Social copy trading enables investors to replicate strategies of expert traders, offering a hands-off approach with diverse market exposure. High-frequency trading relies on advanced algorithms and lightning-fast execution to capitalize on minimal price fluctuations in milliseconds. Explore the distinct advantages and risks of each trading style to enhance your investment strategy.

Why it is important

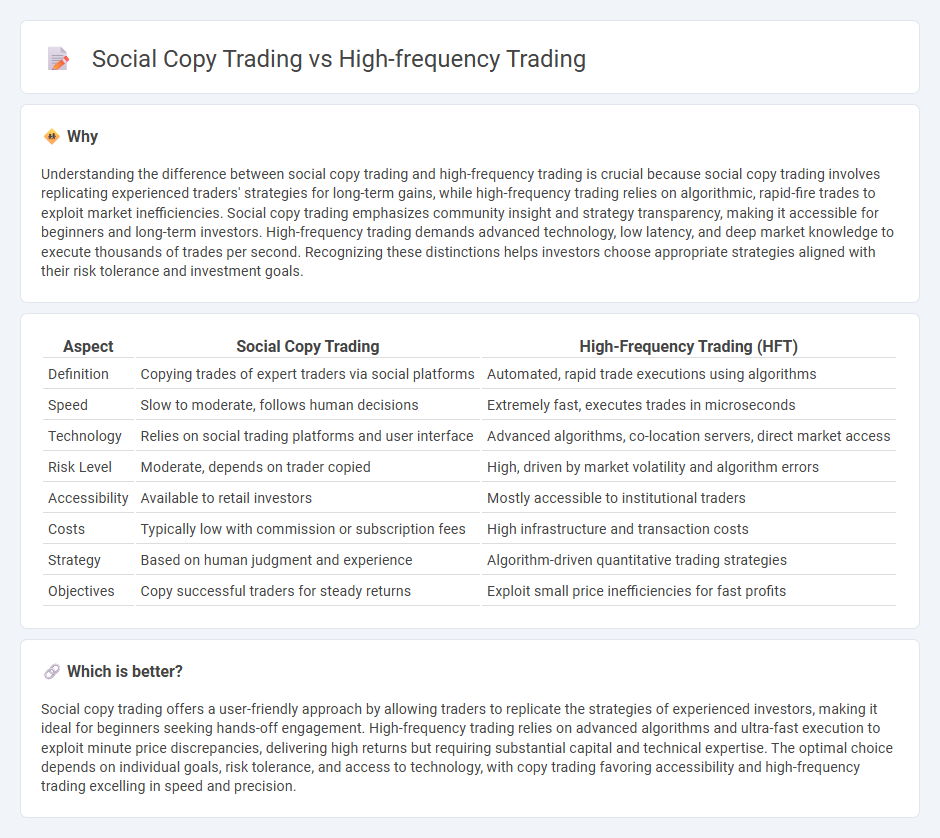

Understanding the difference between social copy trading and high-frequency trading is crucial because social copy trading involves replicating experienced traders' strategies for long-term gains, while high-frequency trading relies on algorithmic, rapid-fire trades to exploit market inefficiencies. Social copy trading emphasizes community insight and strategy transparency, making it accessible for beginners and long-term investors. High-frequency trading demands advanced technology, low latency, and deep market knowledge to execute thousands of trades per second. Recognizing these distinctions helps investors choose appropriate strategies aligned with their risk tolerance and investment goals.

Comparison Table

| Aspect | Social Copy Trading | High-Frequency Trading (HFT) |

|---|---|---|

| Definition | Copying trades of expert traders via social platforms | Automated, rapid trade executions using algorithms |

| Speed | Slow to moderate, follows human decisions | Extremely fast, executes trades in microseconds |

| Technology | Relies on social trading platforms and user interface | Advanced algorithms, co-location servers, direct market access |

| Risk Level | Moderate, depends on trader copied | High, driven by market volatility and algorithm errors |

| Accessibility | Available to retail investors | Mostly accessible to institutional traders |

| Costs | Typically low with commission or subscription fees | High infrastructure and transaction costs |

| Strategy | Based on human judgment and experience | Algorithm-driven quantitative trading strategies |

| Objectives | Copy successful traders for steady returns | Exploit small price inefficiencies for fast profits |

Which is better?

Social copy trading offers a user-friendly approach by allowing traders to replicate the strategies of experienced investors, making it ideal for beginners seeking hands-off engagement. High-frequency trading relies on advanced algorithms and ultra-fast execution to exploit minute price discrepancies, delivering high returns but requiring substantial capital and technical expertise. The optimal choice depends on individual goals, risk tolerance, and access to technology, with copy trading favoring accessibility and high-frequency trading excelling in speed and precision.

Connection

Social copy trading leverages collective intelligence by allowing traders to replicate strategies of successful investors, while high-frequency trading (HFT) relies on advanced algorithms and ultra-fast executions to capitalize on market inefficiencies. Both methods harness technology to enhance decision-making speed and precision, driving competitive advantages in the trading landscape. The convergence of social insights with algorithmic efficiency exemplifies the evolving intersection of human behavior and automated trading systems.

Key Terms

Algorithmic Execution

High-frequency trading (HFT) leverages sophisticated algorithms to execute a large number of orders at extremely fast speeds, capitalizing on minute price discrepancies in milliseconds. Social copy trading, by contrast, allows investors to replicate expert traders' strategies in real-time without deep algorithmic involvement, emphasizing community-driven decision-making over raw execution speed. Explore the nuances of algorithmic execution and its impact on trading outcomes to deepen your understanding.

Latency

High-frequency trading (HFT) leverages ultra-low latency connections and advanced algorithms to execute thousands of trades within microseconds, capitalizing on minimal price discrepancies. Social copy trading, in contrast, emphasizes replicating experienced traders' strategies in real time but operates with higher latency due to human decision time and platform processing delays. Explore the nuances of latency impact on trading performance and strategy effectiveness to optimize your market approach.

Signal Providers

High-frequency trading relies on algorithmic systems executing thousands of trades per second to capitalize on minute market inefficiencies, demanding advanced technology and low-latency networks. Social copy trading, in contrast, centers on signal providers who share their trading strategies and real-time insights, allowing followers to replicate trades manually or automatically. Discover the key differences and performance factors of these approaches to optimize your trading strategy.

Source and External Links

High-Frequency Trading Explained: What Is It and How Do ... - High-frequency trading uses powerful computers and advanced algorithms to execute a very large number of trades in microseconds, exploiting tiny price differences across markets to generate profits rapidly.

High Frequency Trading (HFT) - Definition, Pros and Cons - HFT is algorithmic trading characterized by extremely fast trade execution, high transaction volume, and a short-term investment horizon, mainly used by institutional investors to profit from small price changes and enhance market liquidity.

High-frequency trading - High-frequency trading involves quantitative models to make portfolio decisions with very short holding periods, focusing on rapid arbitrage and market-making strategies to exploit tiny market inefficiencies.

dowidth.com

dowidth.com