Zero knowledge proof trading enhances security by enabling transaction verification without revealing underlying data, reducing risks of fraud and data exposure. Non-custodial trading offers complete asset control to traders, eliminating intermediaries and minimizing counterparty risk. Discover how these advanced trading methods redefine trust and privacy in digital asset exchanges.

Why it is important

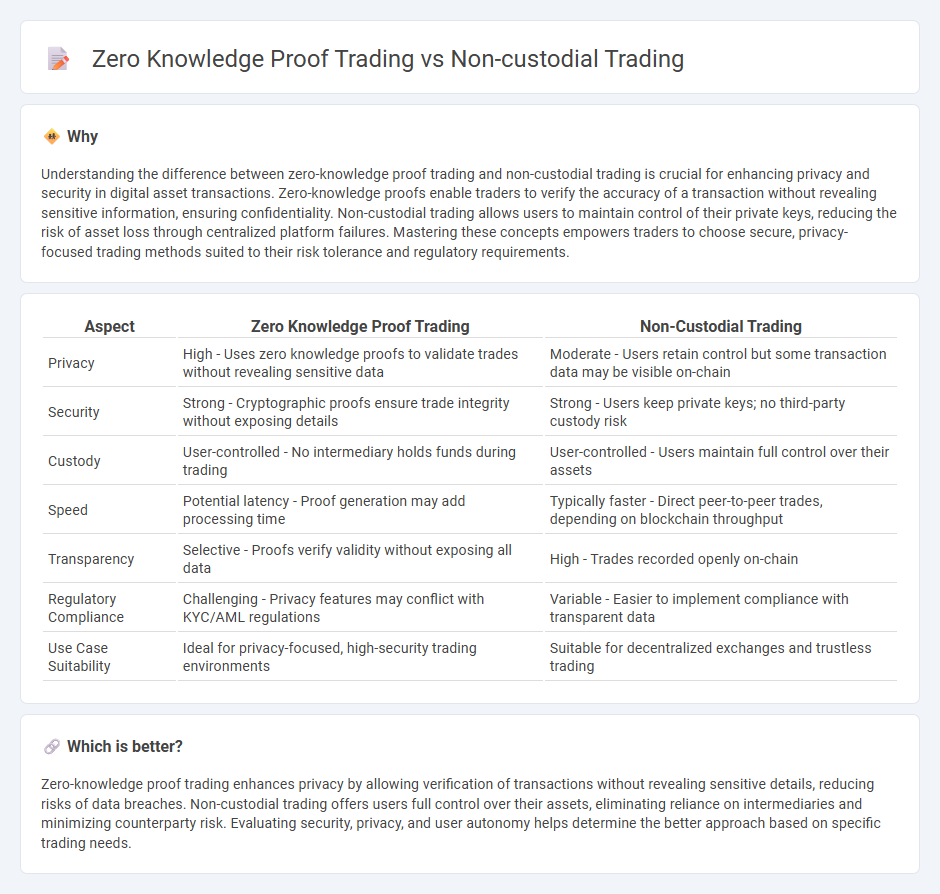

Understanding the difference between zero-knowledge proof trading and non-custodial trading is crucial for enhancing privacy and security in digital asset transactions. Zero-knowledge proofs enable traders to verify the accuracy of a transaction without revealing sensitive information, ensuring confidentiality. Non-custodial trading allows users to maintain control of their private keys, reducing the risk of asset loss through centralized platform failures. Mastering these concepts empowers traders to choose secure, privacy-focused trading methods suited to their risk tolerance and regulatory requirements.

Comparison Table

| Aspect | Zero Knowledge Proof Trading | Non-Custodial Trading |

|---|---|---|

| Privacy | High - Uses zero knowledge proofs to validate trades without revealing sensitive data | Moderate - Users retain control but some transaction data may be visible on-chain |

| Security | Strong - Cryptographic proofs ensure trade integrity without exposing details | Strong - Users keep private keys; no third-party custody risk |

| Custody | User-controlled - No intermediary holds funds during trading | User-controlled - Users maintain full control over their assets |

| Speed | Potential latency - Proof generation may add processing time | Typically faster - Direct peer-to-peer trades, depending on blockchain throughput |

| Transparency | Selective - Proofs verify validity without exposing all data | High - Trades recorded openly on-chain |

| Regulatory Compliance | Challenging - Privacy features may conflict with KYC/AML regulations | Variable - Easier to implement compliance with transparent data |

| Use Case Suitability | Ideal for privacy-focused, high-security trading environments | Suitable for decentralized exchanges and trustless trading |

Which is better?

Zero-knowledge proof trading enhances privacy by allowing verification of transactions without revealing sensitive details, reducing risks of data breaches. Non-custodial trading offers users full control over their assets, eliminating reliance on intermediaries and minimizing counterparty risk. Evaluating security, privacy, and user autonomy helps determine the better approach based on specific trading needs.

Connection

Zero knowledge proof trading enhances Non-custodial trading by enabling secure transaction validation without revealing sensitive information, ensuring user privacy and data integrity on decentralized platforms. This cryptographic method allows trustless verification, reducing reliance on intermediaries and mitigating risks associated with asset custody. Integrating zero knowledge proofs in Non-custodial trading protocols promotes transparent, private, and secure peer-to-peer asset exchanges within blockchain ecosystems.

Key Terms

Private Keys Control

Non-custodial trading ensures users retain full control over their private keys, enhancing security and eliminating reliance on third parties for asset management. Zero knowledge proof trading leverages advanced cryptographic techniques to verify transactions without revealing sensitive information, maintaining privacy without relinquishing control of private keys. Discover how these technologies empower private asset management and secure trading practices.

Transaction Privacy

Non-custodial trading platforms enable users to maintain control over their private keys while executing trades directly from their wallets, enhancing security but often exposing transaction details. Zero-knowledge proof (ZKP) trading leverages cryptographic methods to validate transactions without revealing sensitive information, significantly improving transaction privacy and confidentiality. Explore the latest advancements in privacy-preserving trading technologies to understand their impact on the future of decentralized finance.

Trustless Verification

Non-custodial trading platforms enable users to maintain control of their private keys, ensuring asset security through peer-to-peer transactions without intermediaries. Zero-knowledge proof trading enhances trustless verification by allowing participants to prove transaction validity without revealing sensitive data, bolstering privacy and security. Explore how these innovations transform decentralized finance by combining direct asset control with advanced cryptographic verification.

Source and External Links

What is Non-Custodial? Definition & Meaning | Crypto Wiki - Non-custodial trading involves services that do not require a third party to hold custody of users' assets during transactions, relying instead on decentralized, trustless smart contracts, thereby offering censorship resistance and reducing risks related to centralized control.

Best Non-Custodial Crypto Exchanges 2024 - A non-custodial exchange facilitates trading without holding or storing your cryptocurrencies, leaving users responsible for their private keys, which enhances privacy and security but requires self-custody of assets.

The perils of custodial trading and the promise of non-custodial trading - Non-custodial trading minimizes counterparty risk by allowing users to keep their coins in their own wallets during trading, protecting them from losses if centralized exchanges are hacked.

dowidth.com

dowidth.com