Liquidity sweeps target resting orders in the order book to capture hidden liquidity and execute large trades without significant market impact. Hidden liquidity refers to unexposed buy or sell orders not visible in the public order book, providing opportunities for traders to access deeper market depth. Explore the nuances between liquidity sweeps and hidden liquidity to enhance your trading strategy.

Why it is important

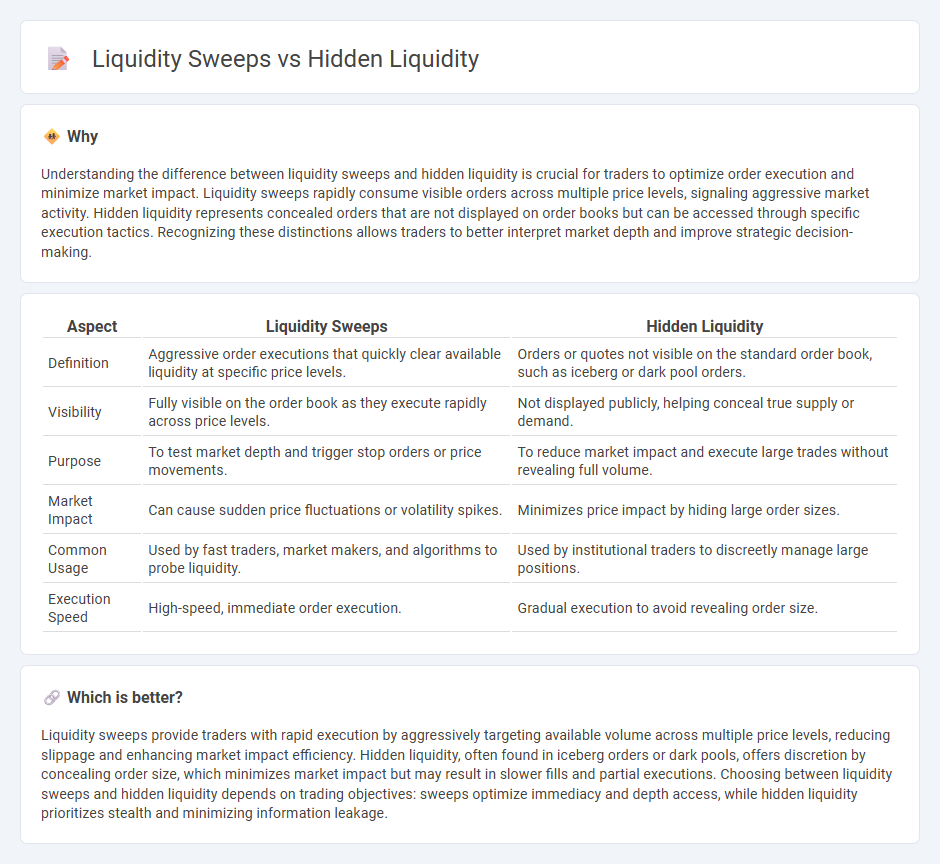

Understanding the difference between liquidity sweeps and hidden liquidity is crucial for traders to optimize order execution and minimize market impact. Liquidity sweeps rapidly consume visible orders across multiple price levels, signaling aggressive market activity. Hidden liquidity represents concealed orders that are not displayed on order books but can be accessed through specific execution tactics. Recognizing these distinctions allows traders to better interpret market depth and improve strategic decision-making.

Comparison Table

| Aspect | Liquidity Sweeps | Hidden Liquidity |

|---|---|---|

| Definition | Aggressive order executions that quickly clear available liquidity at specific price levels. | Orders or quotes not visible on the standard order book, such as iceberg or dark pool orders. |

| Visibility | Fully visible on the order book as they execute rapidly across price levels. | Not displayed publicly, helping conceal true supply or demand. |

| Purpose | To test market depth and trigger stop orders or price movements. | To reduce market impact and execute large trades without revealing full volume. |

| Market Impact | Can cause sudden price fluctuations or volatility spikes. | Minimizes price impact by hiding large order sizes. |

| Common Usage | Used by fast traders, market makers, and algorithms to probe liquidity. | Used by institutional traders to discreetly manage large positions. |

| Execution Speed | High-speed, immediate order execution. | Gradual execution to avoid revealing order size. |

Which is better?

Liquidity sweeps provide traders with rapid execution by aggressively targeting available volume across multiple price levels, reducing slippage and enhancing market impact efficiency. Hidden liquidity, often found in iceberg orders or dark pools, offers discretion by concealing order size, which minimizes market impact but may result in slower fills and partial executions. Choosing between liquidity sweeps and hidden liquidity depends on trading objectives: sweeps optimize immediacy and depth access, while hidden liquidity prioritizes stealth and minimizing information leakage.

Connection

Liquidity sweeps occur when market orders consume available visible liquidity, prompting the discovery of hidden liquidity within order books or dark pools. Hidden liquidity consists of limit orders not displayed openly, allowing large trades to execute without significant price impact. This interaction between liquidity sweeps and concealed liquidity enhances market efficiency by facilitating smoother trade executions and reducing slippage.

Key Terms

Order Book

Hidden liquidity refers to undisclosed orders within the order book that do not appear in the public bid-ask spread but influence price discovery by matching against incoming marketable orders. Liquidity sweeps occur when large market orders aggressively consume visible and hidden liquidity across multiple price levels, rapidly impacting order book depth and price volatility. Explore detailed mechanisms and strategic implications of hidden liquidity and liquidity sweeps to enhance order book analysis and trading execution.

Iceberg Orders

Iceberg orders reveal only a fraction of the total order size, enabling traders to maintain hidden liquidity and minimize market impact. Liquidity sweeps aggressively execute against visible and hidden orders, often triggering these iceberg order replenishments to capture deeper liquidity. Explore more on how understanding iceberg orders enhances strategic trading execution and liquidity management.

Stop-Loss Hunting

Hidden liquidity refers to undisclosed orders in the market that large traders use to execute sizable trades without impacting price, while liquidity sweeps involve aggressive market orders targeting these hidden volumes to trigger stop-loss levels. Stop-loss hunting exploits these tactics to induce price movements by triggering clustered stop-loss orders, increasing volatility and capturing liquidity. Explore the mechanisms behind stop-loss hunting and how hidden liquidity and liquidity sweeps interplay to influence market dynamics.

Source and External Links

Spotting Hidden Liquidity & Iceberg Orders - Hidden liquidity refers to substantial trading orders that are intentionally concealed by breaking them into smaller parts (iceberg orders) to avoid revealing the true size, thus misleading the market and allowing traders to anticipate price moves and detect manipulation.

Hidden Liquidity: Some new light on dark trading - Hidden liquidity is a non-displayed component of market liquidity where orders are partially or totally concealed on the order book, causing market opacity and complicating the assessment of true supply, demand, and price spreads.

Navigating the Murky World of Hidden Liquidity - Hidden liquidity accounts for a significant share of trading volume in U.S. equity markets, with advanced data and AI techniques enabling prediction and interaction with these concealed orders to improve execution quality.

dowidth.com

dowidth.com