Perpetual contracts offer traders the ability to hold positions indefinitely without an expiry date, often providing high leverage and continuous price tracking of underlying assets. Margin trading involves borrowing funds to increase position size, requiring careful management of collateral and margin calls to avoid liquidation risks. Explore our detailed comparison to understand which trading method suits your investment strategy best.

Why it is important

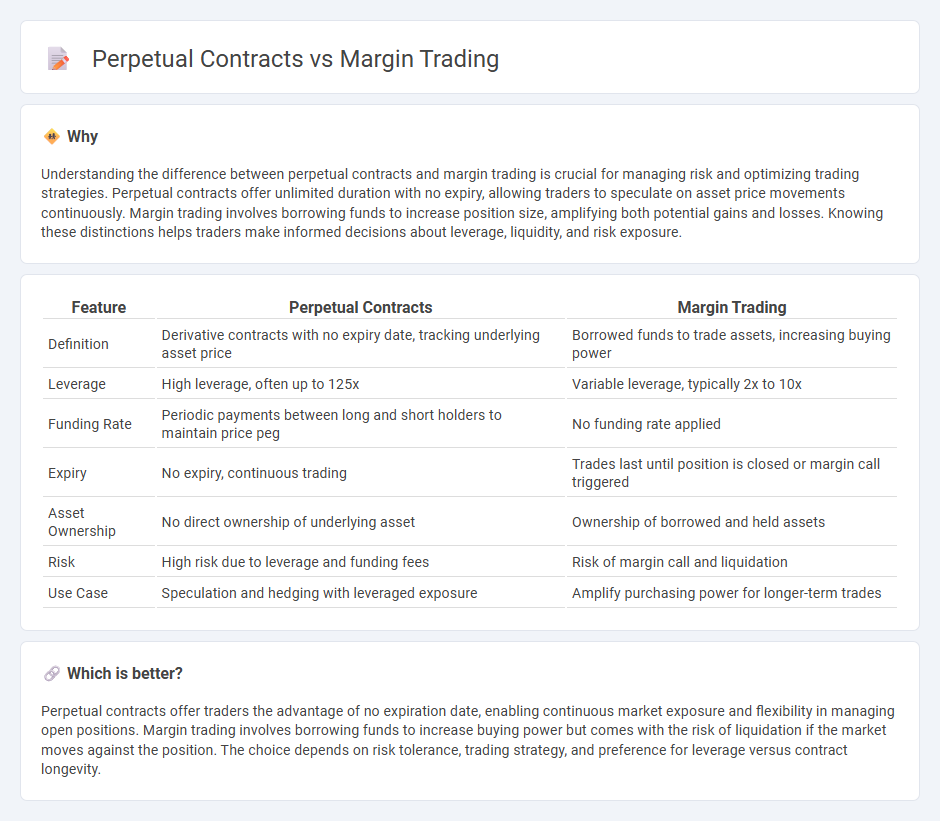

Understanding the difference between perpetual contracts and margin trading is crucial for managing risk and optimizing trading strategies. Perpetual contracts offer unlimited duration with no expiry, allowing traders to speculate on asset price movements continuously. Margin trading involves borrowing funds to increase position size, amplifying both potential gains and losses. Knowing these distinctions helps traders make informed decisions about leverage, liquidity, and risk exposure.

Comparison Table

| Feature | Perpetual Contracts | Margin Trading |

|---|---|---|

| Definition | Derivative contracts with no expiry date, tracking underlying asset price | Borrowed funds to trade assets, increasing buying power |

| Leverage | High leverage, often up to 125x | Variable leverage, typically 2x to 10x |

| Funding Rate | Periodic payments between long and short holders to maintain price peg | No funding rate applied |

| Expiry | No expiry, continuous trading | Trades last until position is closed or margin call triggered |

| Asset Ownership | No direct ownership of underlying asset | Ownership of borrowed and held assets |

| Risk | High risk due to leverage and funding fees | Risk of margin call and liquidation |

| Use Case | Speculation and hedging with leveraged exposure | Amplify purchasing power for longer-term trades |

Which is better?

Perpetual contracts offer traders the advantage of no expiration date, enabling continuous market exposure and flexibility in managing open positions. Margin trading involves borrowing funds to increase buying power but comes with the risk of liquidation if the market moves against the position. The choice depends on risk tolerance, trading strategy, and preference for leverage versus contract longevity.

Connection

Perpetual contracts enable traders to hold leveraged positions without an expiration date, closely linking them to margin trading, where borrowed funds amplify buying power. This connection allows traders to maximize potential returns while managing risk through margin requirements and liquidation thresholds. Understanding how margin influences perpetual contract positions is essential for effective risk management in crypto and forex markets.

Key Terms

Leverage

Margin trading allows traders to borrow funds to increase their position size, typically offering leverage ratios ranging from 2x to 10x depending on the platform and asset. Perpetual contracts, a type of derivative, often provide higher leverage options, reaching up to 100x, enabling amplified exposure without expiry dates. Explore our detailed guide to understand the risks and benefits of leverage in margin trading and perpetual contracts.

Liquidation

Margin trading involves borrowing funds to amplify positions, increasing exposure but also the risk of liquidation when margin requirements are unmet. Perpetual contracts, a type of derivative without expiry, use maintenance margins and funding rates to manage liquidation risk, triggering automatic position closure if collateral falls below threshold levels. Explore detailed comparisons to better understand risk management strategies in crypto trading.

Funding Rate

Margin trading involves borrowing funds to amplify position size, while perpetual contracts are derivative products allowing traders to speculate without expiry dates; both utilize funding rates to balance market demand between longs and shorts. The funding rate is a periodic payment exchanged between traders to ensure the perpetual contract price stays close to the underlying asset's spot price, directly affecting trader profitability and market sentiment. Explore detailed insights on funding rates to optimize your trading strategy and manage risks effectively.

Source and External Links

Margin trading - Definition, how it works and examples - Margin trading involves using borrowed funds from a broker to trade financial assets, allowing investors to control larger positions with the aim of increasing potential returns, but it also carries higher risks including the possibility of losses exceeding the initial investment; if the value of the account falls below a maintenance margin, the broker can issue a margin call requiring additional funds or asset sales.

Basics of Buying on Margin: What's Margin Trading? - Buying on margin means borrowing money from a broker to buy securities, which can amplify both gains and losses proportionally and entails paying interest on the borrowed amount, demonstrated by an example of purchasing stock shares with half the cash funded by the broker.

What is Margin Trading and How Do You Trade On It? - IG - Margin trading, or leveraged trading, means opening a market position using only a fraction of the position's full value as a deposit (initial margin), with brokers requiring maintenance margin to cover ongoing losses, thus amplifying both profits and losses relative to traditional investing based on the size of the margin deposit.

dowidth.com

dowidth.com