Dark pool aggregation consolidates multiple private trading venues to enhance liquidity and reduce market impact by anonymously matching buy and sell orders. Request for Quote (RFQ) platforms enable investors to request price quotes directly from multiple dealers, facilitating competitive pricing and tailored execution for large or illiquid trades. Discover how these trading mechanisms optimize execution strategies and improve market efficiency.

Why it is important

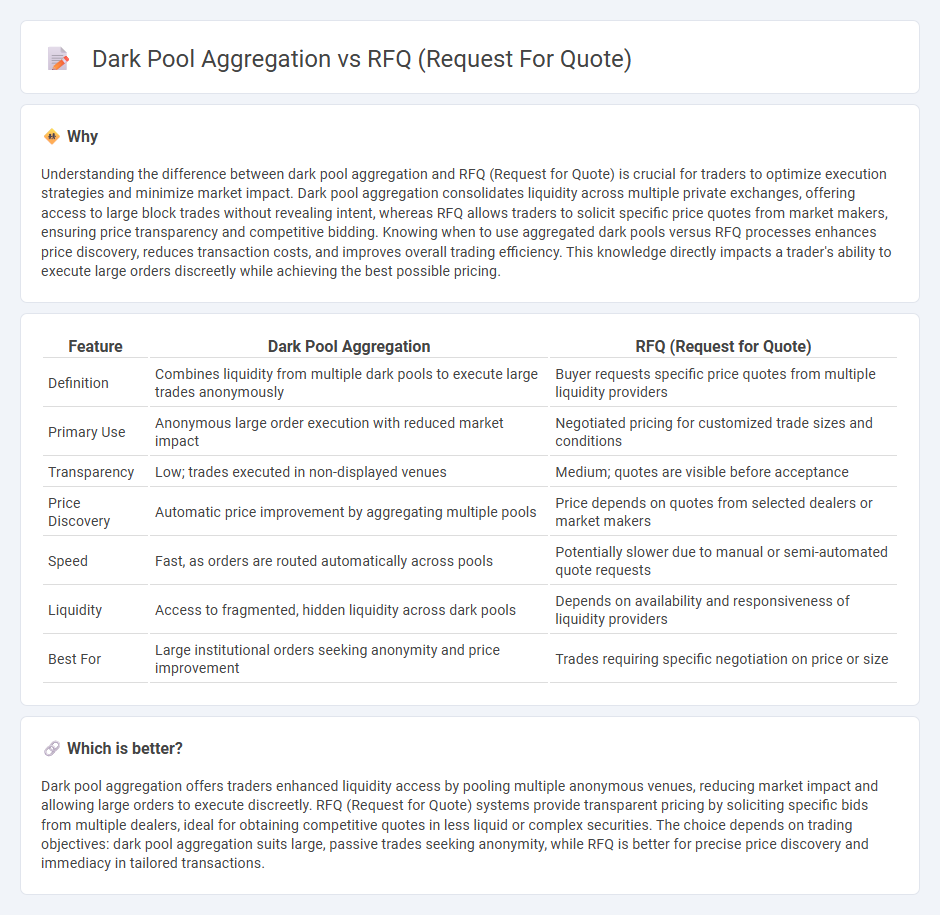

Understanding the difference between dark pool aggregation and RFQ (Request for Quote) is crucial for traders to optimize execution strategies and minimize market impact. Dark pool aggregation consolidates liquidity across multiple private exchanges, offering access to large block trades without revealing intent, whereas RFQ allows traders to solicit specific price quotes from market makers, ensuring price transparency and competitive bidding. Knowing when to use aggregated dark pools versus RFQ processes enhances price discovery, reduces transaction costs, and improves overall trading efficiency. This knowledge directly impacts a trader's ability to execute large orders discreetly while achieving the best possible pricing.

Comparison Table

| Feature | Dark Pool Aggregation | RFQ (Request for Quote) |

|---|---|---|

| Definition | Combines liquidity from multiple dark pools to execute large trades anonymously | Buyer requests specific price quotes from multiple liquidity providers |

| Primary Use | Anonymous large order execution with reduced market impact | Negotiated pricing for customized trade sizes and conditions |

| Transparency | Low; trades executed in non-displayed venues | Medium; quotes are visible before acceptance |

| Price Discovery | Automatic price improvement by aggregating multiple pools | Price depends on quotes from selected dealers or market makers |

| Speed | Fast, as orders are routed automatically across pools | Potentially slower due to manual or semi-automated quote requests |

| Liquidity | Access to fragmented, hidden liquidity across dark pools | Depends on availability and responsiveness of liquidity providers |

| Best For | Large institutional orders seeking anonymity and price improvement | Trades requiring specific negotiation on price or size |

Which is better?

Dark pool aggregation offers traders enhanced liquidity access by pooling multiple anonymous venues, reducing market impact and allowing large orders to execute discreetly. RFQ (Request for Quote) systems provide transparent pricing by soliciting specific bids from multiple dealers, ideal for obtaining competitive quotes in less liquid or complex securities. The choice depends on trading objectives: dark pool aggregation suits large, passive trades seeking anonymity, while RFQ is better for precise price discovery and immediacy in tailored transactions.

Connection

Dark pool aggregation consolidates liquidity from multiple private trading venues to optimize execution efficiency and reduce market impact. RFQ (Request for Quote) systems enable traders to solicit specific price quotes from dark pool participants, enhancing price discovery. Integrating RFQ within dark pool aggregation facilitates more competitive pricing and improved trade execution for institutional investors.

Key Terms

Liquidity

RFQ (Request for Quote) platforms provide traders with direct access to liquidity by soliciting price quotes from multiple dealers, ensuring transparent and competitive pricing for large or illiquid orders. Dark pool aggregation consolidates liquidity from multiple dark pools, allowing participants to execute trades anonymously and reduce market impact while accessing hidden liquidity pools. Explore deeper insights on how these methods optimize liquidity and trading strategies.

Price discovery

Price discovery in RFQ systems relies on direct quotes from a limited pool of liquidity providers, ensuring transparent and competitive pricing for specific trade requests. Dark pool aggregation enhances price discovery by consolidating fragmented liquidity across multiple non-public venues, allowing large orders to execute anonymously without significant market impact. Explore deeper insights into how these mechanisms shape modern market pricing and execution strategies.

Counterparty anonymity

RFQ platforms prioritize counterparty anonymity by allowing buyers to request quotes from multiple dealers without revealing identity, reducing market impact and information leakage. Dark pool aggregation consolidates liquidity from various dark pools, preserving trader anonymity by routing orders through non-displayed venues to prevent price discovery. Explore how these mechanisms enhance anonymous trading and optimize execution strategies in modern financial markets.

Source and External Links

Request for quotation - An RFQ is a business process where a company requests a detailed price quote from suppliers for specific products or services, often including payment terms and quality levels to ensure accurate and comparable bids.

Request for Quote (RFQ) - An RFQ is a document soliciting price quotes from suppliers and is focused primarily on cost and pricing, used either at the start or near the end of the sourcing process, distinct from an RFP which includes broader project or service details.

RFQ: How to write a request for quote (with template) - An RFQ is a formal document used by businesses to collect pricing and terms from vendors, containing specifications, deadlines, contract duration, and terms, and is not in itself a contractual offer but a step prior to contract formation.

dowidth.com

dowidth.com