High-frequency scalp bots execute rapid trades by capitalizing on small price fluctuations within milliseconds, aiming for quick profits on minimal spreads. Market-making bots continuously provide buy and sell orders, enhancing liquidity and profiting from bid-ask spreads while managing inventory risk. Explore the distinct strategies and benefits of these trading bots to optimize your algorithmic trading approach.

Why it is important

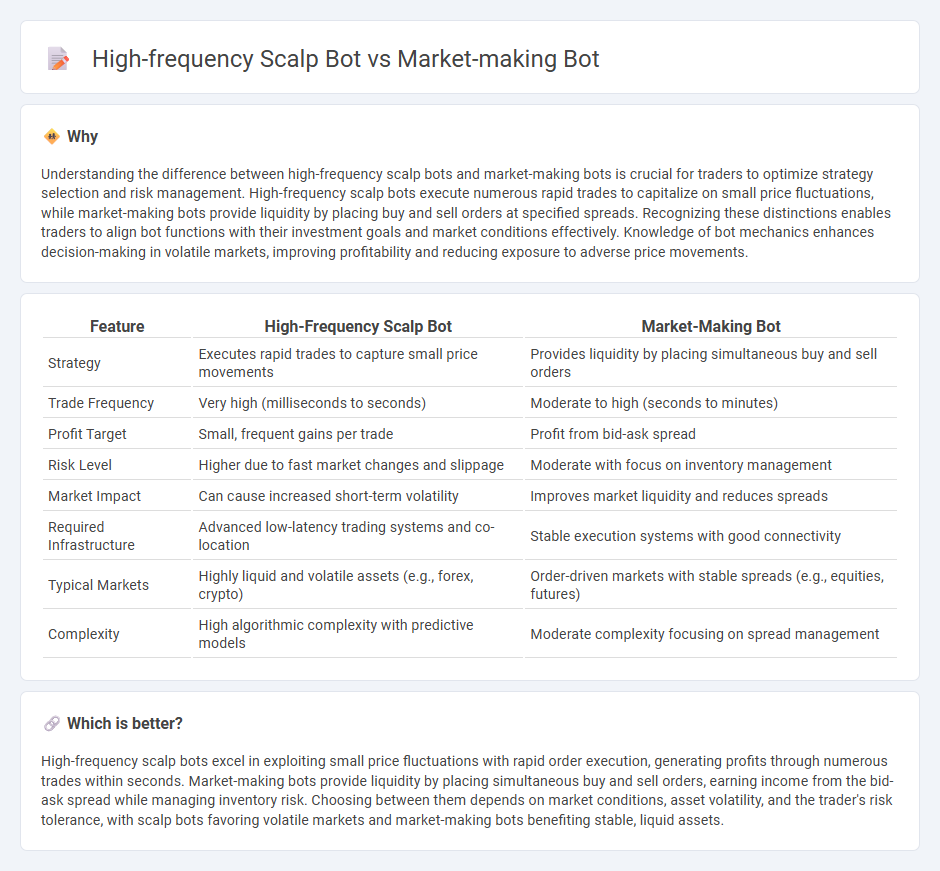

Understanding the difference between high-frequency scalp bots and market-making bots is crucial for traders to optimize strategy selection and risk management. High-frequency scalp bots execute numerous rapid trades to capitalize on small price fluctuations, while market-making bots provide liquidity by placing buy and sell orders at specified spreads. Recognizing these distinctions enables traders to align bot functions with their investment goals and market conditions effectively. Knowledge of bot mechanics enhances decision-making in volatile markets, improving profitability and reducing exposure to adverse price movements.

Comparison Table

| Feature | High-Frequency Scalp Bot | Market-Making Bot |

|---|---|---|

| Strategy | Executes rapid trades to capture small price movements | Provides liquidity by placing simultaneous buy and sell orders |

| Trade Frequency | Very high (milliseconds to seconds) | Moderate to high (seconds to minutes) |

| Profit Target | Small, frequent gains per trade | Profit from bid-ask spread |

| Risk Level | Higher due to fast market changes and slippage | Moderate with focus on inventory management |

| Market Impact | Can cause increased short-term volatility | Improves market liquidity and reduces spreads |

| Required Infrastructure | Advanced low-latency trading systems and co-location | Stable execution systems with good connectivity |

| Typical Markets | Highly liquid and volatile assets (e.g., forex, crypto) | Order-driven markets with stable spreads (e.g., equities, futures) |

| Complexity | High algorithmic complexity with predictive models | Moderate complexity focusing on spread management |

Which is better?

High-frequency scalp bots excel in exploiting small price fluctuations with rapid order execution, generating profits through numerous trades within seconds. Market-making bots provide liquidity by placing simultaneous buy and sell orders, earning income from the bid-ask spread while managing inventory risk. Choosing between them depends on market conditions, asset volatility, and the trader's risk tolerance, with scalp bots favoring volatile markets and market-making bots benefiting stable, liquid assets.

Connection

High-frequency scalp bots execute rapid trades to capture small price movements, generating liquidity that market-making bots rely on to maintain tight bid-ask spreads. Market-making bots provide continuous buy and sell quotes, enhancing market depth and volatility conditions that scalp bots exploit for profit. The synergy between these bots increases market efficiency by balancing supply and demand through near-instantaneous order placements and cancellations.

Key Terms

Spread

Market-making bots prioritize capturing the bid-ask spread by continuously placing limit orders on both sides of the order book, profiting from the difference between buying and selling prices. High-frequency scalp bots execute rapid trades to exploit minimal price changes, often focusing less on the spread and more on quick order execution and market momentum. Explore the detailed differences in spread strategies to optimize your trading bot selection.

Latency

Market-making bots maintain liquidity by placing limit orders and profiting from the bid-ask spread, requiring moderate latency to update orders efficiently. High-frequency scalp bots exploit micro price movements through rapid order execution, necessitating ultra-low latency to capitalize on fleeting arbitrage opportunities. Explore deeper insights on latency's impact in trading bot strategies to optimize performance.

Liquidity

Market-making bots enhance liquidity by placing both buy and sell orders around the current price, narrowing spreads and facilitating smoother trades on exchanges. High-frequency scalp bots capitalize on tiny price fluctuations through rapid trades but do not consistently contribute to liquidity since they focus on quick order execution rather than maintaining order books. Explore more about how these bots influence market dynamics and liquidity provision in different trading environments.

Source and External Links

Market Maker Bot: Elevating Trading Strategies - WunderTrading - A market-making bot continuously places buy and sell orders in crypto markets to maintain liquidity, stabilize prices, and enable fair trading, acting as the backbone of a healthy market.

How does a crypto market making bot work? - Kairon Labs - This bot automates buying and selling using predefined rules to profit from the bid-ask spread without emotional bias or human intervention.

Battle of the Bots: How Market Makers Fight It Out on Crypto Exchanges - Mack Grenfell - Market-making bots strategically place buy orders just above the current bid price to capture favorable trades and compete for best price positions in real-time markets.

dowidth.com

dowidth.com