Copy trading enables investors to automatically replicate the trades of experienced traders, offering a hands-off investment approach with real-time strategy execution. Portfolio management involves actively selecting, monitoring, and rebalancing a diversified mix of assets to align with specific risk tolerance and financial goals. Discover how these methods can optimize your trading success and fit your investment style.

Why it is important

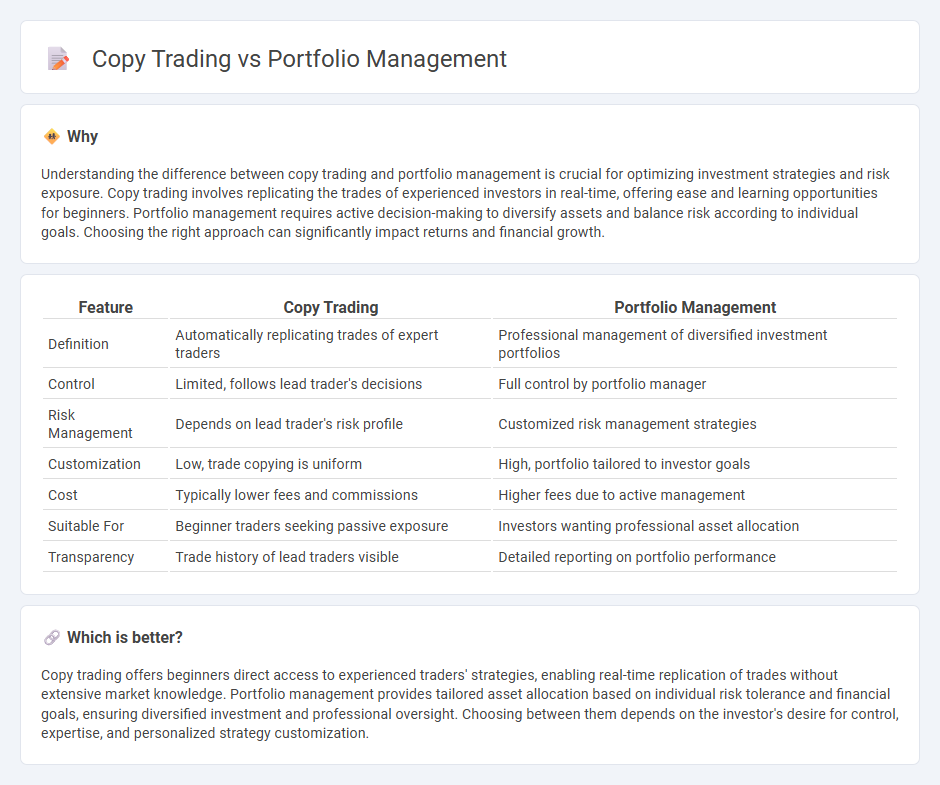

Understanding the difference between copy trading and portfolio management is crucial for optimizing investment strategies and risk exposure. Copy trading involves replicating the trades of experienced investors in real-time, offering ease and learning opportunities for beginners. Portfolio management requires active decision-making to diversify assets and balance risk according to individual goals. Choosing the right approach can significantly impact returns and financial growth.

Comparison Table

| Feature | Copy Trading | Portfolio Management |

|---|---|---|

| Definition | Automatically replicating trades of expert traders | Professional management of diversified investment portfolios |

| Control | Limited, follows lead trader's decisions | Full control by portfolio manager |

| Risk Management | Depends on lead trader's risk profile | Customized risk management strategies |

| Customization | Low, trade copying is uniform | High, portfolio tailored to investor goals |

| Cost | Typically lower fees and commissions | Higher fees due to active management |

| Suitable For | Beginner traders seeking passive exposure | Investors wanting professional asset allocation |

| Transparency | Trade history of lead traders visible | Detailed reporting on portfolio performance |

Which is better?

Copy trading offers beginners direct access to experienced traders' strategies, enabling real-time replication of trades without extensive market knowledge. Portfolio management provides tailored asset allocation based on individual risk tolerance and financial goals, ensuring diversified investment and professional oversight. Choosing between them depends on the investor's desire for control, expertise, and personalized strategy customization.

Connection

Copy trading enables investors to replicate the trades of experienced portfolio managers, creating a seamless link between individual decision-making and professional portfolio strategies. By mirroring the asset allocations and risk management techniques of expert traders, copy trading integrates real-time portfolio management insights into everyday trading activities. This connection enhances diversification and risk-adjusted returns, aligning retail investors' portfolios with proven market trends and performance metrics.

Key Terms

**Portfolio Management:**

Portfolio management involves the strategic allocation of assets tailored to an investor's risk tolerance, financial goals, and market conditions, ensuring diversification and optimized returns. It requires active decision-making and continuous monitoring to rebalance investments and manage risk effectively. Explore deeper insights into portfolio management strategies and techniques to enhance your investment approach.

Asset Allocation

Portfolio management involves strategic asset allocation through diversification across stocks, bonds, and other securities to balance risk and return. Copy trading replicates the asset allocation decisions of expert traders, providing a hands-off approach but potentially less customization. Explore more about these investment strategies to determine the best fit for your financial goals.

Diversification

Portfolio management emphasizes diversification by strategically allocating assets across various sectors and instruments to minimize risk and enhance returns. Copy trading often replicates a single trader's portfolio, which may limit diversification and increase exposure to specific market risks. Explore how balancing these approaches can optimize your investment strategy.

Source and External Links

Portfolio management: What it is and how to do it - Vanguard - Portfolio management involves creating and managing your investment account by evaluating your financial situation, setting investment objectives, determining asset allocation, and choosing diversified investment options to balance risk and return effectively.

Portfolio Management Practices - Portfolio management in organizations consists of identifying and prioritizing potential endeavors, planning capability and resources, managing risk, and governing the portfolio to align with business strategy and maximize value delivery.

Project portfolio management - Project portfolio management (PPM) focuses on centralized coordination of projects to optimize resource allocation and scheduling to meet strategic and financial goals, using frameworks and methodologies that trace back to financial portfolio theories from the 1950s.

dowidth.com

dowidth.com