Pair trading involves simultaneously buying and selling two correlated assets to capitalize on price divergences while minimizing market risk. News-based trading relies on reacting to market-moving events and information releases, often resulting in higher volatility and rapid price shifts. Explore the details and strategies behind pair trading and news-based trading to enhance your market approach.

Why it is important

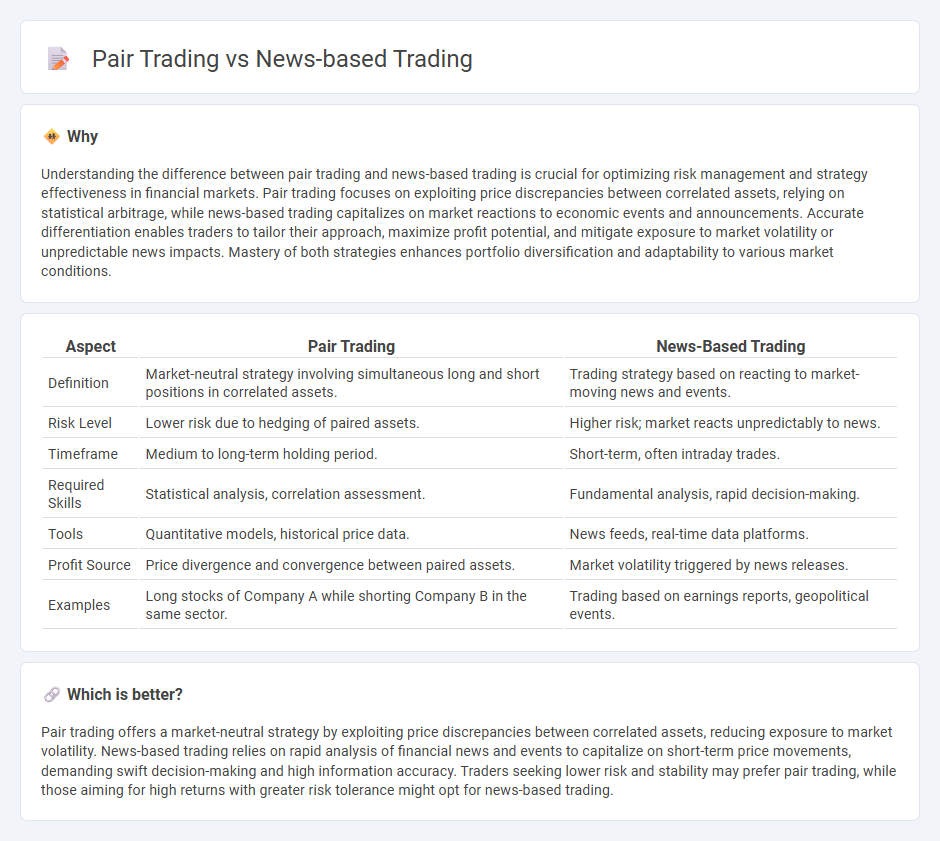

Understanding the difference between pair trading and news-based trading is crucial for optimizing risk management and strategy effectiveness in financial markets. Pair trading focuses on exploiting price discrepancies between correlated assets, relying on statistical arbitrage, while news-based trading capitalizes on market reactions to economic events and announcements. Accurate differentiation enables traders to tailor their approach, maximize profit potential, and mitigate exposure to market volatility or unpredictable news impacts. Mastery of both strategies enhances portfolio diversification and adaptability to various market conditions.

Comparison Table

| Aspect | Pair Trading | News-Based Trading |

|---|---|---|

| Definition | Market-neutral strategy involving simultaneous long and short positions in correlated assets. | Trading strategy based on reacting to market-moving news and events. |

| Risk Level | Lower risk due to hedging of paired assets. | Higher risk; market reacts unpredictably to news. |

| Timeframe | Medium to long-term holding period. | Short-term, often intraday trades. |

| Required Skills | Statistical analysis, correlation assessment. | Fundamental analysis, rapid decision-making. |

| Tools | Quantitative models, historical price data. | News feeds, real-time data platforms. |

| Profit Source | Price divergence and convergence between paired assets. | Market volatility triggered by news releases. |

| Examples | Long stocks of Company A while shorting Company B in the same sector. | Trading based on earnings reports, geopolitical events. |

Which is better?

Pair trading offers a market-neutral strategy by exploiting price discrepancies between correlated assets, reducing exposure to market volatility. News-based trading relies on rapid analysis of financial news and events to capitalize on short-term price movements, demanding swift decision-making and high information accuracy. Traders seeking lower risk and stability may prefer pair trading, while those aiming for high returns with greater risk tolerance might opt for news-based trading.

Connection

Pair trading and news-based trading are interconnected through their reliance on market signals to identify trading opportunities. Pair trading exploits statistical correlations between two assets, while news-based trading capitalizes on real-time information and sentiment analysis to predict price movements. Integrating both strategies enhances risk management by combining quantitative data with timely qualitative insights, improving overall trade execution.

Key Terms

**News-based trading:**

News-based trading leverages real-time information from financial news, economic reports, and corporate announcements to make quick investment decisions, capitalizing on market volatility triggered by unexpected events. It requires advanced algorithms and natural language processing to interpret headlines and sentiment instantly, optimizing trade execution speed and accuracy. Explore further to understand how cutting-edge AI tools enhance news-based trading strategies for maximum profitability.

Event-driven

News-based trading leverages real-time market-moving information from news releases, earnings reports, and geopolitical events to capitalize on short-term price volatility, emphasizing event-driven strategies that react swiftly to new data. Pair trading, a market-neutral strategy, involves simultaneously buying and selling correlated assets to exploit relative value discrepancies without direct reliance on external events. Explore deeper insights into how event-driven approaches uniquely impact news-based trading and compare with pair trading methodologies.

Sentiment analysis

News-based trading leverages real-time sentiment analysis of financial news, social media, and market reports to predict short-term market movements by capturing investor emotions and reactions. Pair trading, a market-neutral strategy, relies on statistical correlations between two historically linked assets, using relative price divergences rather than sentiment data to execute trades. Discover how integrating sentiment analysis enhances these strategies by visiting our detailed insights.

Source and External Links

News Based Trading - Quantra by QuantInsti - News-based trading involves exploiting temporary security mispricing caused by news events through sentiment analysis and algorithms that score news sentiment to guide trading decisions.

News Trading Strategies | How To Trade The News | AvaTrade - News trading is an event-driven strategy that capitalizes on market volatility triggered by economic news releases, with a focus on short-term price movements rather than long-term fundamental analysis.

Trading the news - Wikipedia - Trading the news entails making profits by timing trades around significant financial or economic events, either manually or algorithmically, to capture price changes caused by these announcements.

dowidth.com

dowidth.com