Bid-ask spread capture involves profiting from the difference between the buying (bid) and selling (ask) prices, allowing traders to earn without crossing the spread. Taker fees apply when traders execute market orders that immediately match existing orders, often incurring higher costs compared to maker trades that add liquidity. Explore detailed strategies to optimize trading costs and maximize profitability through effective bid-ask spread management and fee structures.

Why it is important

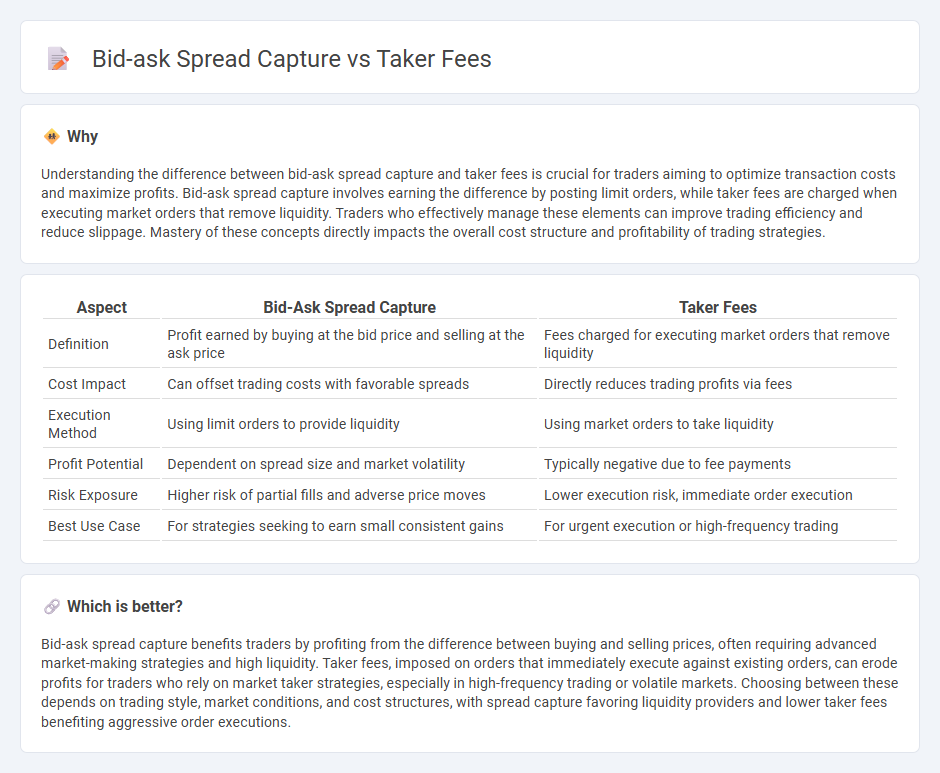

Understanding the difference between bid-ask spread capture and taker fees is crucial for traders aiming to optimize transaction costs and maximize profits. Bid-ask spread capture involves earning the difference by posting limit orders, while taker fees are charged when executing market orders that remove liquidity. Traders who effectively manage these elements can improve trading efficiency and reduce slippage. Mastery of these concepts directly impacts the overall cost structure and profitability of trading strategies.

Comparison Table

| Aspect | Bid-Ask Spread Capture | Taker Fees |

|---|---|---|

| Definition | Profit earned by buying at the bid price and selling at the ask price | Fees charged for executing market orders that remove liquidity |

| Cost Impact | Can offset trading costs with favorable spreads | Directly reduces trading profits via fees |

| Execution Method | Using limit orders to provide liquidity | Using market orders to take liquidity |

| Profit Potential | Dependent on spread size and market volatility | Typically negative due to fee payments |

| Risk Exposure | Higher risk of partial fills and adverse price moves | Lower execution risk, immediate order execution |

| Best Use Case | For strategies seeking to earn small consistent gains | For urgent execution or high-frequency trading |

Which is better?

Bid-ask spread capture benefits traders by profiting from the difference between buying and selling prices, often requiring advanced market-making strategies and high liquidity. Taker fees, imposed on orders that immediately execute against existing orders, can erode profits for traders who rely on market taker strategies, especially in high-frequency trading or volatile markets. Choosing between these depends on trading style, market conditions, and cost structures, with spread capture favoring liquidity providers and lower taker fees benefiting aggressive order executions.

Connection

The bid-ask spread represents the difference between the highest price buyers are willing to pay and the lowest price sellers ask, directly influencing liquidity and trading costs. Market makers capture the spread as profit by providing liquidity, while taker fees are charged to traders who remove liquidity by executing trades at the quoted bid or ask prices. This interconnected dynamic ensures market efficiency, rewarding liquidity providers through the spread and charging takers fees for immediate execution.

Key Terms

Market Order

Taker fees apply when executing market orders that immediately match available bid or ask prices, often incurring a cost based on the order size and exchange rate. Bid-ask spread capture occurs when traders place market orders that take liquidity, potentially sacrificing part of the spread to pay taker fees rather than profiting from it. Explore detailed insights on optimizing order execution strategies to balance taker fees and bid-ask spread capture effectively.

Liquidity Provider

Liquidity providers primarily generate income through the bid-ask spread capture by quoting both buy and sell prices, earning the difference with each transaction. Taker fees, often paid by liquidity takers, represent a cost to those executing market orders, while liquidity providers benefit indirectly as these fees can incentivize stable order flow. Explore deeper insights into how liquidity providers optimize profits amid market dynamics and fee structures.

Execution Cost

Taker fees directly impact execution cost by charging traders a percentage of the trade value for liquidity removal, often increasing overall expenses. The bid-ask spread capture strategy aims to minimize execution cost by taking advantage of price differences between buy and sell orders, effectively reducing transaction costs during trade execution. Explore detailed comparisons to optimize your trading strategy and lower execution cost effectively.

Source and External Links

What are maker fees and taker fees for cryptocurrency traders? - Taker fees are charged to traders who execute orders immediately by taking liquidity from the order book, such as market orders, and these fees are generally higher to compensate for the instant execution and liquidity removal.

Maker vs Taker Fees in Crypto Explained - Taker fees apply when orders are filled immediately at market prices, removing liquidity, and are usually higher than maker fees, which incentivize adding liquidity through limit orders.

What are maker and taker fees? | Binance.US Help Center - Taker fees are charged on orders that execute immediately by "taking" liquidity off the order book, such as market orders or certain limit orders, and are typically higher than maker fees that reward adding liquidity.

dowidth.com

dowidth.com