Microstructure modeling focuses on the intricate mechanisms of order execution, bid-ask spreads, and price formation within financial markets, providing a theoretical framework for understanding market dynamics. High-frequency trading analysis emphasizes the use of advanced algorithms and real-time data to exploit short-term price inefficiencies and optimize trade execution speed. Explore further to understand how these approaches shape modern trading strategies and market behavior.

Why it is important

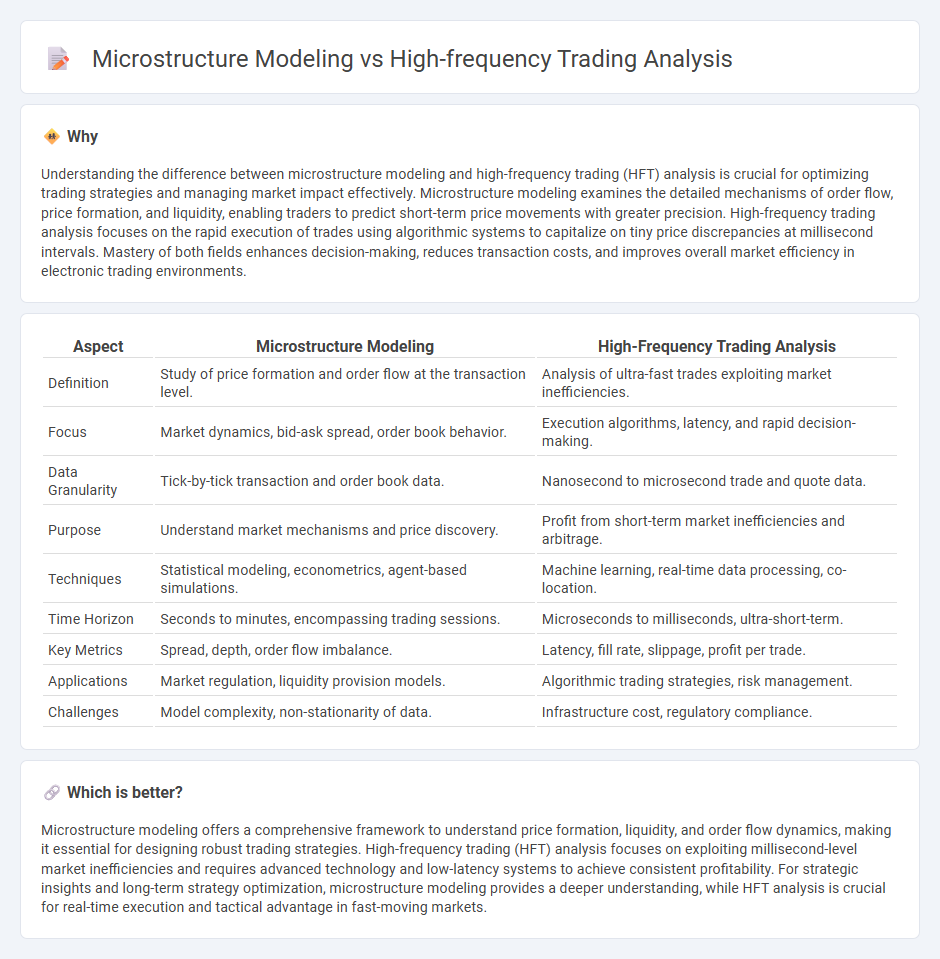

Understanding the difference between microstructure modeling and high-frequency trading (HFT) analysis is crucial for optimizing trading strategies and managing market impact effectively. Microstructure modeling examines the detailed mechanisms of order flow, price formation, and liquidity, enabling traders to predict short-term price movements with greater precision. High-frequency trading analysis focuses on the rapid execution of trades using algorithmic systems to capitalize on tiny price discrepancies at millisecond intervals. Mastery of both fields enhances decision-making, reduces transaction costs, and improves overall market efficiency in electronic trading environments.

Comparison Table

| Aspect | Microstructure Modeling | High-Frequency Trading Analysis |

|---|---|---|

| Definition | Study of price formation and order flow at the transaction level. | Analysis of ultra-fast trades exploiting market inefficiencies. |

| Focus | Market dynamics, bid-ask spread, order book behavior. | Execution algorithms, latency, and rapid decision-making. |

| Data Granularity | Tick-by-tick transaction and order book data. | Nanosecond to microsecond trade and quote data. |

| Purpose | Understand market mechanisms and price discovery. | Profit from short-term market inefficiencies and arbitrage. |

| Techniques | Statistical modeling, econometrics, agent-based simulations. | Machine learning, real-time data processing, co-location. |

| Time Horizon | Seconds to minutes, encompassing trading sessions. | Microseconds to milliseconds, ultra-short-term. |

| Key Metrics | Spread, depth, order flow imbalance. | Latency, fill rate, slippage, profit per trade. |

| Applications | Market regulation, liquidity provision models. | Algorithmic trading strategies, risk management. |

| Challenges | Model complexity, non-stationarity of data. | Infrastructure cost, regulatory compliance. |

Which is better?

Microstructure modeling offers a comprehensive framework to understand price formation, liquidity, and order flow dynamics, making it essential for designing robust trading strategies. High-frequency trading (HFT) analysis focuses on exploiting millisecond-level market inefficiencies and requires advanced technology and low-latency systems to achieve consistent profitability. For strategic insights and long-term strategy optimization, microstructure modeling provides a deeper understanding, while HFT analysis is crucial for real-time execution and tactical advantage in fast-moving markets.

Connection

Microstructure modeling examines the mechanisms of order flow, bid-ask spreads, and price formation in financial markets, providing crucial insights into market behavior at a granular level. High-frequency trading analysis leverages these microstructural insights to optimize trading algorithms, reduce latency, and exploit short-term price inefficiencies. The integration of microstructure models enhances the predictive accuracy and execution efficiency of high-frequency trading strategies, driving improved market liquidity and reduced transaction costs.

Key Terms

**High-Frequency Trading Analysis:**

High-Frequency Trading (HFT) analysis involves examining massive datasets of intraday price movements and order book dynamics to identify ultra-short-term patterns and exploit market inefficiencies. This approach leverages advanced statistical models, machine learning algorithms, and real-time data feeds to optimize trade execution and minimize latency impacts. Explore the latest research and tools to deepen your understanding of HFT strategies and their market implications.

Latency

High-frequency trading analysis prioritizes ultra-low latency to execute trades within microseconds, leveraging real-time market data for rapid decision-making. Microstructure modeling, conversely, examines the detailed mechanisms of order flow and price formation, emphasizing how latency impacts market efficiency and liquidity. Explore further to understand the critical role latency plays in optimizing trading strategies and market design.

Order flow

High-frequency trading analysis examines rapid market transactions to capitalize on minute price changes, heavily relying on real-time order flow data to predict short-term price movements. Microstructure modeling delves into the intricate mechanisms of order flow, bid-ask dynamics, and liquidity provision, offering a theoretical framework for understanding price formation and market efficiency. Explore deeper insights into how order flow drives both trading strategies and market microstructure models for optimized financial decision-making.

Source and External Links

High-Frequency Trading (HFT): What It Is & How It Works - High-frequency trading uses ultra-high-speed computer programs with algorithms to execute numerous trades within fractions of a second, employing strategies like market making, arbitrage, and latency arbitrage to profit from very short-term price movements and bid-ask spreads.

High Frequency Trading (HFT) - Definition, Pros and Cons - HFT is algorithmic trading with exceptionally high trade execution speed and transaction volume, using complex algorithms to analyze stocks and spot trends in milliseconds, thereby capitalizing on tiny price fluctuations for profit and enhancing market liquidity and price efficiency.

High-Frequency Trading Explained: What Is It and How Do You Get ... - High-frequency trading leverages automated systems, integrating global market data and ultra-low-latency infrastructure, to detect and act on fleeting price discrepancies across exchanges within microseconds, often generating profits through high-volume trades on minimal price differences.

dowidth.com

dowidth.com