Order flow analysis focuses on real-time market data to track the transactions and liquidity movements, providing insights into supply and demand dynamics. Quantitative analysis employs mathematical models and statistical techniques to identify trading opportunities and optimize strategies based on historical data patterns. Explore more to understand how these distinct approaches can enhance your trading performance.

Why it is important

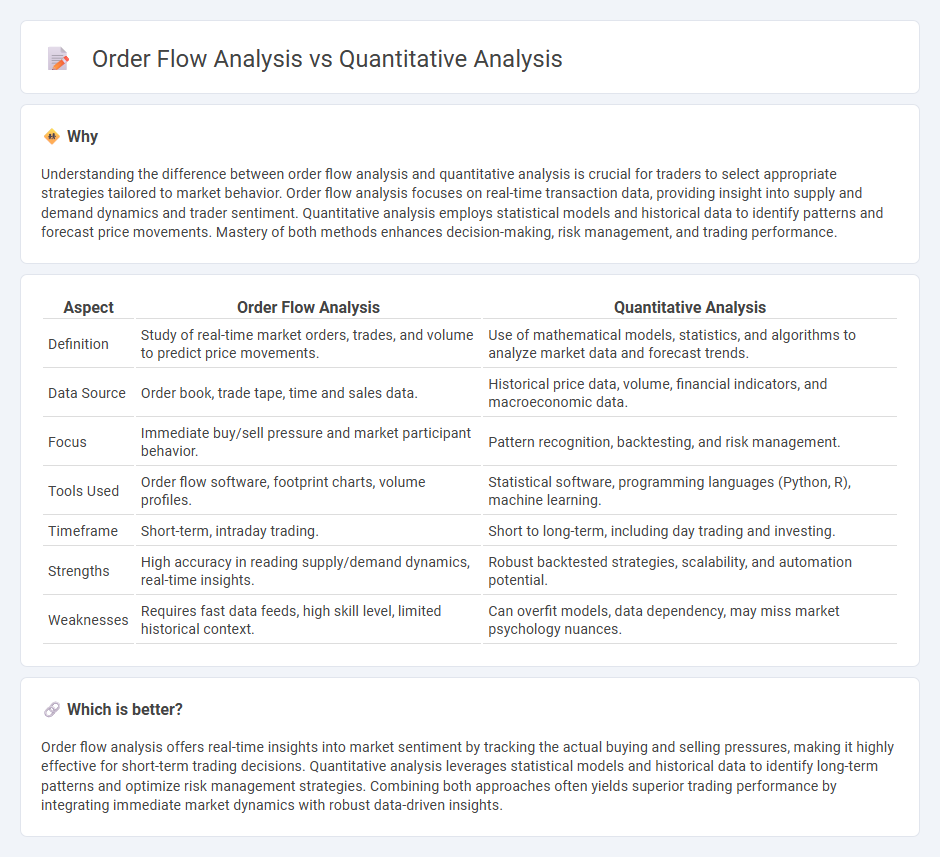

Understanding the difference between order flow analysis and quantitative analysis is crucial for traders to select appropriate strategies tailored to market behavior. Order flow analysis focuses on real-time transaction data, providing insight into supply and demand dynamics and trader sentiment. Quantitative analysis employs statistical models and historical data to identify patterns and forecast price movements. Mastery of both methods enhances decision-making, risk management, and trading performance.

Comparison Table

| Aspect | Order Flow Analysis | Quantitative Analysis |

|---|---|---|

| Definition | Study of real-time market orders, trades, and volume to predict price movements. | Use of mathematical models, statistics, and algorithms to analyze market data and forecast trends. |

| Data Source | Order book, trade tape, time and sales data. | Historical price data, volume, financial indicators, and macroeconomic data. |

| Focus | Immediate buy/sell pressure and market participant behavior. | Pattern recognition, backtesting, and risk management. |

| Tools Used | Order flow software, footprint charts, volume profiles. | Statistical software, programming languages (Python, R), machine learning. |

| Timeframe | Short-term, intraday trading. | Short to long-term, including day trading and investing. |

| Strengths | High accuracy in reading supply/demand dynamics, real-time insights. | Robust backtested strategies, scalability, and automation potential. |

| Weaknesses | Requires fast data feeds, high skill level, limited historical context. | Can overfit models, data dependency, may miss market psychology nuances. |

Which is better?

Order flow analysis offers real-time insights into market sentiment by tracking the actual buying and selling pressures, making it highly effective for short-term trading decisions. Quantitative analysis leverages statistical models and historical data to identify long-term patterns and optimize risk management strategies. Combining both approaches often yields superior trading performance by integrating immediate market dynamics with robust data-driven insights.

Connection

Order flow analysis provides real-time market data on buy and sell orders, which feeds quantitative analysis models to identify trading patterns and predict price movements. Quantitative analysis leverages statistical algorithms to process this granular order flow data, enhancing the accuracy of trade execution strategies. Combining these methods improves risk management and optimizes decision-making in high-frequency trading environments.

Key Terms

Algorithms

Quantitative analysis utilizes mathematical models and statistical techniques to develop algorithms that predict market trends and optimize trading strategies. Order flow analysis focuses on real-time market data, examining the flow of buy and sell orders to gauge supply and demand dynamics, which enhances algorithmic decision-making. Explore how integrating both approaches can revolutionize algorithmic trading performance.

Liquidity

Quantitative analysis evaluates liquidity by analyzing historical price and volume data through statistical models, enabling traders to identify patterns and predict market behavior. Order flow analysis focuses on real-time transaction data, tracking buy and sell orders to gauge current liquidity and market depth, providing insights into immediate supply and demand dynamics. Explore further to understand how combining these methods enhances trading strategies.

Market microstructure

Quantitative analysis leverages statistical models and historical data to predict market trends, while order flow analysis examines real-time trade orders to understand supply and demand dynamics within market microstructure. Market microstructure studies the mechanisms of price formation, liquidity, and trading behavior through the lens of both methods. Explore deeper insights into how these analyses shape efficient trading strategies and market behavior.

Source and External Links

What Is Quantitative Analysis? Definition and Methods | Indeed.com - Quantitative analysis is a data collection and assessment tool that uses numerical data to predict outcomes, identify trends, and guide decision-making across fields like finance, research, and business operations.

Quantitative Analysis: Definition, Types and Examples - MasterClass - Quantitative analysis involves methods such as data mining, linear programming, and regression analysis to analyze numerical data and optimize decisions in finance, inventory management, and project planning.

Quantitative analysis (finance) - Wikipedia - In finance, quantitative analysis applies mathematical and statistical methods to identify patterns and manage risks, supporting activities like derivative pricing, algorithmic trading, and investment management by specialized analysts called "quants".

dowidth.com

dowidth.com