Quantitative momentum trading relies on mathematical models and historical price data to identify assets with strong trends and high potential for continued performance. News-based trading centers on analyzing real-time news events and market sentiment to capitalize on immediate price movements and volatility. Explore how these contrasting strategies can enhance your trading approach.

Why it is important

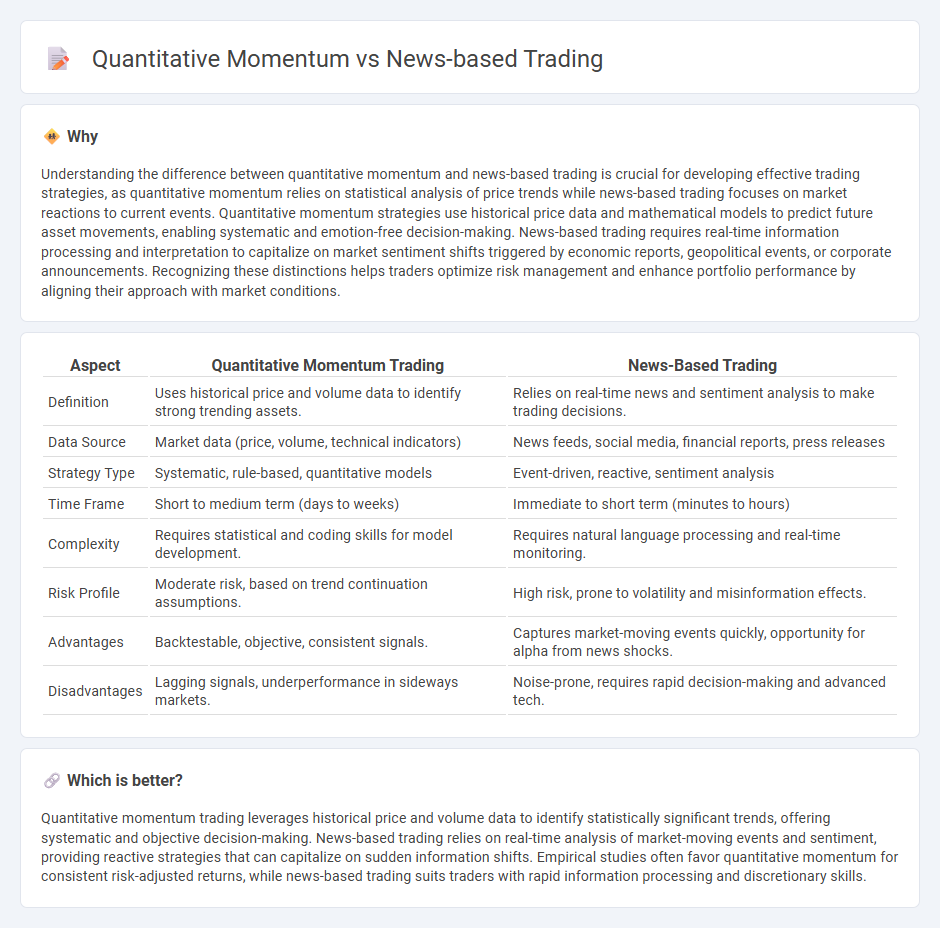

Understanding the difference between quantitative momentum and news-based trading is crucial for developing effective trading strategies, as quantitative momentum relies on statistical analysis of price trends while news-based trading focuses on market reactions to current events. Quantitative momentum strategies use historical price data and mathematical models to predict future asset movements, enabling systematic and emotion-free decision-making. News-based trading requires real-time information processing and interpretation to capitalize on market sentiment shifts triggered by economic reports, geopolitical events, or corporate announcements. Recognizing these distinctions helps traders optimize risk management and enhance portfolio performance by aligning their approach with market conditions.

Comparison Table

| Aspect | Quantitative Momentum Trading | News-Based Trading |

|---|---|---|

| Definition | Uses historical price and volume data to identify strong trending assets. | Relies on real-time news and sentiment analysis to make trading decisions. |

| Data Source | Market data (price, volume, technical indicators) | News feeds, social media, financial reports, press releases |

| Strategy Type | Systematic, rule-based, quantitative models | Event-driven, reactive, sentiment analysis |

| Time Frame | Short to medium term (days to weeks) | Immediate to short term (minutes to hours) |

| Complexity | Requires statistical and coding skills for model development. | Requires natural language processing and real-time monitoring. |

| Risk Profile | Moderate risk, based on trend continuation assumptions. | High risk, prone to volatility and misinformation effects. |

| Advantages | Backtestable, objective, consistent signals. | Captures market-moving events quickly, opportunity for alpha from news shocks. |

| Disadvantages | Lagging signals, underperformance in sideways markets. | Noise-prone, requires rapid decision-making and advanced tech. |

Which is better?

Quantitative momentum trading leverages historical price and volume data to identify statistically significant trends, offering systematic and objective decision-making. News-based trading relies on real-time analysis of market-moving events and sentiment, providing reactive strategies that can capitalize on sudden information shifts. Empirical studies often favor quantitative momentum for consistent risk-adjusted returns, while news-based trading suits traders with rapid information processing and discretionary skills.

Connection

Quantitative momentum trading leverages statistical models to identify securities exhibiting strong price trends, while news-based trading analyzes real-time information to capture market sentiment shifts. Integrating news sentiment data into momentum strategies enhances predictive accuracy by aligning price movements with fundamental events and market psychology. This synergy allows traders to exploit momentum signals amplified by impactful news, improving trade entry and exit timing.

Key Terms

**News-based trading:**

News-based trading leverages real-time market news, sentiment analysis, and breaking events to make swift investment decisions, capitalizing on immediate market reactions. This strategy integrates natural language processing and machine learning algorithms to analyze news headlines, social media, and financial reports for actionable insights. Explore deeper into how news-based trading algorithms transform data into profit opportunities in dynamic markets.

Sentiment analysis

News-based trading leverages sentiment analysis to interpret real-time market reactions by extracting positive or negative tones from financial news, social media, and press releases, providing traders with immediate insights into market-moving events. Quantitative momentum strategies, on the other hand, use mathematical models to identify stocks exhibiting strong price trends, often incorporating sentiment scores as a supplementary factor to enhance predictive accuracy. Explore deeper into how sentiment analysis bridges these approaches to optimize trading performance and decision-making.

Event-driven strategy

News-based trading leverages real-time event data and sentiment analysis to capitalize on immediate market reactions, enhancing the precision of entry and exit points around key corporate announcements or macroeconomic reports. Quantitative momentum strategies rely on historical price trends and statistical indicators to identify sustained asset movements, often incorporating event signals as part of a broader algorithmic model. Explore the nuances and comparative effectiveness of these event-driven strategies to optimize your trading approach.

Source and External Links

News Based Trading - Quantra by QuantInsti - News-based trading involves leveraging temporary mispricing of securities caused by news events, using algorithms to analyze sentiment and make trading decisions, but requires strong risk management due to noise and data timing challenges.

News Trading Strategies | How To Trade The News | AvaTrade - News trading is an event-driven approach focusing on market reactions to economic data and headlines, distinct from technical and fundamental analysis, emphasizing short-term trades based on triggered price movements.

Trading the news - Wikipedia - Trading the news is a technique that capitalizes on strong short-term market moves triggered by economic announcements or corporate events, using both manual and automated methods to exploit these opportunities efficiently.

dowidth.com

dowidth.com