Grid trading employs a systematic approach by placing buy and sell orders at predetermined price intervals to capitalize on market volatility, while quant trading utilizes complex algorithms and statistical models to execute trades based on quantitative data analysis. Grid trading thrives in ranging markets with predictable price oscillations, whereas quant trading adapts to diverse market conditions by leveraging vast datasets and machine learning techniques. Explore the distinct strategies and advantages of grid trading versus quant trading to optimize your trading portfolio.

Why it is important

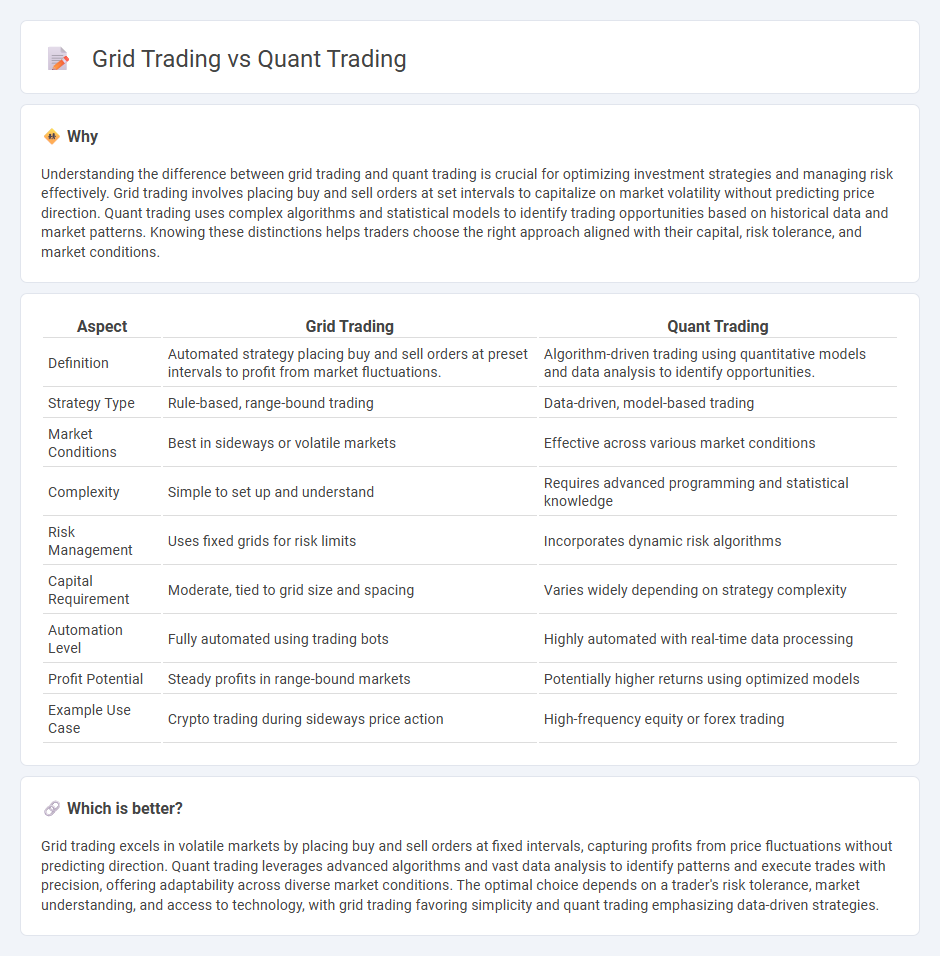

Understanding the difference between grid trading and quant trading is crucial for optimizing investment strategies and managing risk effectively. Grid trading involves placing buy and sell orders at set intervals to capitalize on market volatility without predicting price direction. Quant trading uses complex algorithms and statistical models to identify trading opportunities based on historical data and market patterns. Knowing these distinctions helps traders choose the right approach aligned with their capital, risk tolerance, and market conditions.

Comparison Table

| Aspect | Grid Trading | Quant Trading |

|---|---|---|

| Definition | Automated strategy placing buy and sell orders at preset intervals to profit from market fluctuations. | Algorithm-driven trading using quantitative models and data analysis to identify opportunities. |

| Strategy Type | Rule-based, range-bound trading | Data-driven, model-based trading |

| Market Conditions | Best in sideways or volatile markets | Effective across various market conditions |

| Complexity | Simple to set up and understand | Requires advanced programming and statistical knowledge |

| Risk Management | Uses fixed grids for risk limits | Incorporates dynamic risk algorithms |

| Capital Requirement | Moderate, tied to grid size and spacing | Varies widely depending on strategy complexity |

| Automation Level | Fully automated using trading bots | Highly automated with real-time data processing |

| Profit Potential | Steady profits in range-bound markets | Potentially higher returns using optimized models |

| Example Use Case | Crypto trading during sideways price action | High-frequency equity or forex trading |

Which is better?

Grid trading excels in volatile markets by placing buy and sell orders at fixed intervals, capturing profits from price fluctuations without predicting direction. Quant trading leverages advanced algorithms and vast data analysis to identify patterns and execute trades with precision, offering adaptability across diverse market conditions. The optimal choice depends on a trader's risk tolerance, market understanding, and access to technology, with grid trading favoring simplicity and quant trading emphasizing data-driven strategies.

Connection

Grid trading and quant trading are interconnected through their reliance on algorithmic strategies to optimize market entry and exit points. Grid trading utilizes predefined price levels to systematically place buy and sell orders, while quant trading employs mathematical models and statistical analysis to predict market movements. Both methods leverage automation and data-driven decision-making to enhance trading efficiency and minimize human emotional biases.

Key Terms

Quantitative Analysis,

Quant trading employs advanced quantitative analysis, utilizing complex algorithms and statistical models to identify and exploit market inefficiencies across diverse asset classes. Grid trading, on the other hand, relies on predefined price levels and systematic order placement within a price range, without in-depth statistical optimization. Explore deeper insights into optimizing trading strategies through quantitative analysis and algorithmic precision.

Algorithmic Strategies,

Quant trading employs advanced algorithms and statistical models to identify market inefficiencies and execute high-frequency trades, maximizing profit through data-driven decision-making. Grid trading utilizes algorithmic strategies to place buy and sell orders at predetermined intervals around a set price level, capitalizing on market volatility within a defined range. Explore our comprehensive analysis to understand which algorithmic trading strategy suits your investment goals best.

Price Grid

Quant trading leverages advanced algorithms and statistical models to make data-driven decisions across various markets, optimizing trade execution and risk management. Grid trading uses predefined price levels to place buy and sell orders, capitalizing on market fluctuations within a set price grid to generate profits. Explore the nuances of price grid strategies and algorithmic integration to enhance your trading approach.

Source and External Links

QuantConnect.com: Open Source Algorithmic Trading Platform - A comprehensive platform offering cloud-based tools for quantitative research, backtesting, and live multi-asset algorithmic trading, empowering quants to develop and deploy trading strategies efficiently.

How To Become a Quantitative Trader in 4 Steps (With Skills) - Indeed - Quantitative trading involves using mathematical models to evaluate trade opportunities, requiring strong math skills, risk management, and the ability to adapt and decide quickly under pressure.

8-Course Guide to Quantitative Trading for Beginners - Quantra - Offers practical courses teaching basics of quantitative trading, including momentum strategies, Python coding, backtesting, live trading, and risk management across various asset classes like stocks, forex, and crypto.

dowidth.com

dowidth.com