Quantitative momentum investing focuses on stocks exhibiting strong recent price performance, leveraging statistical models to identify trends and capitalize on continued price momentum. Growth investing targets companies with high earnings potential and revenue expansion, prioritizing fundamental analysis to select stocks expected to outperform due to future growth prospects. Explore the distinct strategies and performance characteristics of quantitative momentum versus growth investing to enhance your investment approach.

Why it is important

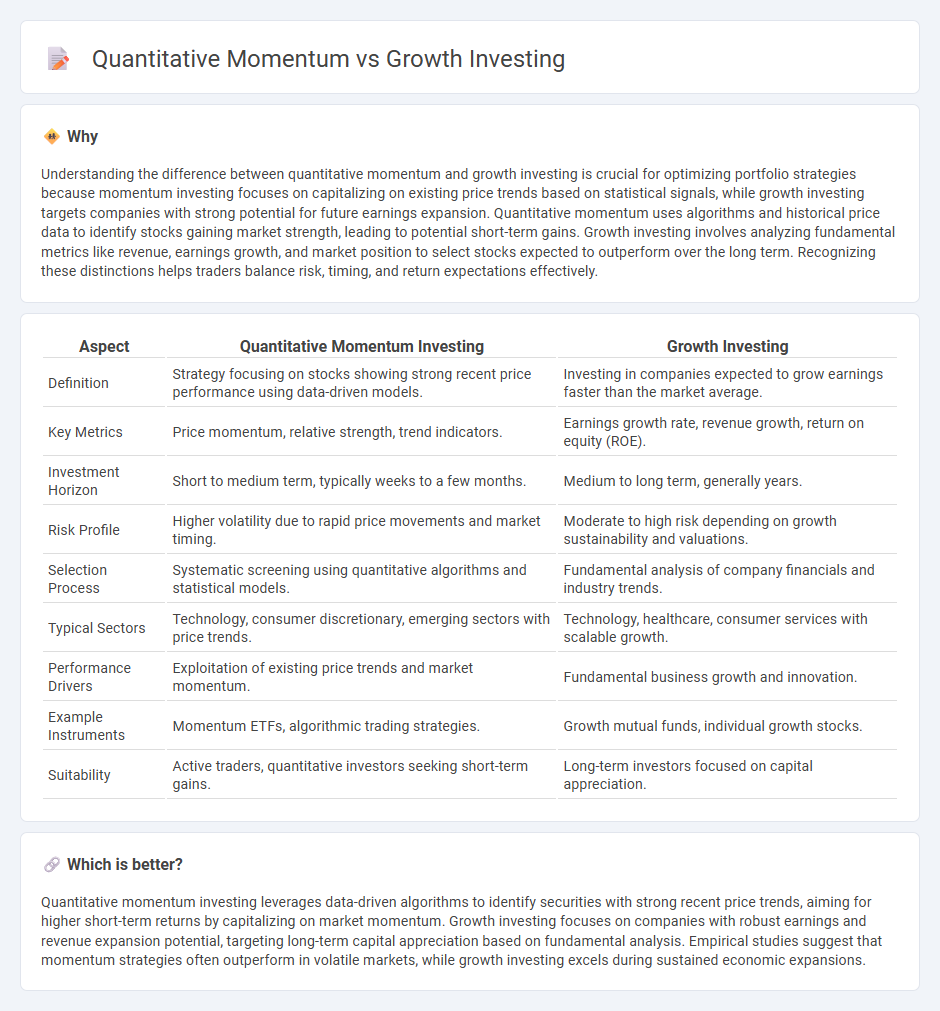

Understanding the difference between quantitative momentum and growth investing is crucial for optimizing portfolio strategies because momentum investing focuses on capitalizing on existing price trends based on statistical signals, while growth investing targets companies with strong potential for future earnings expansion. Quantitative momentum uses algorithms and historical price data to identify stocks gaining market strength, leading to potential short-term gains. Growth investing involves analyzing fundamental metrics like revenue, earnings growth, and market position to select stocks expected to outperform over the long term. Recognizing these distinctions helps traders balance risk, timing, and return expectations effectively.

Comparison Table

| Aspect | Quantitative Momentum Investing | Growth Investing |

|---|---|---|

| Definition | Strategy focusing on stocks showing strong recent price performance using data-driven models. | Investing in companies expected to grow earnings faster than the market average. |

| Key Metrics | Price momentum, relative strength, trend indicators. | Earnings growth rate, revenue growth, return on equity (ROE). |

| Investment Horizon | Short to medium term, typically weeks to a few months. | Medium to long term, generally years. |

| Risk Profile | Higher volatility due to rapid price movements and market timing. | Moderate to high risk depending on growth sustainability and valuations. |

| Selection Process | Systematic screening using quantitative algorithms and statistical models. | Fundamental analysis of company financials and industry trends. |

| Typical Sectors | Technology, consumer discretionary, emerging sectors with price trends. | Technology, healthcare, consumer services with scalable growth. |

| Performance Drivers | Exploitation of existing price trends and market momentum. | Fundamental business growth and innovation. |

| Example Instruments | Momentum ETFs, algorithmic trading strategies. | Growth mutual funds, individual growth stocks. |

| Suitability | Active traders, quantitative investors seeking short-term gains. | Long-term investors focused on capital appreciation. |

Which is better?

Quantitative momentum investing leverages data-driven algorithms to identify securities with strong recent price trends, aiming for higher short-term returns by capitalizing on market momentum. Growth investing focuses on companies with robust earnings and revenue expansion potential, targeting long-term capital appreciation based on fundamental analysis. Empirical studies suggest that momentum strategies often outperform in volatile markets, while growth investing excels during sustained economic expansions.

Connection

Quantitative momentum and growth investing are connected through their focus on identifying stocks exhibiting strong performance trends and earnings potential. Quantitative momentum leverages systematic data analysis to capture price acceleration patterns, while growth investing targets companies with high revenue and profit growth rates. Both strategies rely on robust financial metrics and market data to optimize portfolio returns and manage risk.

Key Terms

Growth Investing:

Growth investing targets companies with above-average earnings growth potential, often in sectors such as technology and healthcare, emphasizing innovation and market expansion. This strategy prioritizes capital appreciation by identifying stocks with strong revenue growth, high return on equity, and sustainable competitive advantages. Explore detailed insights on growth investing strategies, key metrics, and top-performing sectors to enhance your portfolio.

Earnings Growth

Growth investing prioritizes companies exhibiting strong earnings growth, emphasizing consistent revenue and profit increases as indicators of future potential. Quantitative momentum strategies rely on statistical models to identify stocks with accelerating price momentum, often reflecting recent earnings surprises or upward revisions. Explore detailed comparisons and performance metrics to understand the ideal approach for your portfolio.

Price-to-Earnings (P/E) Ratio

Growth investing emphasizes stocks with high Price-to-Earnings (P/E) ratios, reflecting strong earnings potential and market optimism about future growth. Quantitative momentum strategies prioritize stocks displaying upward price trends regardless of their P/E ratios, aiming to capitalize on sustained market performance signals. Explore in-depth comparisons and data-driven insights on how P/E ratios influence these investment approaches.

Source and External Links

Growth investing: What it is and how to build a high-growth portfolio - Growth investing focuses on companies expected to grow at an above-average rate, benefiting from strong earnings potential, compounding returns, and capitalizing on innovation and market trends in sectors like technology and renewable energy.

Growth investing - Wikipedia - Growth investing is an investment strategy aimed at capital appreciation by investing in companies showing above-average growth signs, often at premium valuations, with notable figures like Thomas Rowe Price Jr. and Phil Fisher having shaped this approach.

Investing for growth opportunities - BlackRock - Growth investing targets companies expected to rapidly increase earnings and revenues, suitable for investors seeking long-term wealth accumulation and willing to tolerate risk, in contrast to value or income investing strategies.

dowidth.com

dowidth.com