Microstructure trading focuses on exploiting patterns within market order flows, bid-ask spreads, and trade execution dynamics to gain short-term profits. News-based trading relies on analyzing economic releases, corporate announcements, and geopolitical events to anticipate price movements and capitalize on market reactions. Explore the nuances of both strategies to enhance your trading insights and decision-making.

Why it is important

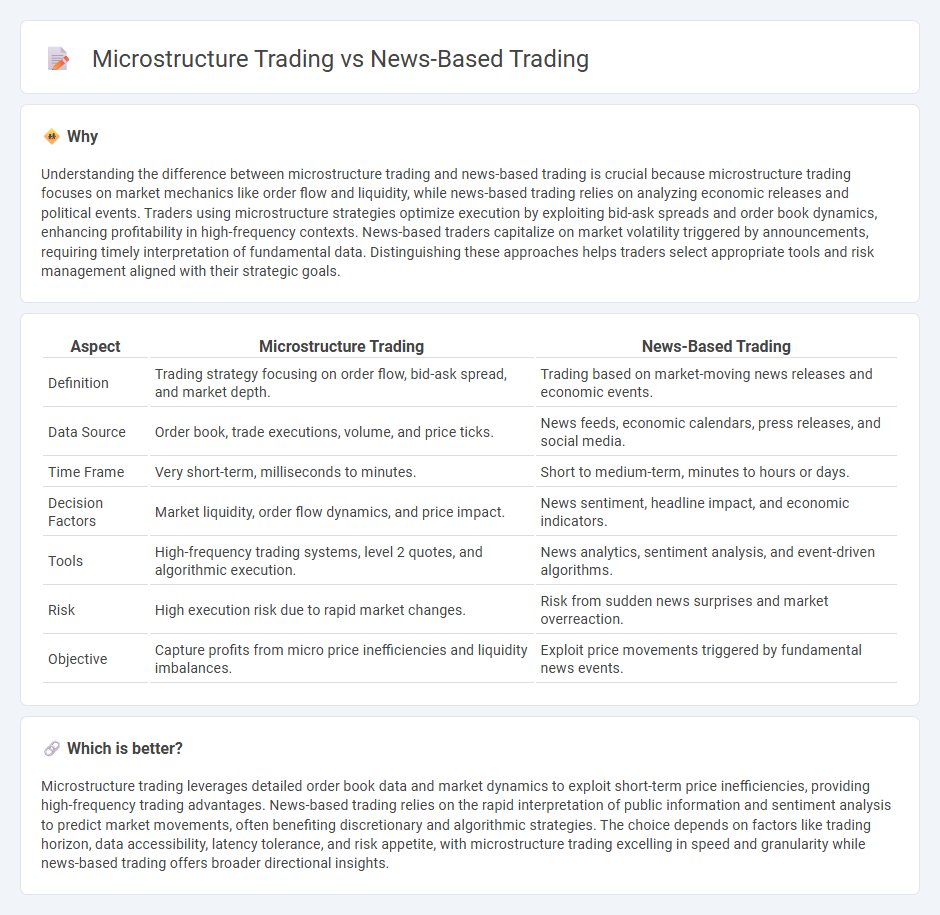

Understanding the difference between microstructure trading and news-based trading is crucial because microstructure trading focuses on market mechanics like order flow and liquidity, while news-based trading relies on analyzing economic releases and political events. Traders using microstructure strategies optimize execution by exploiting bid-ask spreads and order book dynamics, enhancing profitability in high-frequency contexts. News-based traders capitalize on market volatility triggered by announcements, requiring timely interpretation of fundamental data. Distinguishing these approaches helps traders select appropriate tools and risk management aligned with their strategic goals.

Comparison Table

| Aspect | Microstructure Trading | News-Based Trading |

|---|---|---|

| Definition | Trading strategy focusing on order flow, bid-ask spread, and market depth. | Trading based on market-moving news releases and economic events. |

| Data Source | Order book, trade executions, volume, and price ticks. | News feeds, economic calendars, press releases, and social media. |

| Time Frame | Very short-term, milliseconds to minutes. | Short to medium-term, minutes to hours or days. |

| Decision Factors | Market liquidity, order flow dynamics, and price impact. | News sentiment, headline impact, and economic indicators. |

| Tools | High-frequency trading systems, level 2 quotes, and algorithmic execution. | News analytics, sentiment analysis, and event-driven algorithms. |

| Risk | High execution risk due to rapid market changes. | Risk from sudden news surprises and market overreaction. |

| Objective | Capture profits from micro price inefficiencies and liquidity imbalances. | Exploit price movements triggered by fundamental news events. |

Which is better?

Microstructure trading leverages detailed order book data and market dynamics to exploit short-term price inefficiencies, providing high-frequency trading advantages. News-based trading relies on the rapid interpretation of public information and sentiment analysis to predict market movements, often benefiting discretionary and algorithmic strategies. The choice depends on factors like trading horizon, data accessibility, latency tolerance, and risk appetite, with microstructure trading excelling in speed and granularity while news-based trading offers broader directional insights.

Connection

Microstructure trading focuses on the detailed mechanics of how orders are executed and prices are formed within markets, while news-based trading leverages real-time information to predict market movements. Both strategies rely on the rapid processing of data to exploit small inefficiencies and price discrepancies that arise following the release of news. Integrating microstructure insights with news-based analysis enhances traders' ability to react swiftly to news events, optimizing trade execution and profitability.

Key Terms

Market Sentiment

News-based trading leverages real-time information and headlines to gauge market sentiment, quickly reacting to events that influence asset prices and investor behavior. Microstructure trading analyzes order flow, bid-ask spreads, and trade execution patterns to infer underlying market sentiment and liquidity conditions. Explore how combining these approaches can enhance trading strategies and improve market insight.

Order Flow

News-based trading leverages real-time macroeconomic announcements and geopolitical events to anticipate market movements, while microstructure trading focuses on the detailed analysis of order flow, bid-ask spreads, and liquidity to capture short-term price inefficiencies. Order flow in microstructure trading provides granular insights into supply and demand imbalances, enabling traders to predict price changes before they manifest in broader market trends. Explore further how integrating order flow dynamics enhances trading strategies in both domains.

Latency

News-Based Trading leverages real-time information flow to capitalize on market-moving events, relying heavily on rapid data dissemination and processing speeds. Microstructure trading emphasizes order book dynamics and price formation at the millisecond level, where latency impacts the execution quality and slippage. Explore more on how latency differentials shape trading strategies and execution efficiency.

Source and External Links

News Based Trading - Quantra by QuantInsti - News based trading is a strategy where traders exploit temporary mispricing in securities caused by news or events that have not yet been fully reflected in prices, using algorithms that analyze sentiment from news sources to make trading decisions.

News Trading Strategies | How To Trade The News | AvaTrade - News trading focuses on capitalizing on market volatility triggered by relevant economic data and events, distinguishing itself from technical and fundamental analysis by emphasizing short-term, event-driven trades.

Trading the news - Wikipedia - Trading the news is a technique where traders manually or algorithmically trade financial instruments based on timely reactions to news events and economic announcements that significantly impact market prices.

dowidth.com

dowidth.com