Dark pool activity involves private trading venues where large institutional investors execute orders anonymously to minimize market impact, often resulting in significant hidden liquidity. After-hours trading occurs outside regular market hours, allowing investors to react to news and earnings reports but with lower liquidity and higher volatility. Explore the nuances of dark pool transactions and after-hours market dynamics to enhance your trading strategy.

Why it is important

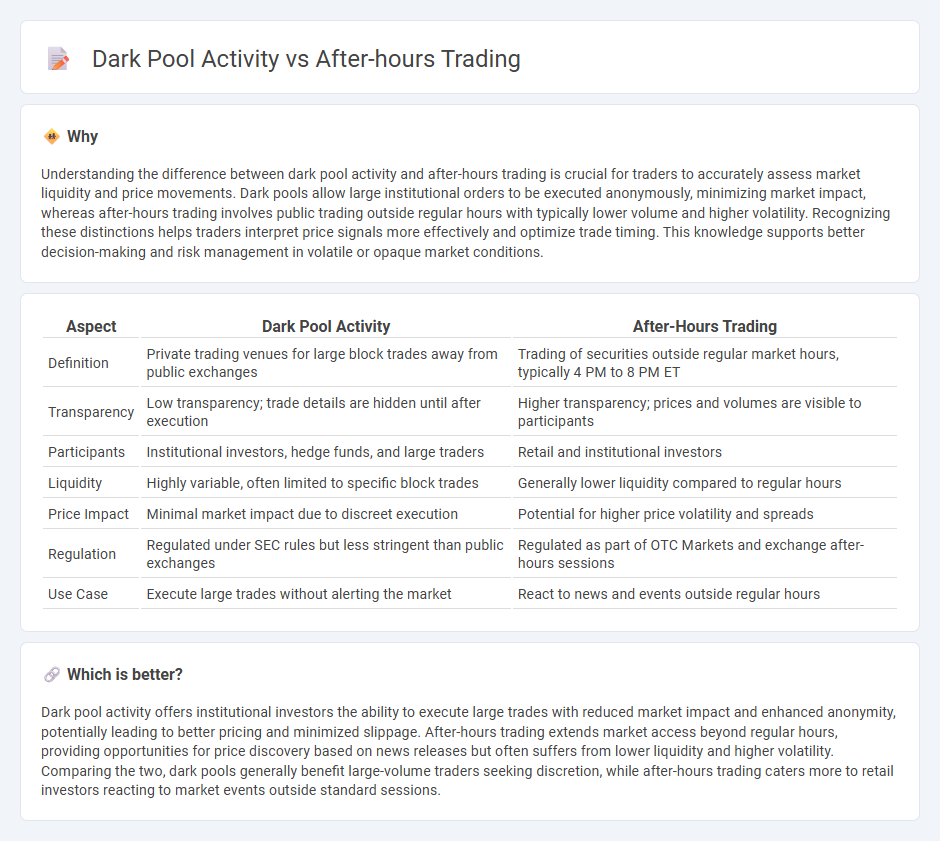

Understanding the difference between dark pool activity and after-hours trading is crucial for traders to accurately assess market liquidity and price movements. Dark pools allow large institutional orders to be executed anonymously, minimizing market impact, whereas after-hours trading involves public trading outside regular hours with typically lower volume and higher volatility. Recognizing these distinctions helps traders interpret price signals more effectively and optimize trade timing. This knowledge supports better decision-making and risk management in volatile or opaque market conditions.

Comparison Table

| Aspect | Dark Pool Activity | After-Hours Trading |

|---|---|---|

| Definition | Private trading venues for large block trades away from public exchanges | Trading of securities outside regular market hours, typically 4 PM to 8 PM ET |

| Transparency | Low transparency; trade details are hidden until after execution | Higher transparency; prices and volumes are visible to participants |

| Participants | Institutional investors, hedge funds, and large traders | Retail and institutional investors |

| Liquidity | Highly variable, often limited to specific block trades | Generally lower liquidity compared to regular hours |

| Price Impact | Minimal market impact due to discreet execution | Potential for higher price volatility and spreads |

| Regulation | Regulated under SEC rules but less stringent than public exchanges | Regulated as part of OTC Markets and exchange after-hours sessions |

| Use Case | Execute large trades without alerting the market | React to news and events outside regular hours |

Which is better?

Dark pool activity offers institutional investors the ability to execute large trades with reduced market impact and enhanced anonymity, potentially leading to better pricing and minimized slippage. After-hours trading extends market access beyond regular hours, providing opportunities for price discovery based on news releases but often suffers from lower liquidity and higher volatility. Comparing the two, dark pools generally benefit large-volume traders seeking discretion, while after-hours trading caters more to retail investors reacting to market events outside standard sessions.

Connection

Dark pool activity and after-hours trading are interconnected through their roles in providing market participants with opportunities to execute large trades outside of regular trading hours, minimizing price impact and market volatility. Dark pools offer private venues for institutional investors to anonymously trade sizable blocks of securities, often influencing liquidity during after-hours sessions. The overlap between these trading mechanisms enhances price discovery and market efficiency in less transparent, extended-hour markets.

Key Terms

Liquidity

After-hours trading extends market access beyond regular hours, providing increased liquidity and price discovery opportunities while exposing investors to wider spreads and less transparency. Dark pool activity involves private exchanges where large blocks of securities are traded anonymously, enhancing liquidity by minimizing market impact but reducing price transparency. Explore the complexities of liquidity dynamics in after-hours trading and dark pools to optimize your trading strategy.

Transparency

After-hours trading operates on public exchanges with real-time price feeds, offering higher transparency compared to dark pool activity, which occurs off-exchange and conceals order sizes and prices to limit market impact. Dark pools enable institutional investors to execute large trades anonymously, reducing market disruption but at the cost of decreased visibility for general investors. Explore the key differences in transparency and market impact between after-hours trading and dark pool activity to understand their implications on price discovery.

Price Discovery

After-hours trading and dark pool activity both influence price discovery by providing alternative venues for trade execution outside regular market hours. After-hours trading allows investors to react to news and events promptly, impacting price transparency and volatility, while dark pools facilitate large block trades with reduced market impact but limited price visibility. Explore how these mechanisms shape efficient market pricing and trading strategies.

Source and External Links

Extended-hours trading - Wikipedia - After-hours trading is stock trading occurring outside of regular market hours, typically from 4:00 p.m. to 8:00 p.m. ET, enabled by electronic communication networks allowing individual investors to participate beyond traditional high-net-worth and institutional investors.

Understanding Pre-Market and After-Hours Trading - TD Bank - After-hours trading lets investors buy and sell securities after the market closes, usually from 4 p.m. to 8 p.m. ET on weekdays, providing flexibility for trades outside the standard 9:30 a.m. to 4 p.m. ET market hours.

Extended Hours Trading - Stocks - Charles Schwab - Extended hours sessions operate independently of regular trading, require specifying order session type, and allow trading after 4 p.m. ET with particular rules, but may have less liquidity and no execution of stop orders during after-hours.

dowidth.com

dowidth.com