High frequency trading bots execute thousands of trades per second using complex algorithms and real-time market data to capitalize on minute price changes, offering speed and precision unattainable by human traders. Manual discretionary trading relies on human expertise, intuition, and experience to make trading decisions, allowing for flexibility and adaptation to unexpected market events but at a slower pace. Explore the advantages and challenges of both methods to determine the optimal trading strategy for your goals.

Why it is important

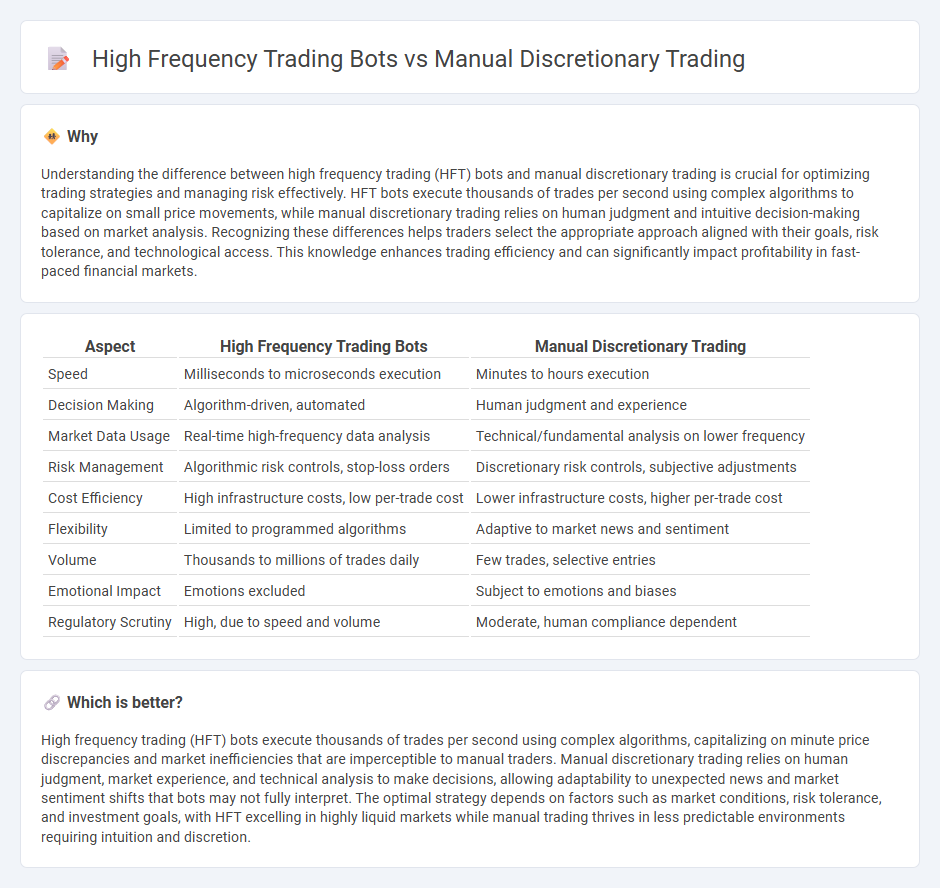

Understanding the difference between high frequency trading (HFT) bots and manual discretionary trading is crucial for optimizing trading strategies and managing risk effectively. HFT bots execute thousands of trades per second using complex algorithms to capitalize on small price movements, while manual discretionary trading relies on human judgment and intuitive decision-making based on market analysis. Recognizing these differences helps traders select the appropriate approach aligned with their goals, risk tolerance, and technological access. This knowledge enhances trading efficiency and can significantly impact profitability in fast-paced financial markets.

Comparison Table

| Aspect | High Frequency Trading Bots | Manual Discretionary Trading |

|---|---|---|

| Speed | Milliseconds to microseconds execution | Minutes to hours execution |

| Decision Making | Algorithm-driven, automated | Human judgment and experience |

| Market Data Usage | Real-time high-frequency data analysis | Technical/fundamental analysis on lower frequency |

| Risk Management | Algorithmic risk controls, stop-loss orders | Discretionary risk controls, subjective adjustments |

| Cost Efficiency | High infrastructure costs, low per-trade cost | Lower infrastructure costs, higher per-trade cost |

| Flexibility | Limited to programmed algorithms | Adaptive to market news and sentiment |

| Volume | Thousands to millions of trades daily | Few trades, selective entries |

| Emotional Impact | Emotions excluded | Subject to emotions and biases |

| Regulatory Scrutiny | High, due to speed and volume | Moderate, human compliance dependent |

Which is better?

High frequency trading (HFT) bots execute thousands of trades per second using complex algorithms, capitalizing on minute price discrepancies and market inefficiencies that are imperceptible to manual traders. Manual discretionary trading relies on human judgment, market experience, and technical analysis to make decisions, allowing adaptability to unexpected news and market sentiment shifts that bots may not fully interpret. The optimal strategy depends on factors such as market conditions, risk tolerance, and investment goals, with HFT excelling in highly liquid markets while manual trading thrives in less predictable environments requiring intuition and discretion.

Connection

High frequency trading (HFT) bots and manual discretionary trading intersect through their shared reliance on market data and price signals to execute trades. HFT bots use algorithmic models to analyze large volumes of real-time market data and execute orders within milliseconds, while manual discretionary traders interpret similar data patterns with human judgment and flexibility. Both methods aim to capitalize on price inefficiencies and market momentum, but HFT relies on speed and automation, whereas discretionary trading depends on trader expertise and intuition.

Key Terms

Decision-making process

Manual discretionary trading relies on human intuition, experience, and real-time judgment to make decisions, allowing for adaptive responses to market nuances and unexpected events. High frequency trading (HFT) bots utilize algorithmic models, processing vast datasets within microseconds to execute trades based on pre-defined strategies and quantitative signals. Explore how decision-making dynamics differ fundamentally and impact trading outcomes in diverse market conditions.

Trade execution speed

Manual discretionary trading relies on human judgment, resulting in slower trade execution speeds typically measured in seconds or minutes, which can limit responsiveness in volatile markets. High-frequency trading bots operate using sophisticated algorithms and ultra-low latency connections to execute thousands of trades in microseconds, maximizing profit opportunities through rapid market analysis and order placement. Explore how execution speed impacts trading performance to optimize your trading strategy effectively.

Algorithmic automation

Manual discretionary trading relies on human judgment and experience to make investment decisions, often resulting in slower execution and higher emotional bias. High-frequency trading bots utilize algorithmic automation to execute thousands of orders per second, capitalizing on tiny price discrepancies to generate profits with minimal latency. Explore the mechanics and advantages of algorithmic trading automation for comprehensive market strategies.

Source and External Links

Discretionary Trading - QuantifiedStrategies.com - Manual discretionary trading allows traders to use their judgment, experience, and intuition rather than strict rules, giving flexibility to adapt strategies dynamically to changing market conditions while requiring strong emotional control and market understanding.

What Is Discretionary Trading and How Does It Differ from Algorithmic Trading? - Discretionary trading involves human traders making buy/sell decisions based on qualitative and quantitative analysis, relying heavily on human judgment, experience, and flexibility to respond in real-time to market changes.

Algorithmic Trading Vs Discretionary Trading | IBKR Quant - Manual discretionary trading requires skills like market experience, analytical ability, continuous market monitoring, and emotional intelligence to avoid impulsive decisions influenced by fear or greed.

dowidth.com

dowidth.com