Zero knowledge proof trading leverages cryptographic methods to enable secure transactions without revealing sensitive data, ensuring privacy and trust in decentralized markets. Algorithmic trading uses pre-programmed instructions and statistical models to execute high-speed trades, optimizing for speed and efficiency across financial markets. Discover how these trading approaches reshape market dynamics and security protocols.

Why it is important

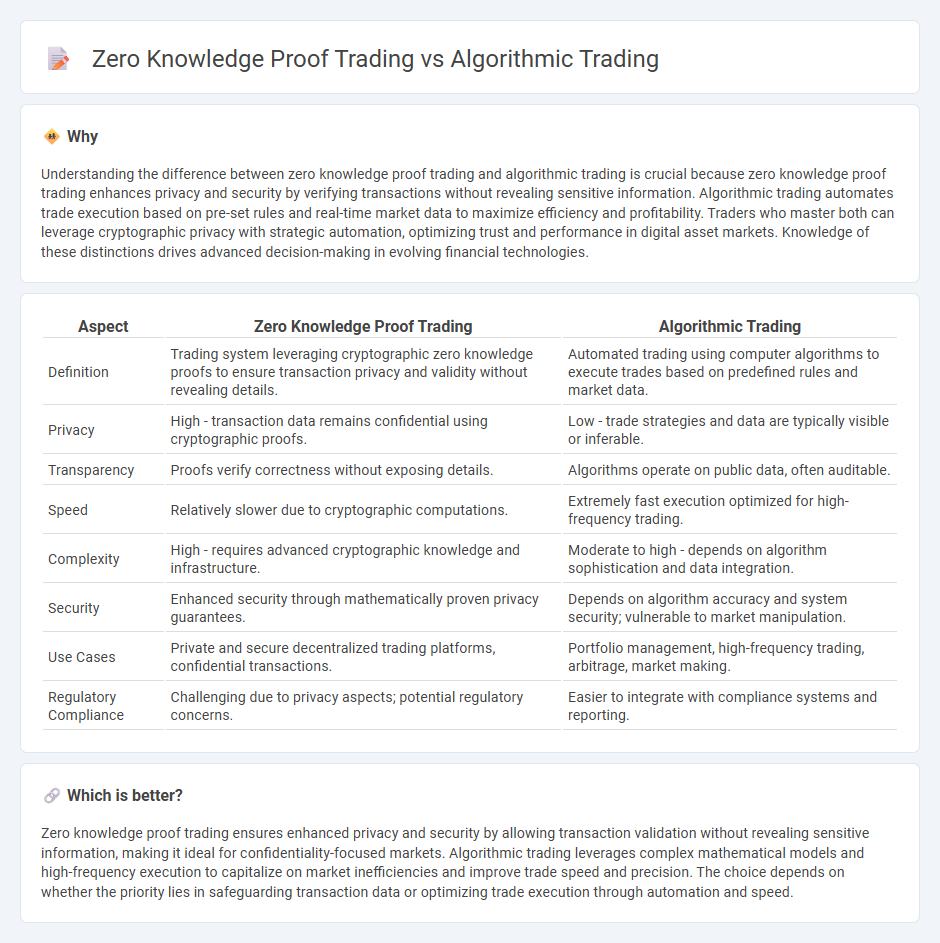

Understanding the difference between zero knowledge proof trading and algorithmic trading is crucial because zero knowledge proof trading enhances privacy and security by verifying transactions without revealing sensitive information. Algorithmic trading automates trade execution based on pre-set rules and real-time market data to maximize efficiency and profitability. Traders who master both can leverage cryptographic privacy with strategic automation, optimizing trust and performance in digital asset markets. Knowledge of these distinctions drives advanced decision-making in evolving financial technologies.

Comparison Table

| Aspect | Zero Knowledge Proof Trading | Algorithmic Trading |

|---|---|---|

| Definition | Trading system leveraging cryptographic zero knowledge proofs to ensure transaction privacy and validity without revealing details. | Automated trading using computer algorithms to execute trades based on predefined rules and market data. |

| Privacy | High - transaction data remains confidential using cryptographic proofs. | Low - trade strategies and data are typically visible or inferable. |

| Transparency | Proofs verify correctness without exposing details. | Algorithms operate on public data, often auditable. |

| Speed | Relatively slower due to cryptographic computations. | Extremely fast execution optimized for high-frequency trading. |

| Complexity | High - requires advanced cryptographic knowledge and infrastructure. | Moderate to high - depends on algorithm sophistication and data integration. |

| Security | Enhanced security through mathematically proven privacy guarantees. | Depends on algorithm accuracy and system security; vulnerable to market manipulation. |

| Use Cases | Private and secure decentralized trading platforms, confidential transactions. | Portfolio management, high-frequency trading, arbitrage, market making. |

| Regulatory Compliance | Challenging due to privacy aspects; potential regulatory concerns. | Easier to integrate with compliance systems and reporting. |

Which is better?

Zero knowledge proof trading ensures enhanced privacy and security by allowing transaction validation without revealing sensitive information, making it ideal for confidentiality-focused markets. Algorithmic trading leverages complex mathematical models and high-frequency execution to capitalize on market inefficiencies and improve trade speed and precision. The choice depends on whether the priority lies in safeguarding transaction data or optimizing trade execution through automation and speed.

Connection

Zero knowledge proof trading enhances algorithmic trading by enabling secure, private validation of transaction data without revealing sensitive information, thereby increasing trust and efficiency in automated strategies. Algorithmic trading leverages these cryptographic methods to verify trades and market conditions on decentralized platforms, maintaining data integrity and compliance. This integration supports faster execution and reduced risks in high-frequency and complex trading environments.

Key Terms

Algorithmic Trading:

Algorithmic trading leverages complex mathematical models and high-frequency execution to optimize trade decisions and reduce human error, offering increased speed and precision in financial markets. It relies on vast datasets and real-time analytics to identify profitable trading opportunities across various asset classes. Explore more to understand how algorithmic trading reshapes market dynamics and enhances investment strategies.

Automated Strategies

Algorithmic trading leverages automated strategies that execute predefined rules based on market data, optimizing trade timing and minimizing human error to enhance efficiency. Zero knowledge proof trading integrates cryptographic methods to verify trade authenticity without revealing sensitive information, offering enhanced privacy and security in automated transactions. Explore the benefits and technological nuances of these strategies to understand their impact on modern financial markets.

Backtesting

Algorithmic trading relies heavily on backtesting to evaluate strategies using historical market data and statistical models, ensuring the algorithms perform well under various market conditions. Zero knowledge proof trading enhances privacy by allowing verification of trades without revealing underlying data, which presents unique challenges and innovations in backtesting, as traditional data transparency is reduced. Explore deeper insights into how these technologies impact trading efficiency and strategy validation.

Source and External Links

Algorithmic Trading - Definition, Example, Pros, Cons - Algorithmic trading involves using pre-programmed computer rules to execute trades automatically when certain market conditions are met, such as moving average crossovers, allowing faster and more systematic trading decisions.

What is Algorithmic Trading and How Do You Get Started? - IG - Algorithmic trading uses computer codes to open and close trades based on predefined rules including price movements or technical indicators, with key strategies such as price action, technical analysis, and combinations for managing risks and exploiting market volatility.

Does Algorithmic Trading Improve Liquidity? - Algorithmic trading has grown sharply and has been shown to improve market liquidity by narrowing spreads, reducing adverse selection, and enhancing the informativeness of quotes, thus contributing to more efficient price discovery.

dowidth.com

dowidth.com