Risk reversal involves buying a call option and selling a put option, or vice versa, to hedge against potential price movements while maintaining directional bias in trading. Ratio spreads require purchasing and selling different quantities of options at varying strike prices to exploit volatility differences and skew in the options market. Explore the nuances of these advanced trading strategies to enhance your market positioning and risk management.

Why it is important

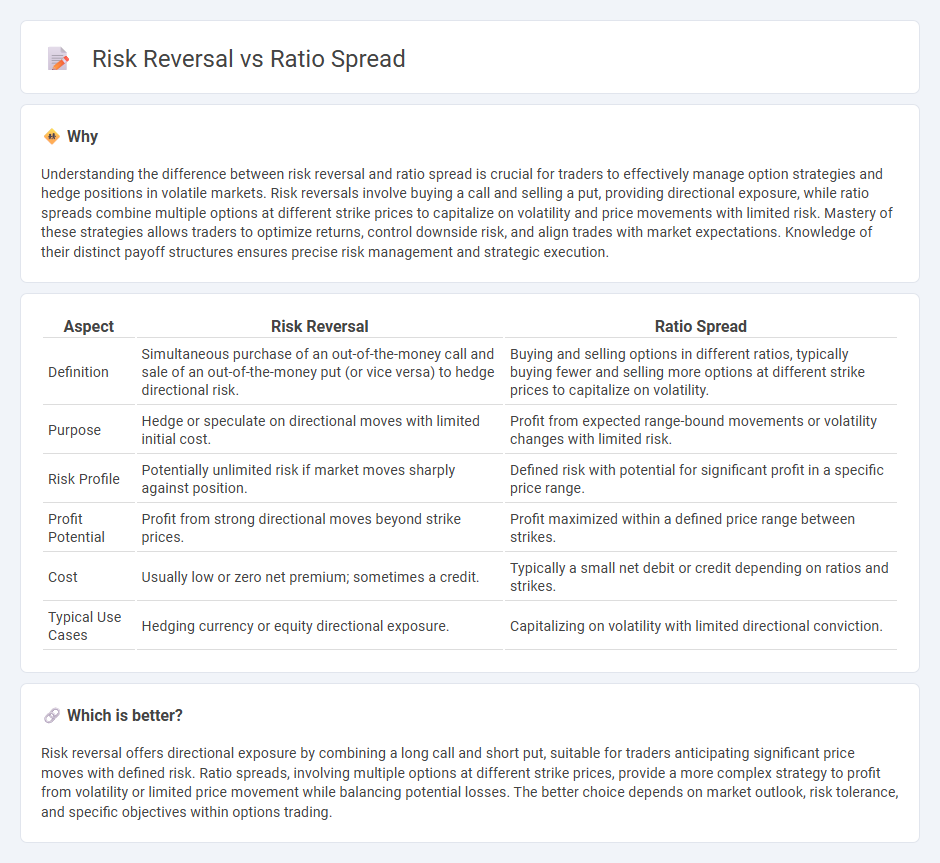

Understanding the difference between risk reversal and ratio spread is crucial for traders to effectively manage option strategies and hedge positions in volatile markets. Risk reversals involve buying a call and selling a put, providing directional exposure, while ratio spreads combine multiple options at different strike prices to capitalize on volatility and price movements with limited risk. Mastery of these strategies allows traders to optimize returns, control downside risk, and align trades with market expectations. Knowledge of their distinct payoff structures ensures precise risk management and strategic execution.

Comparison Table

| Aspect | Risk Reversal | Ratio Spread |

|---|---|---|

| Definition | Simultaneous purchase of an out-of-the-money call and sale of an out-of-the-money put (or vice versa) to hedge directional risk. | Buying and selling options in different ratios, typically buying fewer and selling more options at different strike prices to capitalize on volatility. |

| Purpose | Hedge or speculate on directional moves with limited initial cost. | Profit from expected range-bound movements or volatility changes with limited risk. |

| Risk Profile | Potentially unlimited risk if market moves sharply against position. | Defined risk with potential for significant profit in a specific price range. |

| Profit Potential | Profit from strong directional moves beyond strike prices. | Profit maximized within a defined price range between strikes. |

| Cost | Usually low or zero net premium; sometimes a credit. | Typically a small net debit or credit depending on ratios and strikes. |

| Typical Use Cases | Hedging currency or equity directional exposure. | Capitalizing on volatility with limited directional conviction. |

Which is better?

Risk reversal offers directional exposure by combining a long call and short put, suitable for traders anticipating significant price moves with defined risk. Ratio spreads, involving multiple options at different strike prices, provide a more complex strategy to profit from volatility or limited price movement while balancing potential losses. The better choice depends on market outlook, risk tolerance, and specific objectives within options trading.

Connection

Risk reversal and ratio spread are both options trading strategies used to manage risk and capitalize on directional moves in the underlying asset. Risk reversal involves buying a call option and selling a put option or vice versa to hedge against potential price swings, while ratio spreads consist of buying and selling different quantities of options at varying strike prices to profit from volatility or directional shifts. Both strategies leverage options positions to balance risk exposure and potential reward, making them interconnected tools for sophisticated traders aiming to optimize portfolio performance.

Key Terms

Strike Prices

Ratio spreads involve buying and selling options at different strike prices with an unequal number of contracts, creating a directional trade that benefits from moderate price moves within a specific range. Risk reversals combine a long call and a short put or vice versa, with strike prices chosen to express a bullish or bearish sentiment, often at equidistant but out-of-the-money strikes to hedge or speculate on price direction. Explore in-depth strategies and strike selection criteria to optimize your options trading approach.

Option Premiums

Ratio spreads involve buying and selling options at different strike prices, typically resulting in a net credit or debit where the premium collected or paid reflects the anticipated price movement and volatility of the underlying asset. Risk reversals combine buying a call and selling a put (or vice versa), often with a focus on hedging directional risk, causing an asymmetrical premium profile that reveals market sentiment towards future price direction. Explore detailed strategies and premium dynamics to optimize your options trading approach.

Volatility

Ratio spread options strategies involve buying and selling different quantities of options with varying strike prices, aiming to capitalize on moderate volatility changes while limiting downside risk. Risk reversal strategies combine buying a call option and selling a put option with different strikes, designed to benefit from directional moves and often used to hedge or speculate on implied volatility shifts. Explore comprehensive guides on volatility-focused options strategies to enhance your trading insights.

Source and External Links

Ratio spread - A ratio spread is a multi-leg options strategy where you buy and sell options on the same underlying with different strikes but an unequal number of contracts, typically selling twice as many options as bought, aiming to profit from steady directional moves or implied volatility declines.

Ratio spread Definition | What Does Ratio Mean - IG - The ratio spread involves holding an unequal number of buy and sell option positions, often selling two options for every one purchased, and is profitable when implied volatility falls or the underlying price moves steadily in the trader's favor.

Ratio Spread: What are Front Ratio Puts and Calls? - A ratio spread is a high-probability, directional options trading strategy with more short contracts than long, often entered for a credit, and it benefits when the underlying price moves toward the short strike at expiration.

dowidth.com

dowidth.com