed strategies to enhance inflation rate predictions through the integration of macroeconomic and quantitative approaches.

Source and External Links

Macroeconometric Forecasting - International Monetary Fund (IMF) - This course focuses on teaching macroeconomic forecasting and modeling skills using econometric techniques and software EViews, aimed especially at government officials for policy design and evaluation.

Learn Macroeconometric Forecasting with Online Courses, Classes - edX - Macroeconometric forecasting involves using large-scale economic data and econometric models like vector autoregressions to predict economic variables and growth trends, blending theory and empirical data.

Macroeconomic Forecasting and Structural Change - ECB Working Paper - This paper examines improving macroeconomic forecast accuracy by modeling structural changes and time-varying relations using Time-Varying Coefficients VAR with Stochastic Volatility models.

dowidth.com

dowidth.com