Market microstructure focuses on the intricate processes and mechanisms underlying the trading environment, including how information asymmetry, liquidity, and price formation impact market efficiency. Order matching systems play a crucial role by pairing buy and sell orders based on predefined algorithms that ensure fair price discovery and transaction speed. Explore the fundamental differences between market microstructure and order matching to enhance your trading strategy insights.

Why it is important

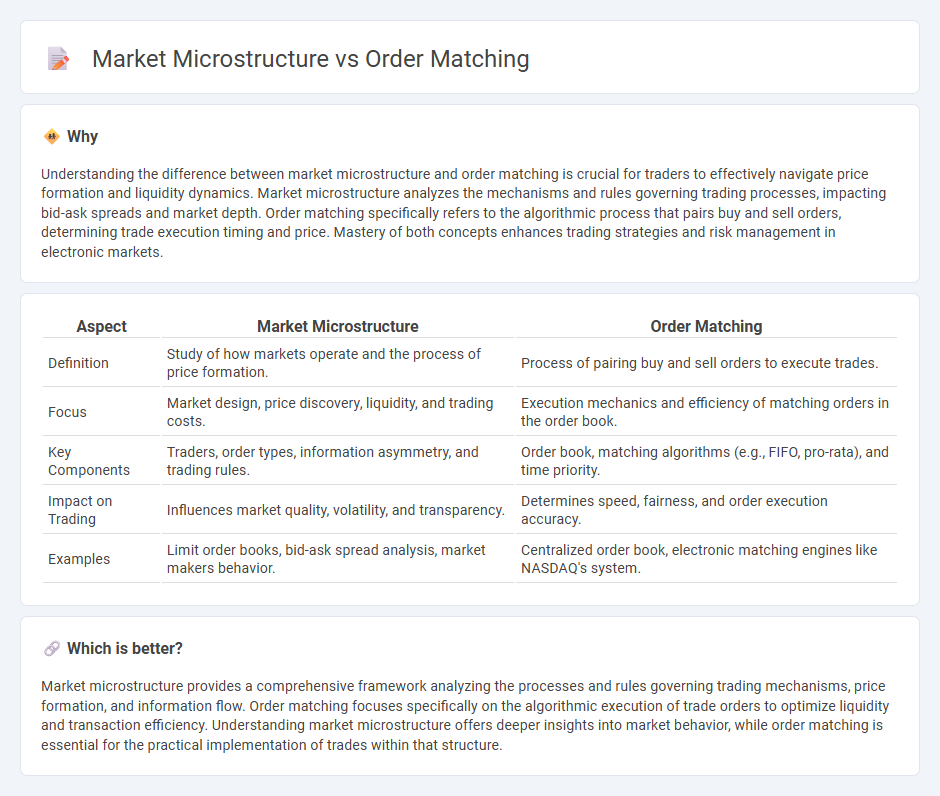

Understanding the difference between market microstructure and order matching is crucial for traders to effectively navigate price formation and liquidity dynamics. Market microstructure analyzes the mechanisms and rules governing trading processes, impacting bid-ask spreads and market depth. Order matching specifically refers to the algorithmic process that pairs buy and sell orders, determining trade execution timing and price. Mastery of both concepts enhances trading strategies and risk management in electronic markets.

Comparison Table

| Aspect | Market Microstructure | Order Matching |

|---|---|---|

| Definition | Study of how markets operate and the process of price formation. | Process of pairing buy and sell orders to execute trades. |

| Focus | Market design, price discovery, liquidity, and trading costs. | Execution mechanics and efficiency of matching orders in the order book. |

| Key Components | Traders, order types, information asymmetry, and trading rules. | Order book, matching algorithms (e.g., FIFO, pro-rata), and time priority. |

| Impact on Trading | Influences market quality, volatility, and transparency. | Determines speed, fairness, and order execution accuracy. |

| Examples | Limit order books, bid-ask spread analysis, market makers behavior. | Centralized order book, electronic matching engines like NASDAQ's system. |

Which is better?

Market microstructure provides a comprehensive framework analyzing the processes and rules governing trading mechanisms, price formation, and information flow. Order matching focuses specifically on the algorithmic execution of trade orders to optimize liquidity and transaction efficiency. Understanding market microstructure offers deeper insights into market behavior, while order matching is essential for the practical implementation of trades within that structure.

Connection

Market microstructure focuses on the mechanisms and protocols governing the trading process, including how orders are submitted, canceled, and executed. Order matching, a key component of market microstructure, determines how buy and sell orders interact to facilitate trade execution efficiently. Understanding the interplay between market microstructure and order matching helps optimize liquidity, minimize transaction costs, and improve price discovery.

Key Terms

**Order Matching:**

Order matching is a core process within market microstructure that aligns buy and sell orders based on price-time priority to facilitate trades efficiently. Modern trading systems employ sophisticated algorithms to optimize order matching speed and accuracy, reducing latency and enhancing liquidity. Explore deeper insights into order matching methodologies and their impact on market efficiency.

Order Book

Order matching is a critical function within market microstructure, where the order book serves as a real-time ledger of buy and sell orders, reflecting supply and demand dynamics. The order book's depth and liquidity influence price discovery and trading efficiency by determining how orders are matched based on price and time priority. Explore more to understand how order book algorithms impact market behavior and trading strategies.

Matching Engine

Order matching is a core function within market microstructure, where the matching engine processes buy and sell orders to facilitate trades at optimal prices. The matching engine uses algorithms to prioritize orders based on price-time priority, liquidity, and order types, ensuring efficient and transparent trade execution. Explore how advanced matching engines impact market efficiency and trading strategies in depth.

Source and External Links

How does order matching work when I trade alternative assets on Public? - Order matching pairs buy and sell orders when bid and ask prices cross or equal each other, prioritizing best price and earliest submitted orders first.

Order matching system: Explained - TIOmarkets - The core of order matching is an algorithm that pairs buy and sell orders based on price and time or size priority, commonly using price-time priority or pro-rata algorithms for fairness and efficiency.

Electronic Trading and Order Matching System Basics - Strike - Order matching in electronic trading involves multiple steps including order placement, validation, queuing in an order book, and matches using price-time priority rules to ensure fair and efficient trade execution.

dowidth.com

dowidth.com