Delta neutral strategy minimizes risk by balancing long and short positions to maintain a neutral portfolio sensitivity to price movements, unlike buy and hold which relies on long-term asset appreciation. This approach suits traders seeking to capitalize on volatility and hedge against market fluctuations without directional exposure. Explore detailed insights to understand the advantages and mechanics of delta neutral trading compared to traditional buy and hold methods.

Why it is important

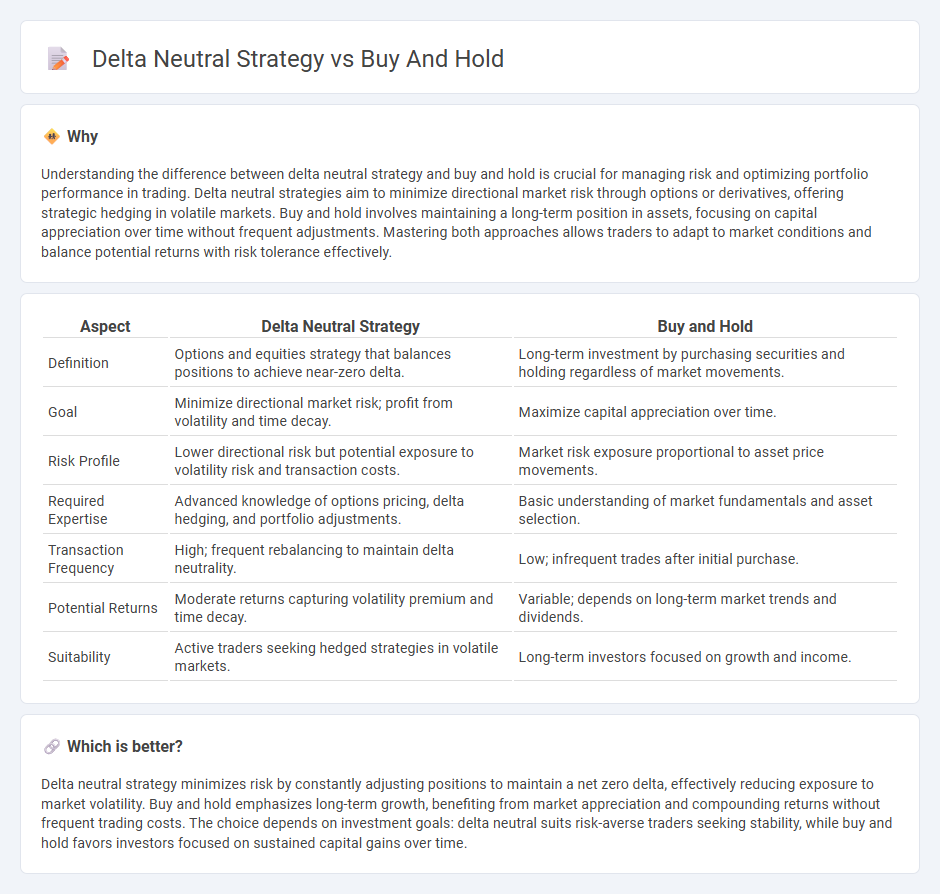

Understanding the difference between delta neutral strategy and buy and hold is crucial for managing risk and optimizing portfolio performance in trading. Delta neutral strategies aim to minimize directional market risk through options or derivatives, offering strategic hedging in volatile markets. Buy and hold involves maintaining a long-term position in assets, focusing on capital appreciation over time without frequent adjustments. Mastering both approaches allows traders to adapt to market conditions and balance potential returns with risk tolerance effectively.

Comparison Table

| Aspect | Delta Neutral Strategy | Buy and Hold |

|---|---|---|

| Definition | Options and equities strategy that balances positions to achieve near-zero delta. | Long-term investment by purchasing securities and holding regardless of market movements. |

| Goal | Minimize directional market risk; profit from volatility and time decay. | Maximize capital appreciation over time. |

| Risk Profile | Lower directional risk but potential exposure to volatility risk and transaction costs. | Market risk exposure proportional to asset price movements. |

| Required Expertise | Advanced knowledge of options pricing, delta hedging, and portfolio adjustments. | Basic understanding of market fundamentals and asset selection. |

| Transaction Frequency | High; frequent rebalancing to maintain delta neutrality. | Low; infrequent trades after initial purchase. |

| Potential Returns | Moderate returns capturing volatility premium and time decay. | Variable; depends on long-term market trends and dividends. |

| Suitability | Active traders seeking hedged strategies in volatile markets. | Long-term investors focused on growth and income. |

Which is better?

Delta neutral strategy minimizes risk by constantly adjusting positions to maintain a net zero delta, effectively reducing exposure to market volatility. Buy and hold emphasizes long-term growth, benefiting from market appreciation and compounding returns without frequent trading costs. The choice depends on investment goals: delta neutral suits risk-averse traders seeking stability, while buy and hold favors investors focused on sustained capital gains over time.

Connection

Delta neutral strategy and buy and hold are connected through their shared goal of managing risk and maintaining portfolio stability. While delta neutral strategy uses options to offset directional market exposure, buy and hold focuses on long-term investment in assets to benefit from compounding returns and market growth. Both approaches aim to minimize the impact of market volatility, enhancing overall investment resilience.

Key Terms

Time Horizon

Buy and hold strategy capitalizes on long-term market growth by maintaining asset positions over extended periods, reducing the impact of short-term volatility and compounding returns. Delta neutral strategy, involving options and derivatives, aims to minimize directional market risk through hedging, often requiring frequent adjustments aligned with shorter time horizons. Discover how choosing the right strategy based on your investment time horizon can optimize portfolio performance.

Market Exposure

Buy and hold strategies maintain significant long-term market exposure by holding securities through various market cycles, leveraging capital gains and dividends for wealth accumulation. Delta neutral strategies minimize market exposure by balancing positions in options and underlying assets, aiming to profit from volatility and price movements rather than directional market trends. Explore the key differences and suitability of each approach to optimize your investment portfolio.

Risk Management

The buy and hold strategy primarily minimizes risk through long-term market exposure, relying on asset appreciation over time and dividends to manage volatility. In contrast, the delta neutral strategy seeks to eliminate directional risk by balancing long and short positions, often using options to hedge against price movements and reduce portfolio sensitivity to underlying asset fluctuations. Explore the nuances of these approaches to strengthen your risk management skills and optimize investment outcomes.

Source and External Links

Buy and hold - Wikipedia - Buy and hold is an investment strategy where an investor purchases assets to hold long term to realize price appreciation despite market volatility, avoiding frequent selling or market timing and exemplifying passive management favored by renowned investors like Warren Buffett.

Buy-and-Hold Investing: Is It the Right Investment Strategy? - This strategy involves buying stocks, securities, or real estate and holding them for the medium or long term to capture capital appreciation while ignoring short-term market fluctuations, helping reduce transaction fees compared to frequent trading.

8-05 Buy and Hold - PersonalFinanceLab - The buy and hold strategy advocates purchasing stocks of well-managed, profitable companies with the intention of holding them for decades, minimizing stress from short-term market volatility and contrasting sharply with day trading or swing trading approaches.

dowidth.com

dowidth.com