Social copy trading allows investors to replicate the strategies of experienced traders in real-time, leveraging collective expertise to minimize risks and maximize profits. Options trading offers flexibility through contracts that give the right, but not the obligation, to buy or sell assets at predetermined prices, enabling sophisticated risk management and speculative opportunities. Explore the distinct advantages of social copy trading and options trading to enhance your investment strategy.

Why it is important

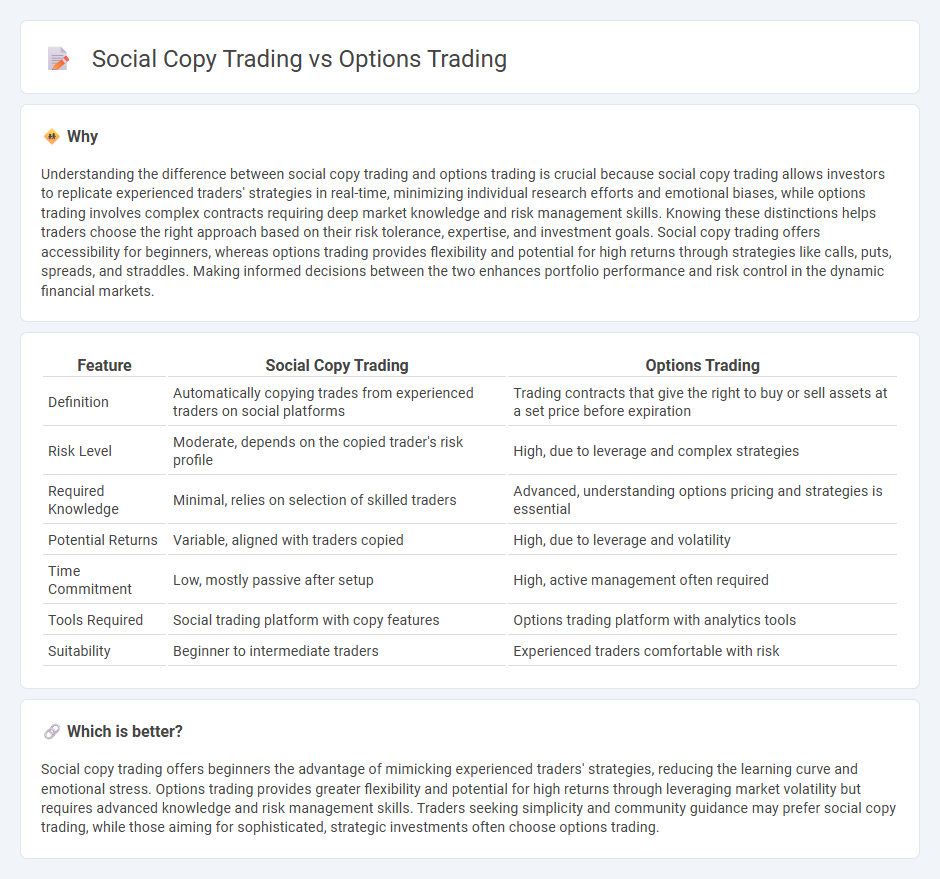

Understanding the difference between social copy trading and options trading is crucial because social copy trading allows investors to replicate experienced traders' strategies in real-time, minimizing individual research efforts and emotional biases, while options trading involves complex contracts requiring deep market knowledge and risk management skills. Knowing these distinctions helps traders choose the right approach based on their risk tolerance, expertise, and investment goals. Social copy trading offers accessibility for beginners, whereas options trading provides flexibility and potential for high returns through strategies like calls, puts, spreads, and straddles. Making informed decisions between the two enhances portfolio performance and risk control in the dynamic financial markets.

Comparison Table

| Feature | Social Copy Trading | Options Trading |

|---|---|---|

| Definition | Automatically copying trades from experienced traders on social platforms | Trading contracts that give the right to buy or sell assets at a set price before expiration |

| Risk Level | Moderate, depends on the copied trader's risk profile | High, due to leverage and complex strategies |

| Required Knowledge | Minimal, relies on selection of skilled traders | Advanced, understanding options pricing and strategies is essential |

| Potential Returns | Variable, aligned with traders copied | High, due to leverage and volatility |

| Time Commitment | Low, mostly passive after setup | High, active management often required |

| Tools Required | Social trading platform with copy features | Options trading platform with analytics tools |

| Suitability | Beginner to intermediate traders | Experienced traders comfortable with risk |

Which is better?

Social copy trading offers beginners the advantage of mimicking experienced traders' strategies, reducing the learning curve and emotional stress. Options trading provides greater flexibility and potential for high returns through leveraging market volatility but requires advanced knowledge and risk management skills. Traders seeking simplicity and community guidance may prefer social copy trading, while those aiming for sophisticated, strategic investments often choose options trading.

Connection

Social copy trading allows investors to replicate the trades of experienced options traders in real-time, leveraging their market insights and strategies. Options trading involves buying and selling contracts that grant the right to buy or sell underlying assets at specified prices, making it a complex market requiring expertise. By integrating social copy trading with options trading, less experienced traders can access sophisticated options strategies without extensive knowledge, enhancing decision-making and potentially improving returns.

Key Terms

Strike Price (Options trading)

Strike price in options trading determines the predetermined price at which an option can be exercised, directly impacting potential profit or loss. Social copy trading, however, involves replicating strategies from experienced traders without needing to analyze metrics like strike price. Explore more to understand how strike price influences options trading outcomes compared to social copy trading methods.

Premium (Options trading)

Options trading allows investors to leverage premium strategies to maximize returns by buying and selling contracts based on underlying assets, offering flexibility to hedge or speculate. Premium in options trading represents the price paid for acquiring the option, influenced by factors like volatility, time decay, and intrinsic value, making it a critical element for risk management and profit optimization. Explore our detailed guide to understand how mastering premium strategies in options trading can enhance your financial portfolio.

Signal Provider (Social copy trading)

Options trading involves analyzing market trends and executing trades based on volatility, strike prices, and expiration dates, demanding considerable expertise from the trader. Social copy trading centers around following Signal Providers who share their trading strategies and real-time trade signals, allowing less experienced traders to replicate their moves automatically. Explore the dynamics of Signal Providers and their impact on trading success to enhance your trading approach.

Source and External Links

Options | FINRA.org - Options are contracts that give investors the potential to profit from changes in the value of an underlying security, either by buying or selling calls or puts, with gains realized by exercising the option or trading the contract before expiration.

Options Trading: Step-by-Step Guide for Beginners - NerdWallet - Options trading involves buying or selling contracts that grant the right to buy or sell a stock at a set price before a certain date, with potential profits based on stock price movements relative to the option's strike price.

Option (finance) - Wikipedia - An option is a contract that allows the holder to buy or sell an underlying asset at a specified price on or before expiration, with common strategies including buying calls to profit from price increases and selling options to earn premiums.

dowidth.com

dowidth.com