Options flow reveals real-time market sentiment by tracking large trades and institutional activity, offering insights into potential price movements. Time & Sales provides detailed transaction data, including trade size, price, and timestamp, enabling precise analysis of market dynamics and liquidity. Explore the key differences and advantages of each tool to enhance your trading strategy.

Why it is important

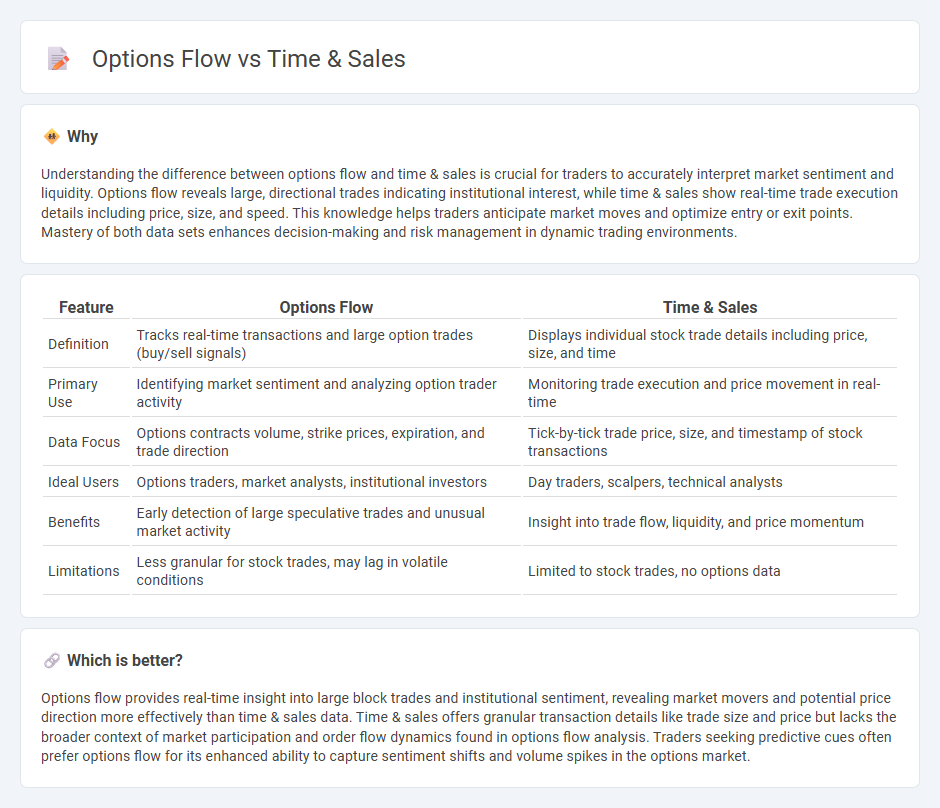

Understanding the difference between options flow and time & sales is crucial for traders to accurately interpret market sentiment and liquidity. Options flow reveals large, directional trades indicating institutional interest, while time & sales show real-time trade execution details including price, size, and speed. This knowledge helps traders anticipate market moves and optimize entry or exit points. Mastery of both data sets enhances decision-making and risk management in dynamic trading environments.

Comparison Table

| Feature | Options Flow | Time & Sales |

|---|---|---|

| Definition | Tracks real-time transactions and large option trades (buy/sell signals) | Displays individual stock trade details including price, size, and time |

| Primary Use | Identifying market sentiment and analyzing option trader activity | Monitoring trade execution and price movement in real-time |

| Data Focus | Options contracts volume, strike prices, expiration, and trade direction | Tick-by-tick trade price, size, and timestamp of stock transactions |

| Ideal Users | Options traders, market analysts, institutional investors | Day traders, scalpers, technical analysts |

| Benefits | Early detection of large speculative trades and unusual market activity | Insight into trade flow, liquidity, and price momentum |

| Limitations | Less granular for stock trades, may lag in volatile conditions | Limited to stock trades, no options data |

Which is better?

Options flow provides real-time insight into large block trades and institutional sentiment, revealing market movers and potential price direction more effectively than time & sales data. Time & sales offers granular transaction details like trade size and price but lacks the broader context of market participation and order flow dynamics found in options flow analysis. Traders seeking predictive cues often prefer options flow for its enhanced ability to capture sentiment shifts and volume spikes in the options market.

Connection

Options flow reveals real-time market sentiment by tracking large volume trades, which helps traders anticipate price movements. Time & sales data provides granular transaction details such as price, volume, and timing, enabling precise analysis of order execution patterns. Combining options flow with time & sales offers a comprehensive view of market liquidity and trader behavior, enhancing strategic decision-making.

Key Terms

**Time & Sales:**

Time & Sales provides real-time data on executed trades, including price, volume, and time, offering precise insight into market activity and order executions at the ticker level. This granular trade information helps traders identify liquidity, momentum, and possible large market participant actions impacting price movements. Explore more about how Time & Sales can enhance your trading strategy.

Tape

Time & Sales provides real-time transaction data displaying individual trade sizes, prices, and timestamps on the Tape, crucial for analyzing market momentum and order flow. Options Flow tracks large, unusual options trades and block trades, revealing potential market sentiment shifts not immediately visible in Time & Sales data. Explore in-depth insights on how Tape analysis enhances trading strategies by monitoring genuine market activity in real time.

Prints

Time & Sales provides a detailed, real-time record of executed trades, highlighting individual prints with precise price, volume, and timestamp data essential for understanding market momentum. Options Flow aggregates and analyzes large options trades and unusual activity, offering insights into institutional sentiment and potential market moves through the tracking of directional prints. Explore deeper insights into how prints reveal market dynamics and the actionable intelligence behind options flow data.

Source and External Links

Time and Sales for Traders - The Complete Guide - Time and Sales is a real-time digital feed showing every trade executed for a stock, including time, price, and volume, useful for gauging supply and demand and spotting trading activity for decision-making.

Time & Sales - Fidelity - The Time & Sales tool offers real-time, intraday, and historical trade data with filtering options by date, time, price, size, and exchange, showing all trades regardless of condition or session.

Time And Sales Definition: Day Trading Terminology - Time and Sales (the tape) shows every executed trade along with size and time, distinguishing trades on the ask, bid, or between, making it essential for active traders to track market activity.

dowidth.com

dowidth.com