Bid-ask spread capture involves profiting from the difference between the buying price and selling price of an asset, capitalizing on market inefficiencies with low-risk trades. Momentum ignition aims to trigger rapid price movements by initiating aggressive trades, causing other traders to follow and thus amplifying market momentum for larger profits. Explore these distinct trading strategies to understand their mechanisms and potential impact on market behavior.

Why it is important

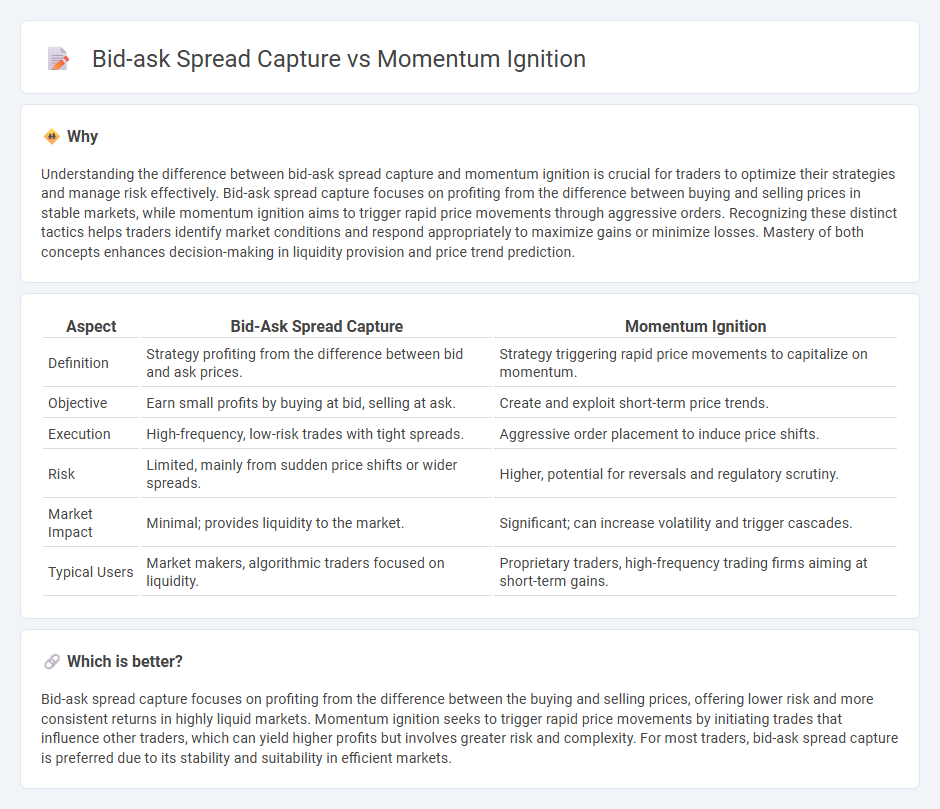

Understanding the difference between bid-ask spread capture and momentum ignition is crucial for traders to optimize their strategies and manage risk effectively. Bid-ask spread capture focuses on profiting from the difference between buying and selling prices in stable markets, while momentum ignition aims to trigger rapid price movements through aggressive orders. Recognizing these distinct tactics helps traders identify market conditions and respond appropriately to maximize gains or minimize losses. Mastery of both concepts enhances decision-making in liquidity provision and price trend prediction.

Comparison Table

| Aspect | Bid-Ask Spread Capture | Momentum Ignition |

|---|---|---|

| Definition | Strategy profiting from the difference between bid and ask prices. | Strategy triggering rapid price movements to capitalize on momentum. |

| Objective | Earn small profits by buying at bid, selling at ask. | Create and exploit short-term price trends. |

| Execution | High-frequency, low-risk trades with tight spreads. | Aggressive order placement to induce price shifts. |

| Risk | Limited, mainly from sudden price shifts or wider spreads. | Higher, potential for reversals and regulatory scrutiny. |

| Market Impact | Minimal; provides liquidity to the market. | Significant; can increase volatility and trigger cascades. |

| Typical Users | Market makers, algorithmic traders focused on liquidity. | Proprietary traders, high-frequency trading firms aiming at short-term gains. |

Which is better?

Bid-ask spread capture focuses on profiting from the difference between the buying and selling prices, offering lower risk and more consistent returns in highly liquid markets. Momentum ignition seeks to trigger rapid price movements by initiating trades that influence other traders, which can yield higher profits but involves greater risk and complexity. For most traders, bid-ask spread capture is preferred due to its stability and suitability in efficient markets.

Connection

Bid-ask spread capture exploits price discrepancies between bid and ask prices to generate profits, often signaling liquidity imbalances that can trigger momentum ignition. Momentum ignition occurs when traders intentionally push prices beyond normal levels, exploiting widened bid-ask spreads to accelerate price movements. Understanding this connection reveals how strategic manipulation of spreads influences short-term market momentum and price dynamics.

Key Terms

Order Flow

Momentum ignition exploits rapid order flow acceleration to trigger price moves, aiming to induce other traders' reactions for profit. Bid-ask spread capture relies on strategic order placement within the order book, profiting from the spread between buying and selling prices during normal order flow. Explore detailed analyses to understand the nuanced interplay between momentum ignition and bid-ask spread capture in order flow dynamics.

Liquidity

Momentum ignition exploits rapid price movements to trigger a cascade of trades, capturing liquidity by causing buy or sell pressure imbalance. Bid-ask spread capture profits from the difference between buy and sell quotes, providing liquidity and earning the spread with minimal price impact. Explore deeper insights into liquidity-sensitive trading strategies to optimize execution and market participation.

Price Impact

Momentum ignition strategies seek to trigger significant price movements by rapidly executing trades to influence market sentiment and create cascades of buying or selling pressure. Bid-ask spread capture involves profiting from the difference between buying and selling prices, aiming to minimize price impact by quickly executing trades within the spread. Explore the intricate dynamics of price impact in momentum ignition versus bid-ask spread capture to enhance your trading strategy insights.

Source and External Links

Momentum Ignition - DayTrading.com - Momentum ignition is a trading strategy used by high-frequency traders to trigger rapid price movements by executing aggressive buy or sell orders to provoke other traders and algorithms into pushing the price further, creating short-term profit opportunities.

Market Abuse "Momentum Ignition" - AfterData - Momentum ignition, also called ramping, is a market manipulation technique where a participant executes large one-sided trades to create an artificial trend, deceiving other investors into following that trend before quickly exiting their position for profit.

What is Momentum Ignition? A Guide for Enterprises - Kx Systems - Momentum ignition involves deliberate rapid price movements triggered by traders or algorithms; AI-powered tools now play a key role in detecting and preventing this potentially manipulative trading behavior by recognizing patterns and alerting market participants.

dowidth.com

dowidth.com