Funded account programs offer traders access to significant capital provided by proprietary firms, eliminating the need to risk personal funds and enabling scalable trading opportunities. Cash accounts require traders to use their own capital, limiting leverage and potentially restricting profit capacity but offering full control over funds and strategies. Discover how funded accounts can accelerate your trading career compared to traditional cash accounts.

Why it is important

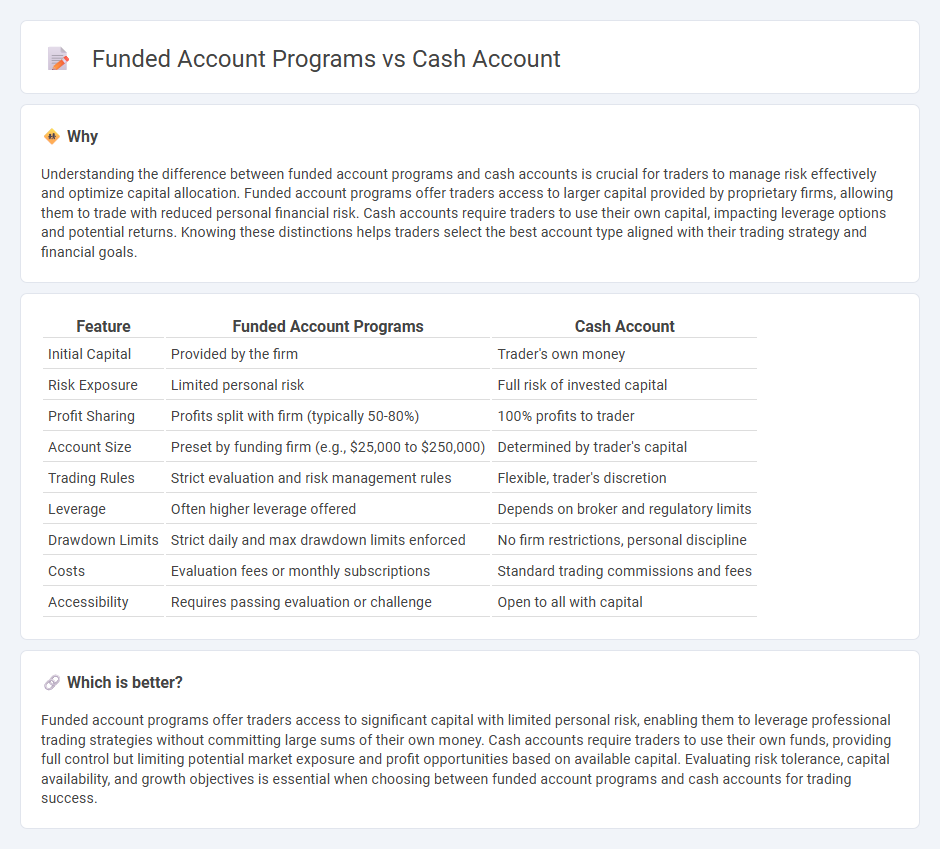

Understanding the difference between funded account programs and cash accounts is crucial for traders to manage risk effectively and optimize capital allocation. Funded account programs offer traders access to larger capital provided by proprietary firms, allowing them to trade with reduced personal financial risk. Cash accounts require traders to use their own capital, impacting leverage options and potential returns. Knowing these distinctions helps traders select the best account type aligned with their trading strategy and financial goals.

Comparison Table

| Feature | Funded Account Programs | Cash Account |

|---|---|---|

| Initial Capital | Provided by the firm | Trader's own money |

| Risk Exposure | Limited personal risk | Full risk of invested capital |

| Profit Sharing | Profits split with firm (typically 50-80%) | 100% profits to trader |

| Account Size | Preset by funding firm (e.g., $25,000 to $250,000) | Determined by trader's capital |

| Trading Rules | Strict evaluation and risk management rules | Flexible, trader's discretion |

| Leverage | Often higher leverage offered | Depends on broker and regulatory limits |

| Drawdown Limits | Strict daily and max drawdown limits enforced | No firm restrictions, personal discipline |

| Costs | Evaluation fees or monthly subscriptions | Standard trading commissions and fees |

| Accessibility | Requires passing evaluation or challenge | Open to all with capital |

Which is better?

Funded account programs offer traders access to significant capital with limited personal risk, enabling them to leverage professional trading strategies without committing large sums of their own money. Cash accounts require traders to use their own funds, providing full control but limiting potential market exposure and profit opportunities based on available capital. Evaluating risk tolerance, capital availability, and growth objectives is essential when choosing between funded account programs and cash accounts for trading success.

Connection

Funded account programs provide traders with capital to trade in live markets, reducing personal financial risk while offering profit-sharing incentives. Cash accounts require traders to use their own funds, which limits leverage but ensures direct ownership of assets. Both accounts interact by allowing traders to build skills and capital, where success in funded programs can transition into profitable management of cash accounts.

Key Terms

Margin

A cash account requires investors to fully pay for securities, whereas funded account programs allow margin trading with borrowed funds to leverage investments. Margin accounts enable traders to buy more assets than their cash balance, increasing potential returns and risks. Explore the differences in margin requirements and risk management strategies in these account types to make informed investment decisions.

Leverage

Cash accounts strictly require full payment for securities purchases, eliminating leverage and minimizing risk exposure. Funded account programs often provide leverage, enabling traders to control larger positions with smaller capital but increasing both potential gains and risks. Explore the benefits and risks of leverage in trading accounts to optimize your investment strategy.

Account Capital

Cash accounts require traders to fund the entire capital upfront, limiting the trading volume to the deposited amount and ensuring full control over allocated funds. Funded account programs provide traders access to larger capital pools managed by third-party firms, allowing greater leverage and risk diversification without personal capital commitment. Explore the advantages and differences of cash versus funded account programs to optimize your trading strategy with Account Capital.

Source and External Links

What is the Wealthfront Cash Account? - A cash account that combines checking and savings features, offering a debit card, no fees, direct deposit, and FDIC insurance up to $8 million, with 4.00% APY on the balance.

What Is a Cash Account and How Does It Work? - Bill.com - A brokerage account type where investors must pay the full amount of securities purchased, with simple opening requirements including ID, proof of residence, and sometimes a minimum deposit.

Cash Account | Investor.gov - A brokerage account requiring full payment before securities transactions, disallowing margin trading, and governed by Regulation T to prevent freeriding.

dowidth.com

dowidth.com