Quantitative signals utilize statistical models and historical price data to generate predictive indicators for trading decisions. Order flow analysis focuses on real-time market transactions, examining the volume and direction of trades to gauge supply and demand dynamics. Explore the nuances of these strategies to enhance your trading performance.

Why it is important

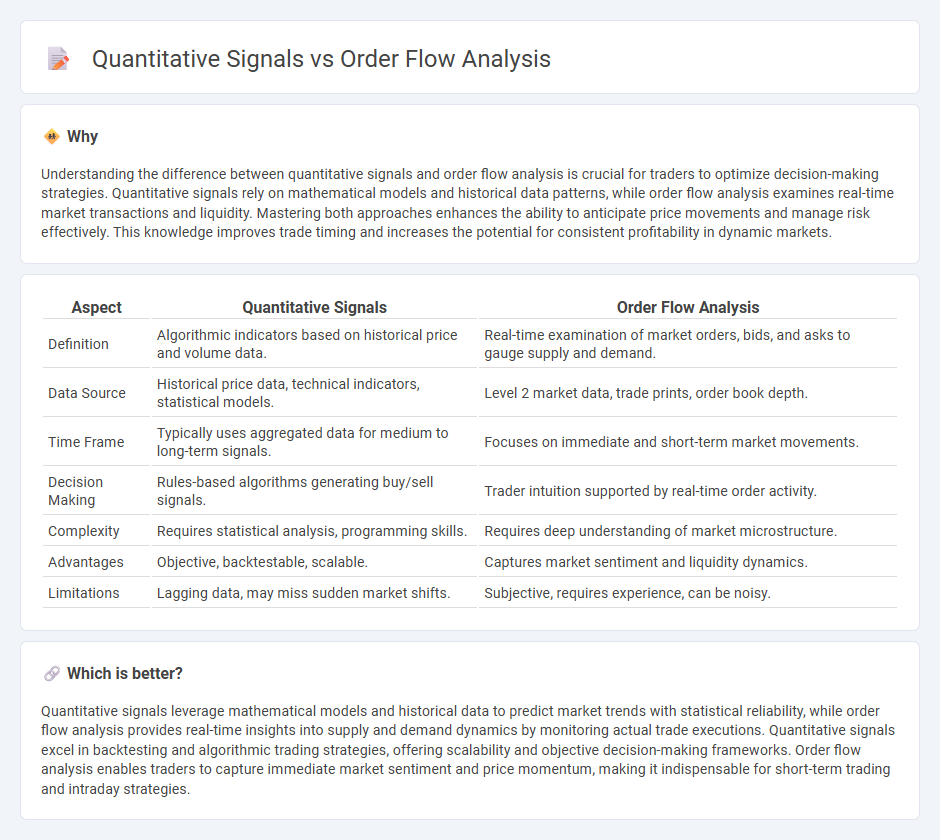

Understanding the difference between quantitative signals and order flow analysis is crucial for traders to optimize decision-making strategies. Quantitative signals rely on mathematical models and historical data patterns, while order flow analysis examines real-time market transactions and liquidity. Mastering both approaches enhances the ability to anticipate price movements and manage risk effectively. This knowledge improves trade timing and increases the potential for consistent profitability in dynamic markets.

Comparison Table

| Aspect | Quantitative Signals | Order Flow Analysis |

|---|---|---|

| Definition | Algorithmic indicators based on historical price and volume data. | Real-time examination of market orders, bids, and asks to gauge supply and demand. |

| Data Source | Historical price data, technical indicators, statistical models. | Level 2 market data, trade prints, order book depth. |

| Time Frame | Typically uses aggregated data for medium to long-term signals. | Focuses on immediate and short-term market movements. |

| Decision Making | Rules-based algorithms generating buy/sell signals. | Trader intuition supported by real-time order activity. |

| Complexity | Requires statistical analysis, programming skills. | Requires deep understanding of market microstructure. |

| Advantages | Objective, backtestable, scalable. | Captures market sentiment and liquidity dynamics. |

| Limitations | Lagging data, may miss sudden market shifts. | Subjective, requires experience, can be noisy. |

Which is better?

Quantitative signals leverage mathematical models and historical data to predict market trends with statistical reliability, while order flow analysis provides real-time insights into supply and demand dynamics by monitoring actual trade executions. Quantitative signals excel in backtesting and algorithmic trading strategies, offering scalability and objective decision-making frameworks. Order flow analysis enables traders to capture immediate market sentiment and price momentum, making it indispensable for short-term trading and intraday strategies.

Connection

Quantitative signals utilize mathematical models and statistical data to identify trading opportunities, while order flow analysis examines the real-time stream of buy and sell orders to gauge market sentiment and liquidity. Together, these tools enhance market predictions by integrating structured numerical indicators with direct insight into trader behavior and market dynamics. This synergy improves trade execution strategies and risk management.

Key Terms

**Order Flow Analysis:**

Order Flow Analysis examines real-time transaction data to track market participant behavior and liquidity shifts, offering insights into supply and demand dynamics. This technique prioritizes the granular study of order book movements and trade executions, contrasting with quantitative signals that rely on pre-defined mathematical models and historical price data. Explore the nuances of Order Flow Analysis to enhance trading strategies and market prediction accuracy.

Order Book

Order flow analysis examines real-time transactions and order placements within the order book to predict short-term price movements with precision, whereas quantitative signals leverage statistical models and historical data to identify broader market trends. The order book provides granular insights into supply and demand dynamics, highlighting liquidity levels and trader sentiment essential for high-frequency trading strategies. Explore how combining order flow analysis with quantitative signals can enhance trading accuracy and profitability.

Market Depth

Order flow analysis leverages real-time market depth data to track the precise buying and selling pressure, highlighting the volume and imbalance at various price levels. Quantitative signals utilize historical order book patterns aggregated into statistical models, often smoothing over granular changes in market depth. Explore how integrating market depth insights enhances trading strategies through our in-depth analysis.

Source and External Links

Technical Analysis vs. Order Flow: Techniques and Tools - Order flow analysis is the technique of observing and interpreting the real-time flow of buy and sell orders, including their size and aggressiveness, allowing traders to predict price movements by reading the order book and volume clusters at key price levels.

Order Flow Trading Strategy That Pros Are Using In 2024 - Order flow trading involves watching the flow of trading orders and their impact on price to anticipate future moves, using indicators like volume profile, order book imbalance, delta, and cumulative delta to analyze buying and selling activity.

Master ORDER FLOW TRADING in Less than ONE HOUR! - This tutorial explains foundational tools for order flow analysis, including footprint charts, volume profile, and cumulative volume delta, highlighting how aggressive buying and selling are represented within price levels during trading.

dowidth.com

dowidth.com