Paper trading competitions allow participants to simulate real-time market conditions using virtual funds, honing decision-making skills without financial risk. Backtesting contests focus on evaluating trading strategies against historical data to optimize performance metrics such as Sharpe ratio and drawdowns. Explore the key differences and advantages of paper trading competitions versus backtesting contests to enhance your trading expertise.

Why it is important

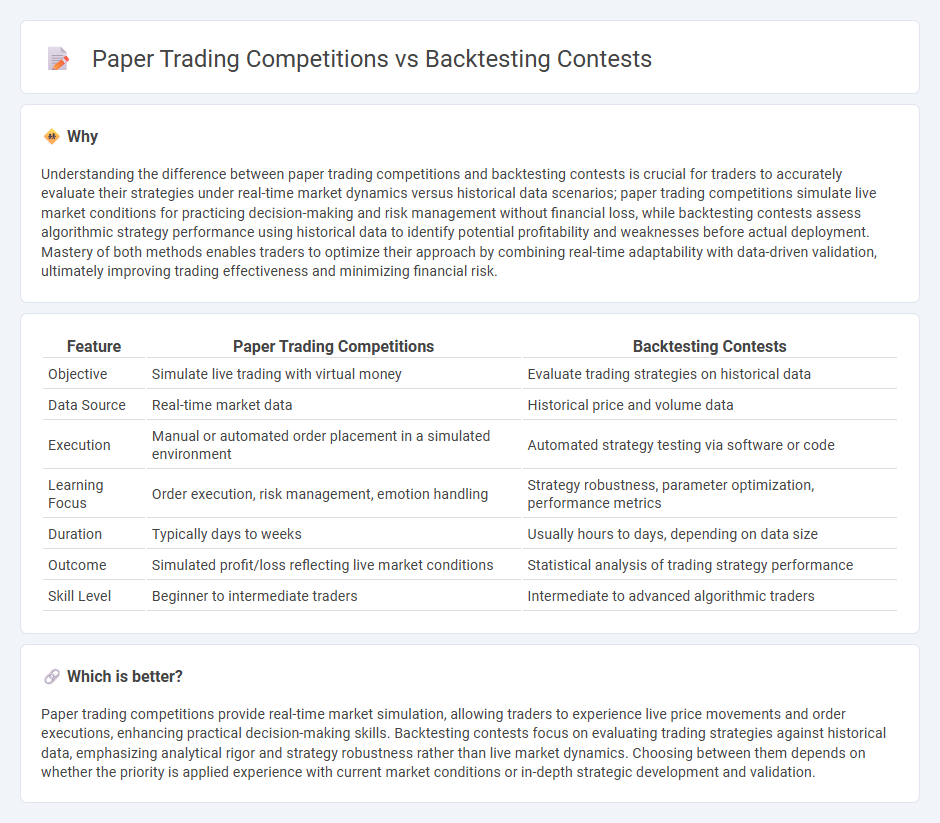

Understanding the difference between paper trading competitions and backtesting contests is crucial for traders to accurately evaluate their strategies under real-time market dynamics versus historical data scenarios; paper trading competitions simulate live market conditions for practicing decision-making and risk management without financial loss, while backtesting contests assess algorithmic strategy performance using historical data to identify potential profitability and weaknesses before actual deployment. Mastery of both methods enables traders to optimize their approach by combining real-time adaptability with data-driven validation, ultimately improving trading effectiveness and minimizing financial risk.

Comparison Table

| Feature | Paper Trading Competitions | Backtesting Contests |

|---|---|---|

| Objective | Simulate live trading with virtual money | Evaluate trading strategies on historical data |

| Data Source | Real-time market data | Historical price and volume data |

| Execution | Manual or automated order placement in a simulated environment | Automated strategy testing via software or code |

| Learning Focus | Order execution, risk management, emotion handling | Strategy robustness, parameter optimization, performance metrics |

| Duration | Typically days to weeks | Usually hours to days, depending on data size |

| Outcome | Simulated profit/loss reflecting live market conditions | Statistical analysis of trading strategy performance |

| Skill Level | Beginner to intermediate traders | Intermediate to advanced algorithmic traders |

Which is better?

Paper trading competitions provide real-time market simulation, allowing traders to experience live price movements and order executions, enhancing practical decision-making skills. Backtesting contests focus on evaluating trading strategies against historical data, emphasizing analytical rigor and strategy robustness rather than live market dynamics. Choosing between them depends on whether the priority is applied experience with current market conditions or in-depth strategic development and validation.

Connection

Paper trading competitions and backtesting contests both serve as vital tools for traders to refine strategies without financial risk. Paper trading competitions simulate live market conditions allowing participants to practice order execution and decision-making, while backtesting contests focus on evaluating strategy performance using historical data for optimization. The integration of both approaches enhances a trader's ability to develop robust, data-driven trading systems before deploying capital in real markets.

Key Terms

**Backtesting Contests:**

Backtesting contests emphasize evaluating trading strategies using historical market data, allowing participants to optimize algorithms without real-time risk. These contests often incorporate performance metrics such as Sharpe ratio, maximum drawdown, and net profit to assess strategy robustness and consistency over multiple market conditions. Explore more to understand how backtesting contests can sharpen your quantitative trading skills effectively.

Historical Data

Backtesting contests evaluate trading strategies using historical market data, allowing participants to analyze past price movements and optimize performance metrics without real-time risks. Paper trading competitions simulate current market conditions with virtual funds to test execution and decision-making skills in real-time environments. Explore further to understand how each approach enhances strategy development and trader skill acquisition.

Algorithmic Strategy

Backtesting contests evaluate algorithmic trading strategies using historical market data to measure performance without real-time execution, emphasizing accuracy in simulated conditions. Paper trading competitions simulate live market environments allowing participants to test algorithmic strategies with virtual capital, providing insights into strategy execution and market dynamics. Explore in-depth differences and benefits to enhance your algorithmic trading approach.

Source and External Links

What is backtesting and how do you backtest a trading strategy? - IG - Explains backtesting as analyzing trading strategies on historical data and contrasts it with scenario analysis and forward performance testing to evaluate strategy effectiveness.

How to Backtest Trading Strategies with Python and More - Details the importance of backtesting in trading, emphasizing how it helps evaluate strategies, manage risk, build confidence, and make informed decisions using historical data.

BacktestingMax - The only FREE backtesting platform - Offers a free and user-friendly platform specifically for backtesting Forex and Crypto trading strategies with real charts and bar replay features.

dowidth.com

dowidth.com