Delta hedging manages portfolio risk by neutralizing the sensitivity of an option's value to price changes in the underlying asset, using continuous adjustments in the position of the underlying. Stop-loss hedging limits potential losses by automatically selling assets once they reach a predetermined price, providing a straightforward risk control mechanism. Explore the detailed differences and applications of delta hedging versus stop-loss strategies to optimize your trading approach.

Why it is important

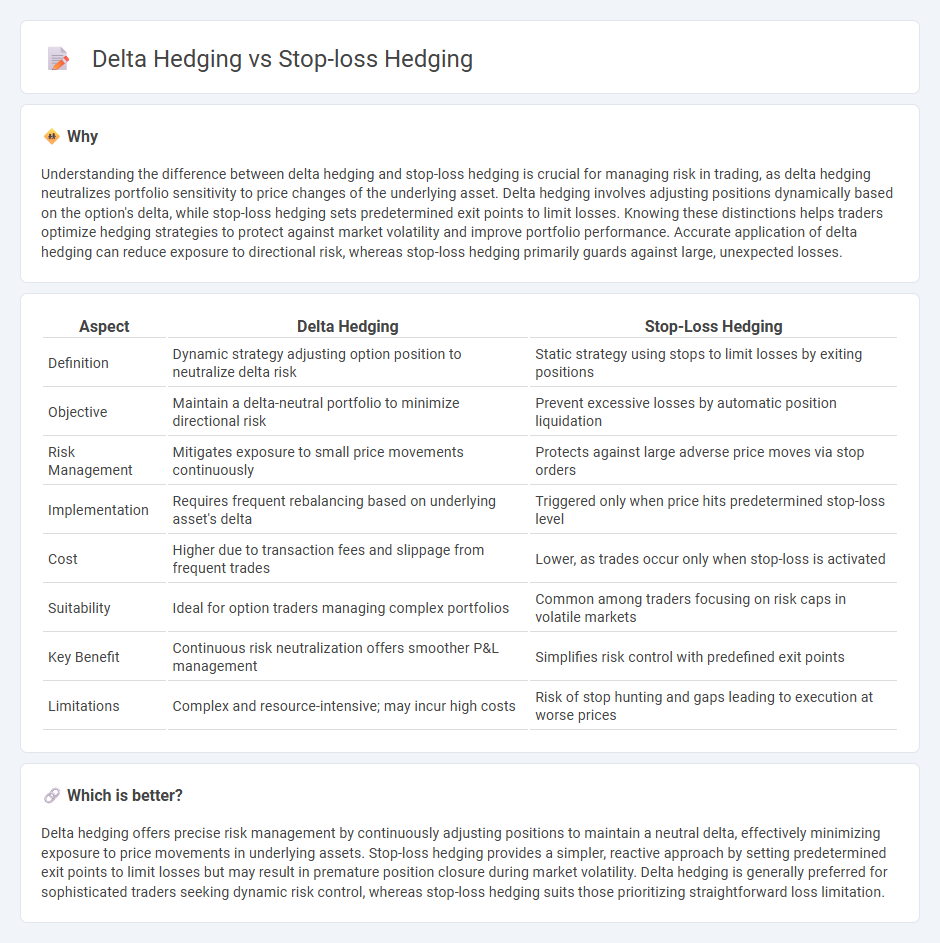

Understanding the difference between delta hedging and stop-loss hedging is crucial for managing risk in trading, as delta hedging neutralizes portfolio sensitivity to price changes of the underlying asset. Delta hedging involves adjusting positions dynamically based on the option's delta, while stop-loss hedging sets predetermined exit points to limit losses. Knowing these distinctions helps traders optimize hedging strategies to protect against market volatility and improve portfolio performance. Accurate application of delta hedging can reduce exposure to directional risk, whereas stop-loss hedging primarily guards against large, unexpected losses.

Comparison Table

| Aspect | Delta Hedging | Stop-Loss Hedging |

|---|---|---|

| Definition | Dynamic strategy adjusting option position to neutralize delta risk | Static strategy using stops to limit losses by exiting positions |

| Objective | Maintain a delta-neutral portfolio to minimize directional risk | Prevent excessive losses by automatic position liquidation |

| Risk Management | Mitigates exposure to small price movements continuously | Protects against large adverse price moves via stop orders |

| Implementation | Requires frequent rebalancing based on underlying asset's delta | Triggered only when price hits predetermined stop-loss level |

| Cost | Higher due to transaction fees and slippage from frequent trades | Lower, as trades occur only when stop-loss is activated |

| Suitability | Ideal for option traders managing complex portfolios | Common among traders focusing on risk caps in volatile markets |

| Key Benefit | Continuous risk neutralization offers smoother P&L management | Simplifies risk control with predefined exit points |

| Limitations | Complex and resource-intensive; may incur high costs | Risk of stop hunting and gaps leading to execution at worse prices |

Which is better?

Delta hedging offers precise risk management by continuously adjusting positions to maintain a neutral delta, effectively minimizing exposure to price movements in underlying assets. Stop-loss hedging provides a simpler, reactive approach by setting predetermined exit points to limit losses but may result in premature position closure during market volatility. Delta hedging is generally preferred for sophisticated traders seeking dynamic risk control, whereas stop-loss hedging suits those prioritizing straightforward loss limitation.

Connection

Delta hedging and stop-loss hedging are connected through their shared goal of managing risk in trading strategies. Delta hedging involves adjusting a portfolio's positions to maintain a neutral delta, thereby minimizing exposure to price movements in the underlying asset. Stop-loss hedging complements this by setting predetermined exit points to limit losses when the market moves unfavorably, enhancing overall risk control.

Key Terms

Risk Management

Stop-loss hedging limits potential losses by setting predefined exit points to protect investments from significant declines, effectively managing downside risk. Delta hedging involves adjusting options positions to maintain a neutral delta, minimizing sensitivity to price movements of the underlying asset and stabilizing portfolio value. Explore more about advanced risk management techniques and their impact on portfolio stability.

Position Adjustment

Stop-loss hedging involves making position adjustments by closing or reducing exposure once a predetermined loss threshold is reached, effectively limiting downside risk without constantly changing the portfolio. Delta hedging requires continuous position adjustments to maintain a neutral delta, balancing the portfolio's sensitivity to underlying asset price movements in real-time. Explore detailed strategies and risk management techniques to optimize position adjustments in both stop-loss and delta hedging methods.

Price Sensitivity

Stop-loss hedging minimizes potential losses by automatically triggering an exit when asset prices hit preset thresholds, limiting downside risk without constant portfolio adjustments. Delta hedging continuously recalibrates a portfolio's exposure to price sensitivity in options by neutralizing the delta, ensuring that small price movements in the underlying asset do not affect the portfolio's value. Explore more to understand how these strategies optimize risk management based on price sensitivity.

Source and External Links

4 Stop Loss Techniques Traders Should Know - FXCG - Stop-loss protects your trades by automatically closing positions at a predefined price, while hedging opens an opposite trade to offset potential losses, with stop-loss being simpler and preferred by most traders for risk management.

Hedge Trading Strategy: Protect Your Trades Without Stop-Losses ... - Hedging is ideal for long-term positions during volatile markets by taking offsetting positions, unlike stop-loss which is better for short-term trades and simpler protection.

6 Key Differences Between Hedging and Stop-Loss | Blueberry - Hedging involves taking offsetting positions to minimize losses, whereas stop-loss is an automatic exit order at a price level to limit losses on a trade, both being essential risk management tools.

dowidth.com

dowidth.com