Social sentiment analysis in trading harnesses real-time data from news, social media, and market chatter to gauge investor emotions and predict price movements with enhanced accuracy. High-frequency trading relies on ultra-fast algorithms and minimal latency to execute thousands of trades per second, capitalizing on minute market inefficiencies. Explore how combining social sentiment insights with high-frequency strategies can revolutionize trading performance and market prediction.

Why it is important

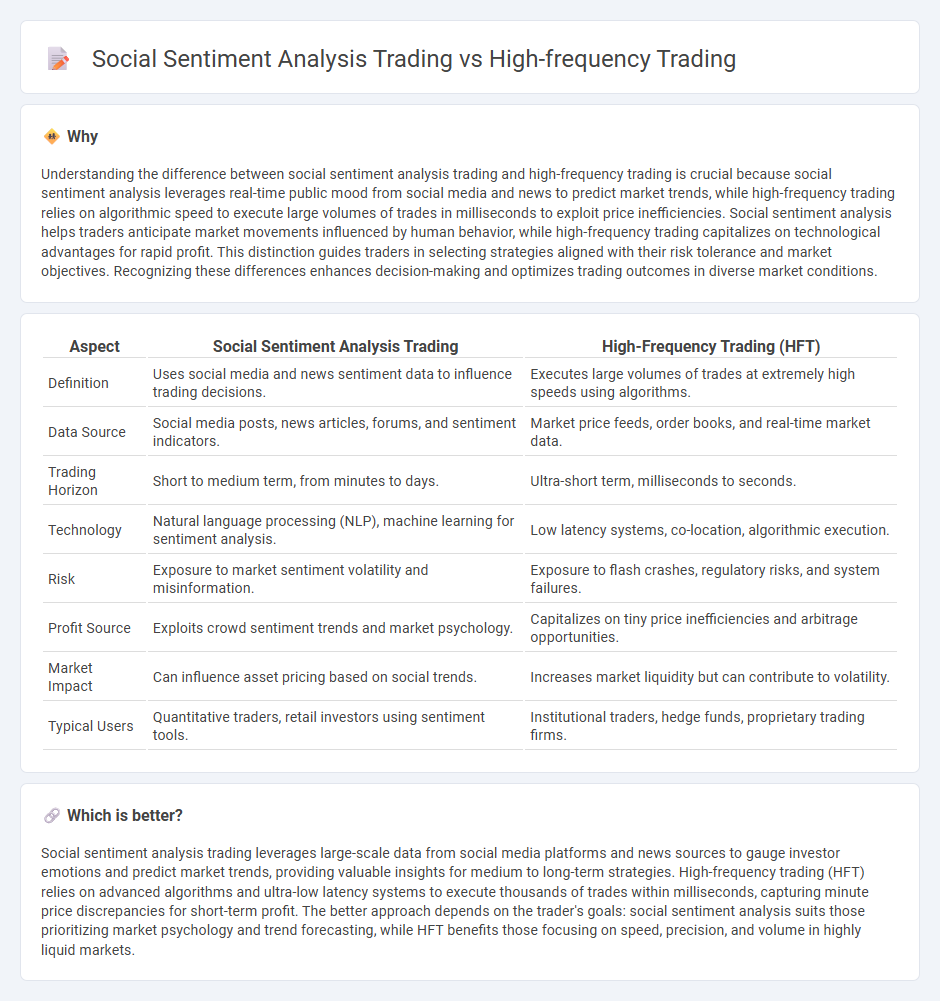

Understanding the difference between social sentiment analysis trading and high-frequency trading is crucial because social sentiment analysis leverages real-time public mood from social media and news to predict market trends, while high-frequency trading relies on algorithmic speed to execute large volumes of trades in milliseconds to exploit price inefficiencies. Social sentiment analysis helps traders anticipate market movements influenced by human behavior, while high-frequency trading capitalizes on technological advantages for rapid profit. This distinction guides traders in selecting strategies aligned with their risk tolerance and market objectives. Recognizing these differences enhances decision-making and optimizes trading outcomes in diverse market conditions.

Comparison Table

| Aspect | Social Sentiment Analysis Trading | High-Frequency Trading (HFT) |

|---|---|---|

| Definition | Uses social media and news sentiment data to influence trading decisions. | Executes large volumes of trades at extremely high speeds using algorithms. |

| Data Source | Social media posts, news articles, forums, and sentiment indicators. | Market price feeds, order books, and real-time market data. |

| Trading Horizon | Short to medium term, from minutes to days. | Ultra-short term, milliseconds to seconds. |

| Technology | Natural language processing (NLP), machine learning for sentiment analysis. | Low latency systems, co-location, algorithmic execution. |

| Risk | Exposure to market sentiment volatility and misinformation. | Exposure to flash crashes, regulatory risks, and system failures. |

| Profit Source | Exploits crowd sentiment trends and market psychology. | Capitalizes on tiny price inefficiencies and arbitrage opportunities. |

| Market Impact | Can influence asset pricing based on social trends. | Increases market liquidity but can contribute to volatility. |

| Typical Users | Quantitative traders, retail investors using sentiment tools. | Institutional traders, hedge funds, proprietary trading firms. |

Which is better?

Social sentiment analysis trading leverages large-scale data from social media platforms and news sources to gauge investor emotions and predict market trends, providing valuable insights for medium to long-term strategies. High-frequency trading (HFT) relies on advanced algorithms and ultra-low latency systems to execute thousands of trades within milliseconds, capturing minute price discrepancies for short-term profit. The better approach depends on the trader's goals: social sentiment analysis suits those prioritizing market psychology and trend forecasting, while HFT benefits those focusing on speed, precision, and volume in highly liquid markets.

Connection

Social sentiment analysis trading leverages real-time data from social media and news to gauge market mood, which directly influences high-frequency trading (HFT) algorithms designed for rapid execution. HFT systems integrate sentiment signals to adjust trading strategies instantly, capitalizing on emerging trends and market fluctuations before traditional analysis can respond. This synergy between social sentiment analysis and HFT enhances predictive accuracy and optimizes trade timing, driving competitive advantage in financial markets.

Key Terms

Algorithmic Execution

High-frequency trading (HFT) leverages ultra-low latency algorithms to execute large volumes of orders at microsecond speeds, capitalizing on minute price discrepancies across markets. Social sentiment analysis trading uses natural language processing to gauge public sentiment from news, social media, and other sources, guiding algorithmic execution based on emerging trends and market mood. Explore the intricacies of integrating these strategies for optimized algorithmic execution and enhanced trading performance.

Order Book Dynamics

High-frequency trading (HFT) leverages microsecond-level order book dynamics to exploit price inefficiencies by rapidly executing trades based on changes in bid-ask spreads and order flow. Social sentiment analysis trading integrates real-time sentiment data from social media platforms to predict market movements, influencing order book behavior through shifts in trader psychology and demand. Explore how combining these strategies can enhance market prediction models and optimize trading performance.

Natural Language Processing (NLP)

High-frequency trading (HFT) relies on ultra-fast algorithms and market data to execute trades within microseconds, optimizing for speed and minimal latency, whereas social sentiment analysis trading harnesses Natural Language Processing (NLP) techniques to analyze vast amounts of user-generated content across social media and news sources to gauge market sentiment and predict price movements. NLP models interpret nuances, emotion, and context from textual data, enabling traders to capitalize on shifts in public opinion and market psychology, which are often missed by traditional quantitative methods used in HFT. Explore the cutting-edge intersection of NLP and algorithmic trading to understand how machine learning transforms market strategies.

Source and External Links

High-Frequency Trading Explained: What Is It and How Do You Get ... - High-frequency trading (HFT) uses powerful computers and advanced algorithms to execute massive numbers of trades in microseconds, exploiting very small price differences across markets to generate profits at high speed.

High Frequency Trading (HFT) - Definition, Pros and Cons - HFT is a form of algorithmic trading characterized by ultra-fast execution and high volume, mainly used by large institutions to profit from tiny price movements and improve market liquidity through increased competition and reduced bid-ask spreads.

High Frequency Trading | EBSCO Research Starters - HFT leverages advanced algorithms and high-speed computing to automate trading and analyze vast financial data instantly, resulting in high transaction volumes and controversial effects on market stability and fairness.

dowidth.com

dowidth.com