Order flow analysis provides real-time insights by tracking the actual buy and sell orders in the market, revealing supply and demand dynamics at a granular level. Momentum trading focuses on identifying and capitalizing on price trends through technical indicators and historical price movements. Explore these strategies further to enhance your trading precision and decision-making skills.

Why it is important

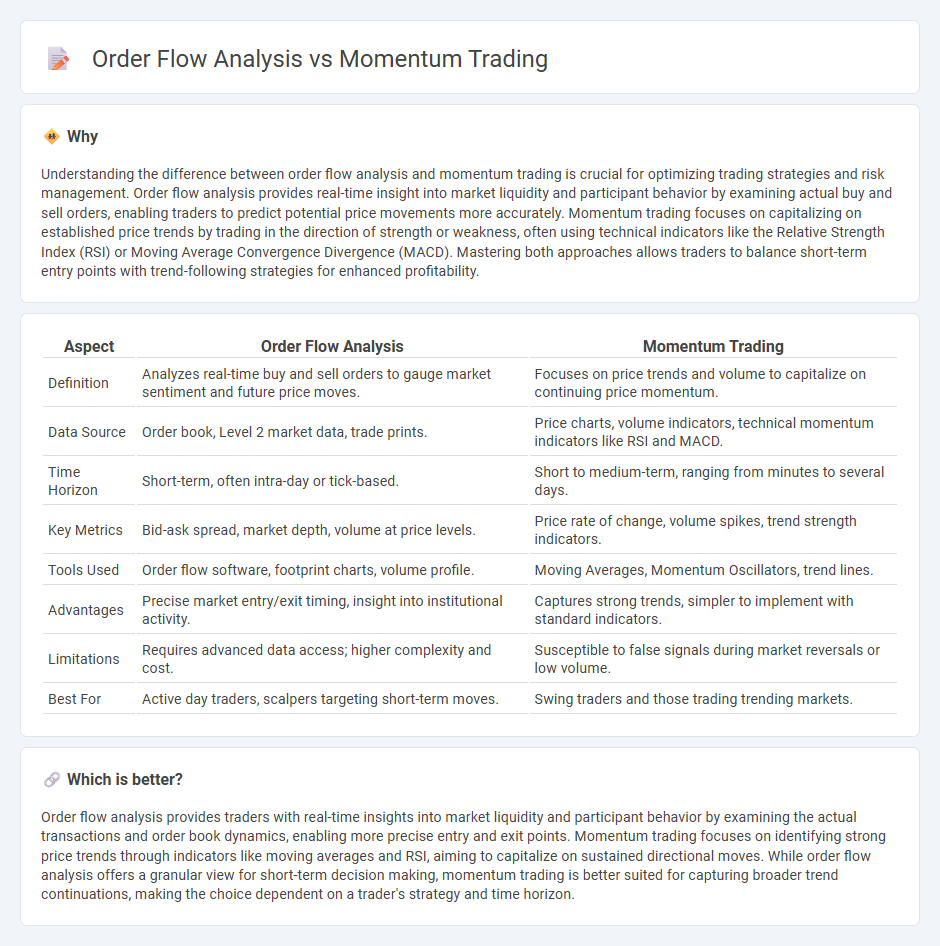

Understanding the difference between order flow analysis and momentum trading is crucial for optimizing trading strategies and risk management. Order flow analysis provides real-time insight into market liquidity and participant behavior by examining actual buy and sell orders, enabling traders to predict potential price movements more accurately. Momentum trading focuses on capitalizing on established price trends by trading in the direction of strength or weakness, often using technical indicators like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD). Mastering both approaches allows traders to balance short-term entry points with trend-following strategies for enhanced profitability.

Comparison Table

| Aspect | Order Flow Analysis | Momentum Trading |

|---|---|---|

| Definition | Analyzes real-time buy and sell orders to gauge market sentiment and future price moves. | Focuses on price trends and volume to capitalize on continuing price momentum. |

| Data Source | Order book, Level 2 market data, trade prints. | Price charts, volume indicators, technical momentum indicators like RSI and MACD. |

| Time Horizon | Short-term, often intra-day or tick-based. | Short to medium-term, ranging from minutes to several days. |

| Key Metrics | Bid-ask spread, market depth, volume at price levels. | Price rate of change, volume spikes, trend strength indicators. |

| Tools Used | Order flow software, footprint charts, volume profile. | Moving Averages, Momentum Oscillators, trend lines. |

| Advantages | Precise market entry/exit timing, insight into institutional activity. | Captures strong trends, simpler to implement with standard indicators. |

| Limitations | Requires advanced data access; higher complexity and cost. | Susceptible to false signals during market reversals or low volume. |

| Best For | Active day traders, scalpers targeting short-term moves. | Swing traders and those trading trending markets. |

Which is better?

Order flow analysis provides traders with real-time insights into market liquidity and participant behavior by examining the actual transactions and order book dynamics, enabling more precise entry and exit points. Momentum trading focuses on identifying strong price trends through indicators like moving averages and RSI, aiming to capitalize on sustained directional moves. While order flow analysis offers a granular view for short-term decision making, momentum trading is better suited for capturing broader trend continuations, making the choice dependent on a trader's strategy and time horizon.

Connection

Order flow analysis provides real-time insight into market liquidity and participant behavior, enabling traders to anticipate price movements with greater precision. Momentum trading leverages these insights by identifying and capitalizing on sustained buying or selling pressure revealed through order flow data. Integrating order flow analysis enhances momentum trading strategies by confirming trend strength and timing entry and exit points effectively.

Key Terms

Momentum Trading:

Momentum trading capitalizes on the continuation of existing market trends by identifying assets with strong price movement and volume surges. Traders use technical indicators such as moving averages, Relative Strength Index (RSI), and MACD to gauge the strength and sustainability of momentum in stocks, commodities, or forex pairs. Explore deeper insights into momentum trading strategies and tools to enhance your market performance.

Relative Strength Index (RSI)

Momentum trading leverages the Relative Strength Index (RSI) to identify overbought or oversold conditions, signaling potential price reversals or continuations. Order flow analysis examines the actual buying and selling pressure behind price movements, offering real-time insight into market sentiment that complements RSI readings. Explore the nuances of combining momentum trading and order flow analysis for enhanced decision-making strategies.

Moving Average Convergence Divergence (MACD)

Momentum trading relies on indicators like Moving Average Convergence Divergence (MACD) to identify shifts in price trends and momentum by measuring the difference between short-term and long-term moving averages. Order flow analysis delves into real-time market transactions, examining the volume and price changes to predict short-term movements, which complements MACD's signal-based approach. Explore the nuances of how combining MACD with order flow analysis can enhance trading strategies and market timing.

Source and External Links

Momentum Trading: Types, Strategies and More - Part I - Momentum trading involves buying or selling assets based on recent price trends and includes two main types: time-series momentum (trading based on an asset's own past performance) and cross-sectional momentum (trading based on an asset's performance relative to others).

Momentum Trading: Types, Strategies, and More - QuantInsti Blog - This resource explains momentum trading as seeking assets with strong upward or downward trends, using time-series momentum strategies that focus on historical asset returns and cross-sectional momentum strategies that compare performance across multiple assets.

Momentum Trading for Beginners (What They Don't Teach You) - A video tutorial covering the basics of momentum trading, including how to identify strong price moves, use technical indicators like RSI and MACD, and apply risk management techniques for trading momentum effectively.

dowidth.com

dowidth.com