Volatility harvesting capitalizes on price fluctuations by systematically buying low and selling high within a volatile market environment, aiming to generate returns from market unpredictability. Pair trading involves taking simultaneous long and short positions in two correlated assets to exploit relative price movements while minimizing market risk exposure. Explore the nuances of these strategies to enhance your trading portfolio's performance.

Why it is important

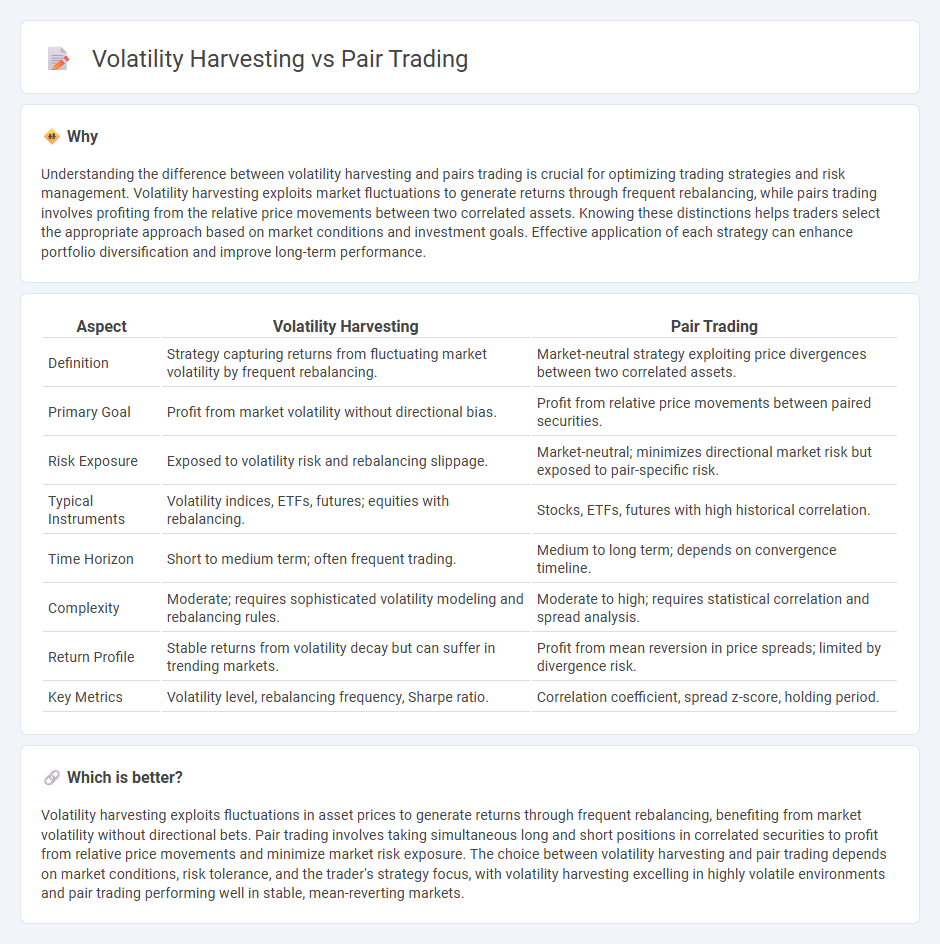

Understanding the difference between volatility harvesting and pairs trading is crucial for optimizing trading strategies and risk management. Volatility harvesting exploits market fluctuations to generate returns through frequent rebalancing, while pairs trading involves profiting from the relative price movements between two correlated assets. Knowing these distinctions helps traders select the appropriate approach based on market conditions and investment goals. Effective application of each strategy can enhance portfolio diversification and improve long-term performance.

Comparison Table

| Aspect | Volatility Harvesting | Pair Trading |

|---|---|---|

| Definition | Strategy capturing returns from fluctuating market volatility by frequent rebalancing. | Market-neutral strategy exploiting price divergences between two correlated assets. |

| Primary Goal | Profit from market volatility without directional bias. | Profit from relative price movements between paired securities. |

| Risk Exposure | Exposed to volatility risk and rebalancing slippage. | Market-neutral; minimizes directional market risk but exposed to pair-specific risk. |

| Typical Instruments | Volatility indices, ETFs, futures; equities with rebalancing. | Stocks, ETFs, futures with high historical correlation. |

| Time Horizon | Short to medium term; often frequent trading. | Medium to long term; depends on convergence timeline. |

| Complexity | Moderate; requires sophisticated volatility modeling and rebalancing rules. | Moderate to high; requires statistical correlation and spread analysis. |

| Return Profile | Stable returns from volatility decay but can suffer in trending markets. | Profit from mean reversion in price spreads; limited by divergence risk. |

| Key Metrics | Volatility level, rebalancing frequency, Sharpe ratio. | Correlation coefficient, spread z-score, holding period. |

Which is better?

Volatility harvesting exploits fluctuations in asset prices to generate returns through frequent rebalancing, benefiting from market volatility without directional bets. Pair trading involves taking simultaneous long and short positions in correlated securities to profit from relative price movements and minimize market risk exposure. The choice between volatility harvesting and pair trading depends on market conditions, risk tolerance, and the trader's strategy focus, with volatility harvesting excelling in highly volatile environments and pair trading performing well in stable, mean-reverting markets.

Connection

Volatility harvesting exploits price fluctuations to generate returns by systematically rebalancing a portfolio, often utilizing strategies like pair trading that involve simultaneously buying and selling correlated assets to capitalize on relative value differences. Pair trading mitigates market risk and enhances volatility harvesting by maintaining market-neutral positions, allowing traders to profit from asset price divergences regardless of overall market direction. This synergy improves risk-adjusted returns through disciplined exploitation of short-term volatility within correlated financial instruments.

Key Terms

**Pair Trading:**

Pair trading leverages the statistical correlation between two related assets to exploit price divergences, enabling traders to capitalize on market inefficiencies while maintaining market neutrality. This strategy relies heavily on cointegration tests and z-score thresholds to identify entry and exit points, minimizing directional risk. Explore detailed methodologies and performance analyses to enhance your understanding of pair trading techniques.

Cointegration

Pair trading relies on cointegration to identify statistically significant relationships between two assets, enabling traders to exploit price divergences for profit. Volatility harvesting focuses on capturing gains from volatility fluctuations rather than price direction, often employing strategies that benefit from mean reversion in cointegrated pairs. Explore how cointegration enhances risk-adjusted returns in both methodologies and discover their distinct applications.

Spread

Pair trading exploits price divergence between two correlated assets by monitoring the spread to identify entry and exit points, aiming to profit from mean reversion. Volatility harvesting leverages fluctuations within a portfolio to systematically rebalance and capture gains from volatility without directional bias, emphasizing spread management to optimize returns. Discover how mastering spread analysis can enhance your pair trading and volatility harvesting strategies.

Source and External Links

Pairs trade - Wikipedia - Pairs trading is a market-neutral, statistical arbitrage strategy that profits from the convergence of prices between two historically correlated securities by shorting the outperformer and buying the underperformer, betting their spread will narrow.

Understanding Pairs Trading: A Beginner Guide | easyMarkets AU - Pairs trading involves simultaneously buying a weaker asset and selling a stronger, related asset, aiming to profit as their prices realign over time.

What Is Pairs Trading? - Fidelity Investments - Pairs trading is a non-directional, relative value strategy that seeks to capitalize on the divergence or convergence of prices between two similar securities, requiring careful selection, execution, and management of trades.

dowidth.com

dowidth.com