Dark pool aggregation consolidates private trading venues to enhance liquidity and minimize market impact, allowing large orders to execute discreetly. Quote-driven trading relies on market makers providing continuous bid and ask prices, ensuring immediate execution and price discovery. Explore further to understand how each method transforms trading strategies and market efficiency.

Why it is important

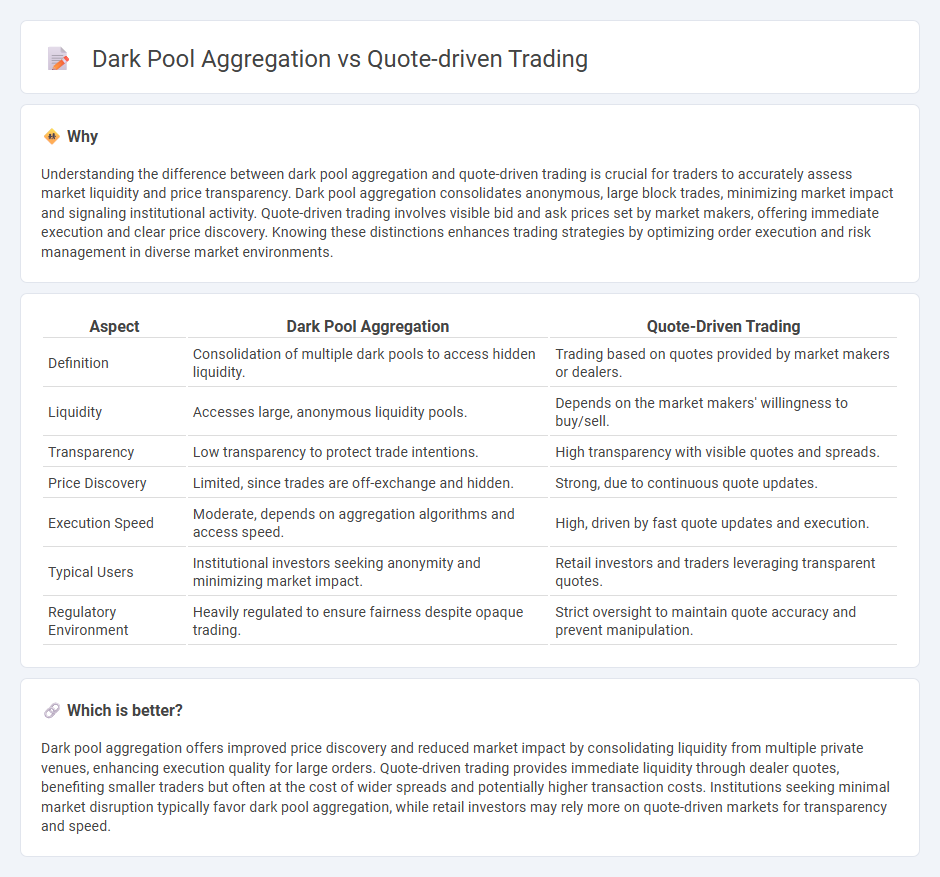

Understanding the difference between dark pool aggregation and quote-driven trading is crucial for traders to accurately assess market liquidity and price transparency. Dark pool aggregation consolidates anonymous, large block trades, minimizing market impact and signaling institutional activity. Quote-driven trading involves visible bid and ask prices set by market makers, offering immediate execution and clear price discovery. Knowing these distinctions enhances trading strategies by optimizing order execution and risk management in diverse market environments.

Comparison Table

| Aspect | Dark Pool Aggregation | Quote-Driven Trading |

|---|---|---|

| Definition | Consolidation of multiple dark pools to access hidden liquidity. | Trading based on quotes provided by market makers or dealers. |

| Liquidity | Accesses large, anonymous liquidity pools. | Depends on the market makers' willingness to buy/sell. |

| Transparency | Low transparency to protect trade intentions. | High transparency with visible quotes and spreads. |

| Price Discovery | Limited, since trades are off-exchange and hidden. | Strong, due to continuous quote updates. |

| Execution Speed | Moderate, depends on aggregation algorithms and access speed. | High, driven by fast quote updates and execution. |

| Typical Users | Institutional investors seeking anonymity and minimizing market impact. | Retail investors and traders leveraging transparent quotes. |

| Regulatory Environment | Heavily regulated to ensure fairness despite opaque trading. | Strict oversight to maintain quote accuracy and prevent manipulation. |

Which is better?

Dark pool aggregation offers improved price discovery and reduced market impact by consolidating liquidity from multiple private venues, enhancing execution quality for large orders. Quote-driven trading provides immediate liquidity through dealer quotes, benefiting smaller traders but often at the cost of wider spreads and potentially higher transaction costs. Institutions seeking minimal market disruption typically favor dark pool aggregation, while retail investors may rely more on quote-driven markets for transparency and speed.

Connection

Dark pool aggregation consolidates multiple private trading venues' liquidity, enhancing price discovery and trade execution efficiency. Quote-driven trading relies on market makers providing continuous bid and ask prices, which dark pool aggregators utilize to access deeper liquidity and improve transaction pricing. This integration reduces market impact and increases anonymity in large-volume trades.

Key Terms

Bid-Ask Spread

Quote-driven trading relies on market makers providing continuous bid-ask spreads, ensuring liquidity and price stability in public exchanges. Dark pool aggregation consolidates large institutional orders off-exchange, often offering narrower bid-ask spreads due to reduced market impact and information leakage. Explore the intricacies of bid-ask spreads in both models to enhance your trading strategy insights.

Liquidity Provider

Liquidity providers play a critical role in quote-driven trading by continuously posting bid and ask prices, ensuring market depth and price discovery. Dark pool aggregation consolidates orders from various dark venues, enhancing anonymity and minimizing market impact for liquidity providers. Explore the dynamics between these mechanisms to understand their impact on trading efficiency and liquidity management.

Order Anonymity

Quote-driven trading relies on market makers providing continuous bid and ask prices, often revealing order intentions openly. Dark pool aggregation enables institutional traders to execute large orders anonymously, minimizing market impact and information leakage. Explore the nuances of order anonymity to understand how these mechanisms influence trading strategies and market transparency.

Source and External Links

Key Differences between Quote-Driven vs. Order-Driven Markets - Quote-driven trading involves market makers or dealers who continuously quote bid and ask prices and fulfill orders from their inventory, acting as intermediaries that provide liquidity typically in OTC markets.

Quote-Driven, Order-Driven & Brokered Markets | CFA Level 1 - In quote-driven markets, customers trade at prices quoted by dealers, who provide liquidity by posting bid and ask prices, commonly used for bonds and certain stocks, contrasting with order-driven markets which match buy and sell orders directly.

Trading Mechanism - Quote Driven and Order Driven - Quote-driven trading systems feature market makers providing continuous price quotes to buyers and sellers, with the difference between bid and ask prices representing the dealer's profit, making these systems suited to OTC or dealer markets.

dowidth.com

dowidth.com