Algorithmic arbitrage leverages automated systems to exploit price discrepancies across different markets with high-speed execution and minimal human intervention, focusing on statistical inefficiencies. News-based trading relies on real-time analysis of market-moving news and events to make informed decisions, often requiring sophisticated natural language processing to interpret sentiment and impact rapidly. Discover how each approach can optimize your trading strategy.

Why it is important

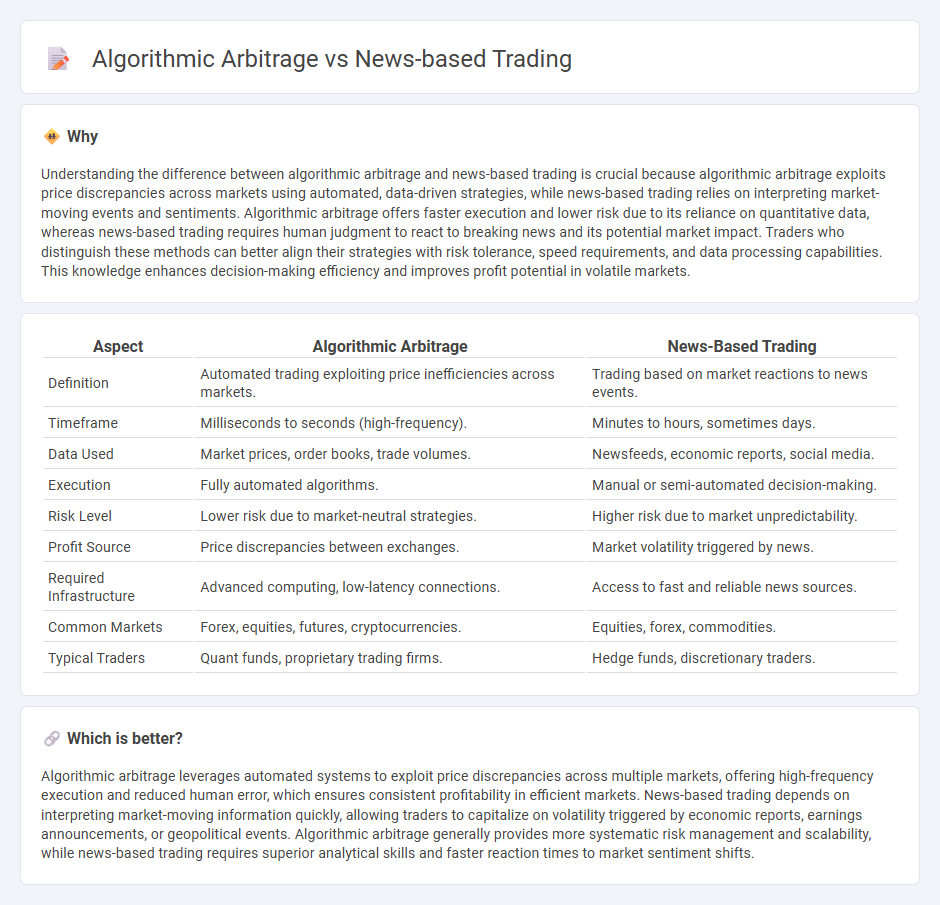

Understanding the difference between algorithmic arbitrage and news-based trading is crucial because algorithmic arbitrage exploits price discrepancies across markets using automated, data-driven strategies, while news-based trading relies on interpreting market-moving events and sentiments. Algorithmic arbitrage offers faster execution and lower risk due to its reliance on quantitative data, whereas news-based trading requires human judgment to react to breaking news and its potential market impact. Traders who distinguish these methods can better align their strategies with risk tolerance, speed requirements, and data processing capabilities. This knowledge enhances decision-making efficiency and improves profit potential in volatile markets.

Comparison Table

| Aspect | Algorithmic Arbitrage | News-Based Trading |

|---|---|---|

| Definition | Automated trading exploiting price inefficiencies across markets. | Trading based on market reactions to news events. |

| Timeframe | Milliseconds to seconds (high-frequency). | Minutes to hours, sometimes days. |

| Data Used | Market prices, order books, trade volumes. | Newsfeeds, economic reports, social media. |

| Execution | Fully automated algorithms. | Manual or semi-automated decision-making. |

| Risk Level | Lower risk due to market-neutral strategies. | Higher risk due to market unpredictability. |

| Profit Source | Price discrepancies between exchanges. | Market volatility triggered by news. |

| Required Infrastructure | Advanced computing, low-latency connections. | Access to fast and reliable news sources. |

| Common Markets | Forex, equities, futures, cryptocurrencies. | Equities, forex, commodities. |

| Typical Traders | Quant funds, proprietary trading firms. | Hedge funds, discretionary traders. |

Which is better?

Algorithmic arbitrage leverages automated systems to exploit price discrepancies across multiple markets, offering high-frequency execution and reduced human error, which ensures consistent profitability in efficient markets. News-based trading depends on interpreting market-moving information quickly, allowing traders to capitalize on volatility triggered by economic reports, earnings announcements, or geopolitical events. Algorithmic arbitrage generally provides more systematic risk management and scalability, while news-based trading requires superior analytical skills and faster reaction times to market sentiment shifts.

Connection

Algorithmic arbitrage and news-based trading are connected through their reliance on real-time data processing to exploit market inefficiencies. Trading algorithms analyze news sentiment and breaking headlines to quickly identify price discrepancies across different exchanges, enabling rapid arbitrage opportunities. This fusion of natural language processing and quantitative strategies enhances trade execution speed and accuracy in volatile markets.

Key Terms

**News-based trading:**

News-based trading leverages real-time information from news sources, economic reports, and social media to execute timely trades, capitalizing on market-moving events and sentiment shifts. This strategy often relies on natural language processing (NLP) algorithms to analyze the impact of breaking news on asset prices within seconds, enabling traders to respond before wider market reactions occur. Discover how integrating advanced AI and machine learning enhances the accuracy and speed of news-based trading for superior investment performance.

Sentiment Analysis

News-based trading leverages real-time sentiment analysis from financial news, social media, and market reports to predict stock price movements based on public perception and market reactions. Algorithmic arbitrage, on the other hand, exploits price discrepancies between markets or assets through automated strategies without relying heavily on sentiment data. Explore deeper insights into how sentiment analysis enhances trading strategies and transforms market dynamics by learning more.

Event-driven Strategy

Event-driven strategy in news-based trading exploits price movements triggered by corporate events such as earnings reports, mergers, or regulatory announcements to generate alpha. Algorithmic arbitrage uses automated systems to identify and exploit price discrepancies between related securities or markets, often relying on high-frequency trading and latency advantages. Discover how integrating event-driven techniques with algorithmic models can enhance profitability and risk management.

Source and External Links

News Based Trading - Quantra by QuantInsti - News based trading involves exploiting temporary mispricing of securities caused by new information not yet priced in, using algorithms to analyze sentiment from news articles or tweets to inform trading decisions while managing risks from noisy or delayed data.

News Trading Strategies | How To Trade The News | AvaTrade - News trading is an event-driven strategy focusing on short-term opportunities arising from economic data releases and headlines, distinct from longer-term fundamental analysis and technical trading methods.

Trading the news - Wikipedia - Trading the news refers to trading financial instruments based on market-moving news events, either manually or via algorithmic systems that scan live news feeds to capture volatility triggered by economic or corporate announcements.

dowidth.com

dowidth.com