Dark pool prints represent large-volume trades executed privately away from public exchanges, minimizing market impact and preserving anonymity for institutional investors. Off-exchange transactions encompass a broader range of trade executions outside traditional exchanges, including dark pools, alternative trading systems (ATS), and over-the-counter (OTC) deals, offering varied liquidity and price discovery advantages. Explore deeper insights into how dark pool prints and off-exchange transactions influence market transparency and trading strategies.

Why it is important

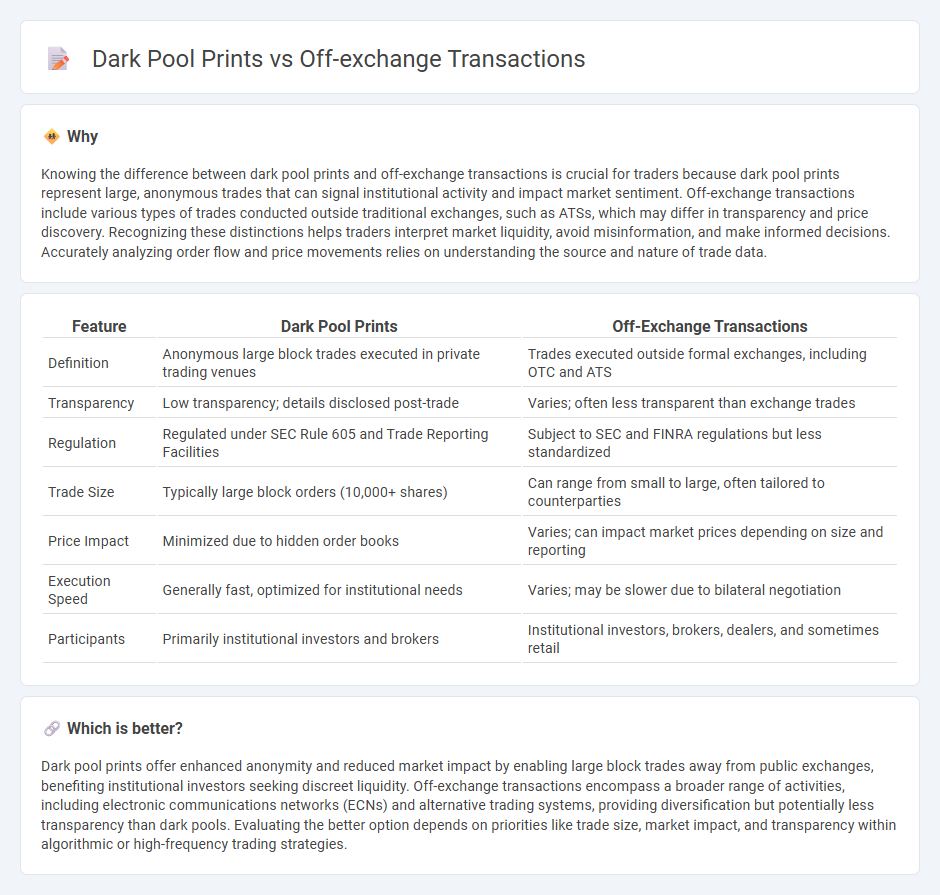

Knowing the difference between dark pool prints and off-exchange transactions is crucial for traders because dark pool prints represent large, anonymous trades that can signal institutional activity and impact market sentiment. Off-exchange transactions include various types of trades conducted outside traditional exchanges, such as ATSs, which may differ in transparency and price discovery. Recognizing these distinctions helps traders interpret market liquidity, avoid misinformation, and make informed decisions. Accurately analyzing order flow and price movements relies on understanding the source and nature of trade data.

Comparison Table

| Feature | Dark Pool Prints | Off-Exchange Transactions |

|---|---|---|

| Definition | Anonymous large block trades executed in private trading venues | Trades executed outside formal exchanges, including OTC and ATS |

| Transparency | Low transparency; details disclosed post-trade | Varies; often less transparent than exchange trades |

| Regulation | Regulated under SEC Rule 605 and Trade Reporting Facilities | Subject to SEC and FINRA regulations but less standardized |

| Trade Size | Typically large block orders (10,000+ shares) | Can range from small to large, often tailored to counterparties |

| Price Impact | Minimized due to hidden order books | Varies; can impact market prices depending on size and reporting |

| Execution Speed | Generally fast, optimized for institutional needs | Varies; may be slower due to bilateral negotiation |

| Participants | Primarily institutional investors and brokers | Institutional investors, brokers, dealers, and sometimes retail |

Which is better?

Dark pool prints offer enhanced anonymity and reduced market impact by enabling large block trades away from public exchanges, benefiting institutional investors seeking discreet liquidity. Off-exchange transactions encompass a broader range of activities, including electronic communications networks (ECNs) and alternative trading systems, providing diversification but potentially less transparency than dark pools. Evaluating the better option depends on priorities like trade size, market impact, and transparency within algorithmic or high-frequency trading strategies.

Connection

Dark pool prints represent large trade executions occurring in private, off-exchange venues that provide anonymity and reduced market impact. These off-exchange transactions bypass public order books, allowing institutional investors to trade substantial volumes without revealing their intentions to the broader market. The interplay between dark pool prints and off-exchange trading thus plays a crucial role in liquidity distribution and price discovery mechanisms within financial markets.

Key Terms

Liquidity

Off-exchange transactions involve trade executions occurring outside traditional stock exchanges, typically enhancing liquidity by facilitating larger block trades without impacting public order books. Dark pool prints, however, represent completed trades within private, non-transparent marketplaces that allow institutional investors to execute transactions discreetly, often preserving market anonymity and reducing price volatility. Explore how these mechanisms influence market liquidity for deeper insights.

Transparency

Off-exchange transactions occur outside traditional public exchanges, often lacking full transparency and detailed reporting, which can create challenges for market participants seeking accurate price discovery. Dark pool prints, executed within private trading venues, provide anonymity for large orders but still contribute to market transparency by reporting trade data after execution, although the timing and detail vary. Explore how transparency differences impact market behavior and regulatory oversight to better understand these trading mechanisms.

Price Discovery

Off-exchange transactions refer to trades executed away from public exchanges, often impacting price discovery by providing less transparent pricing information. Dark pool prints occur within private trading venues where large blocks of shares are exchanged anonymously, potentially delaying price signals essential for accurate market valuation. Explore how these mechanisms influence market efficiency and price discovery by learning more about their distinct roles.

Source and External Links

Does Off-Exchange Trading Affect Prices and Liquidity on Exchanges? - Off-exchange trading frequently offers investors better prices than exchanges and briefly impacts exchange liquidity, particularly odd-lot orders, though this liquidity can rapidly disappear around off-exchange trades.

Off-Exchange Trends: Beyond Sub-dollar Trading - Off-exchange U.S. equity volumes have grown significantly, representing about 45% of total market volume as of April 2023, with off-exchange trades occurring via Alternative Trading Systems and non-ATS venues that provide anonymity and other benefits compared to exchanges.

Over-the-counter (finance) - Wikipedia - Off-exchange or OTC trading is direct trading between two parties without exchange supervision, often involving customized contracts like forwards and swaps, but includes risks such as counterparty default and less regulation compared to exchange trading.

dowidth.com

dowidth.com