Dark pool prints represent large, undisclosed trades executed privately to minimize market impact, while iceberg orders conceal the full order size by displaying only a fraction to the public order book. These trading strategies help institutional investors maintain anonymity and reduce price fluctuations during significant transactions. Discover how understanding these mechanisms can enhance your trading strategy and market insight.

Why it is important

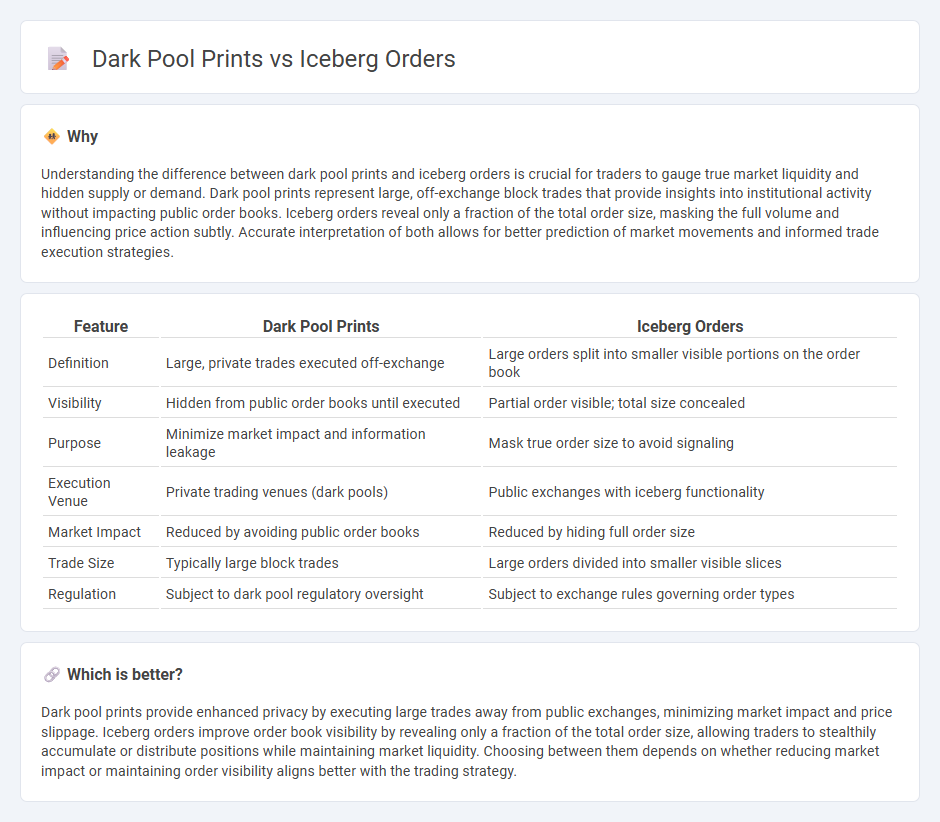

Understanding the difference between dark pool prints and iceberg orders is crucial for traders to gauge true market liquidity and hidden supply or demand. Dark pool prints represent large, off-exchange block trades that provide insights into institutional activity without impacting public order books. Iceberg orders reveal only a fraction of the total order size, masking the full volume and influencing price action subtly. Accurate interpretation of both allows for better prediction of market movements and informed trade execution strategies.

Comparison Table

| Feature | Dark Pool Prints | Iceberg Orders |

|---|---|---|

| Definition | Large, private trades executed off-exchange | Large orders split into smaller visible portions on the order book |

| Visibility | Hidden from public order books until executed | Partial order visible; total size concealed |

| Purpose | Minimize market impact and information leakage | Mask true order size to avoid signaling |

| Execution Venue | Private trading venues (dark pools) | Public exchanges with iceberg functionality |

| Market Impact | Reduced by avoiding public order books | Reduced by hiding full order size |

| Trade Size | Typically large block trades | Large orders divided into smaller visible slices |

| Regulation | Subject to dark pool regulatory oversight | Subject to exchange rules governing order types |

Which is better?

Dark pool prints provide enhanced privacy by executing large trades away from public exchanges, minimizing market impact and price slippage. Iceberg orders improve order book visibility by revealing only a fraction of the total order size, allowing traders to stealthily accumulate or distribute positions while maintaining market liquidity. Choosing between them depends on whether reducing market impact or maintaining order visibility aligns better with the trading strategy.

Connection

Dark pool prints and iceberg orders are intrinsically connected through their role in maintaining anonymity in large trade executions. Iceberg orders conceal the total volume by displaying only a fraction of the order size on the public order book, while dark pool prints execute large blocks of trades off-exchange to avoid market impact. Both mechanisms help institutional traders minimize price disruptions and gain strategic advantage in liquidity management.

Key Terms

Order Book

Iceberg orders are large trade orders divided into smaller visible chunks to limit market impact, while dark pool prints occur in private exchanges, hidden from the public order book to maintain anonymity. Both strategies disrupt the traditional order book transparency, with iceberg orders revealing partial depth and dark pool prints remaining entirely off-book. Explore how these mechanisms influence liquidity and price discovery within the order book.

Hidden Liquidity

Iceberg orders and dark pool prints both represent significant aspects of hidden liquidity in financial markets, where large trades are intentionally concealed to minimize market impact. Iceberg orders reveal only a fraction of the total order size to public order books, while dark pool prints execute trades off-exchange, away from transparent order flow. Explore the intricacies of hidden liquidity strategies and their impact on market dynamics here.

Trade Transparency

Iceberg orders split large trade volumes into smaller visible portions to avoid market impact, while dark pool prints represent aggregated trades executed privately, off public exchanges, limiting trade transparency. Both methods obscure full order size and trading intentions but differ in visibility and execution venues, influencing market liquidity and price discovery. Explore the nuances of these trading mechanisms for deeper insights into market transparency and trading strategies.

Source and External Links

Iceberg Order - Overview, How It Works, and Example - An iceberg order is a large buy or sell order broken into smaller parts, revealing only the visible quantity ("tip of the iceberg") at a time to minimize market impact and avoid moving the price significantly.

Iceberg Orders - Kraken Support - Iceberg orders allow traders to place limit orders where only a small portion (display quantity) is visible in the order book, while the rest remains hidden, with additional portions revealed incrementally as parts are filled.

What are Iceberg Orders? - Bookmap - Iceberg orders help large investors avoid causing sharp price fluctuations by splitting large sell or buy orders into smaller chunks, keeping most of the order hidden to prevent market disruption and rumors.

dowidth.com

dowidth.com