Paper trading competitions offer a risk-free environment for traders to test strategies and develop skills without financial consequences, using virtual money to simulate real market conditions. Prop firm challenges require participants to demonstrate consistent profitability and risk management on live accounts, with the opportunity to secure funded trading capital upon success. Explore the key differences and benefits of each to determine the best pathway for your trading career.

Why it is important

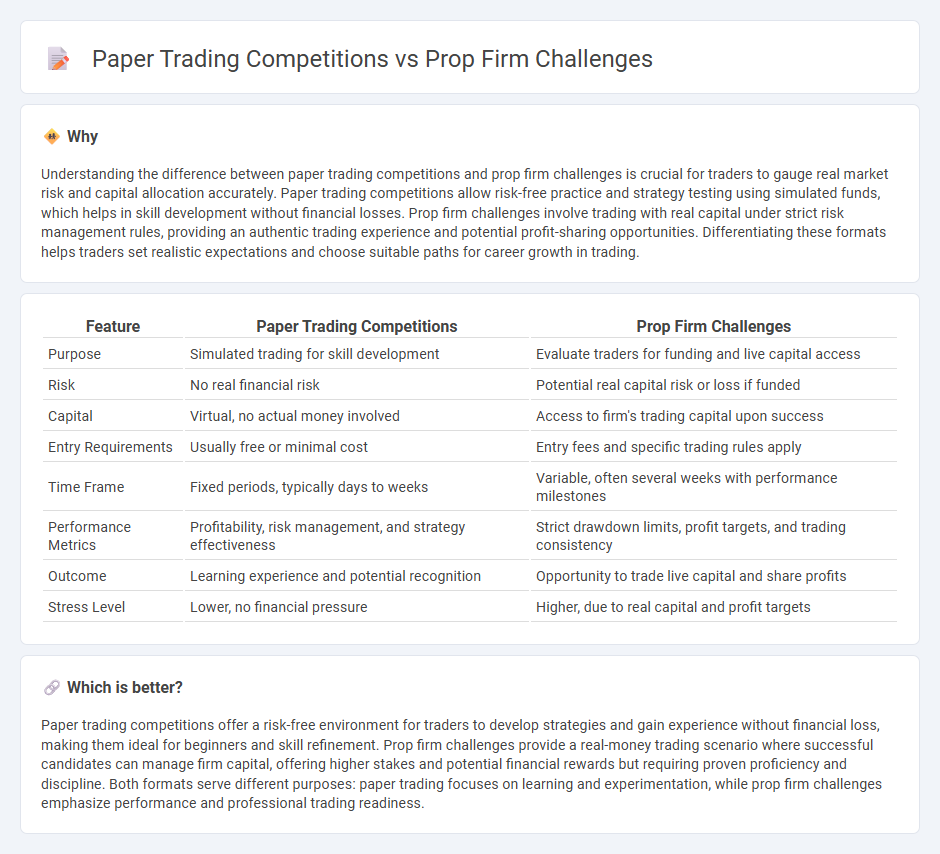

Understanding the difference between paper trading competitions and prop firm challenges is crucial for traders to gauge real market risk and capital allocation accurately. Paper trading competitions allow risk-free practice and strategy testing using simulated funds, which helps in skill development without financial losses. Prop firm challenges involve trading with real capital under strict risk management rules, providing an authentic trading experience and potential profit-sharing opportunities. Differentiating these formats helps traders set realistic expectations and choose suitable paths for career growth in trading.

Comparison Table

| Feature | Paper Trading Competitions | Prop Firm Challenges |

|---|---|---|

| Purpose | Simulated trading for skill development | Evaluate traders for funding and live capital access |

| Risk | No real financial risk | Potential real capital risk or loss if funded |

| Capital | Virtual, no actual money involved | Access to firm's trading capital upon success |

| Entry Requirements | Usually free or minimal cost | Entry fees and specific trading rules apply |

| Time Frame | Fixed periods, typically days to weeks | Variable, often several weeks with performance milestones |

| Performance Metrics | Profitability, risk management, and strategy effectiveness | Strict drawdown limits, profit targets, and trading consistency |

| Outcome | Learning experience and potential recognition | Opportunity to trade live capital and share profits |

| Stress Level | Lower, no financial pressure | Higher, due to real capital and profit targets |

Which is better?

Paper trading competitions offer a risk-free environment for traders to develop strategies and gain experience without financial loss, making them ideal for beginners and skill refinement. Prop firm challenges provide a real-money trading scenario where successful candidates can manage firm capital, offering higher stakes and potential financial rewards but requiring proven proficiency and discipline. Both formats serve different purposes: paper trading focuses on learning and experimentation, while prop firm challenges emphasize performance and professional trading readiness.

Connection

Paper trading competitions and prop firm challenges both serve as platforms for traders to showcase their skills in simulated environments without risking real capital. These contests provide valuable experience in market analysis, risk management, and strategy refinement, which are critical for succeeding in prop firm challenges that often require demonstrating consistent profitability under strict conditions. Success in paper trading competitions can significantly improve a trader's chances of passing prop firm evaluations and securing funded accounts.

Key Terms

Funded Account

Prop firm challenges require traders to meet strict profit targets and risk management rules to secure a funded account, often involving real capital and psychological pressure unlike paper trading competitions. Paper trading competitions provide a risk-free environment with simulated funds, allowing traders to develop strategies without financial consequences but lack the emotional intensity and real market impact found in prop firm assessments. Explore detailed comparisons and insights to choose the best path toward securing a funded trading account.

Simulated Performance

Prop firm challenges and paper trading competitions both emphasize simulated performance to evaluate traders' skills under risk-free conditions, but prop firm challenges often incorporate strict risk management rules and real market pressures that mimic live trading more closely. Paper trading competitions typically allow more flexibility and do not penalize for real financial loss, which may result in less disciplined trading behavior. Explore detailed comparisons to understand which simulation method better prepares traders for live market environments.

Risk Management

Prop firm challenges enforce strict risk management rules with real capital, requiring traders to adhere to daily loss limits and maximum drawdowns, which builds discipline under pressure. Paper trading competitions allow for risk-free practice but often lack the psychological intensity and real-time consequences associated with live trading. Discover how mastering risk management in prop firm challenges can elevate your trading proficiency.

Source and External Links

Prop Firm Challenges: What They Are, How to Pass - Online Trading - Prop firm challenges assess traders' skills and risk management, with paid challenges offering higher capital and support but posing financial risks; key considerations include firm reputation, cost, evaluation criteria, support, capital allocation, and withdrawal policies.

Trading Challenge Prop Firms Are a Scam (Here's Proof) - YouTube - Some prop firms operate with little regulation, using offshore locations and business models that generate profit from traders failing or breaking rules, raising concerns over transparency and trader protection.

Funded Account Challenge | Prop Firm Challenges - Maven Trading - Prop firm challenges allow skilled traders to earn leverage and funded accounts with profit splits often favoring traders, but only those with experience and strong risk management are typically accepted after passing evaluation challenges.

dowidth.com

dowidth.com