Quantitative momentum strategies focus on capitalizing on assets exhibiting strong recent performance trends by buying securities with upward price momentum and selling those with downward momentum. Mean reversion strategies, conversely, rely on the principle that asset prices will revert to their historical average over time, prompting traders to buy undervalued securities and sell overvalued ones. Explore the nuances between momentum and mean reversion approaches to enhance your trading strategy.

Why it is important

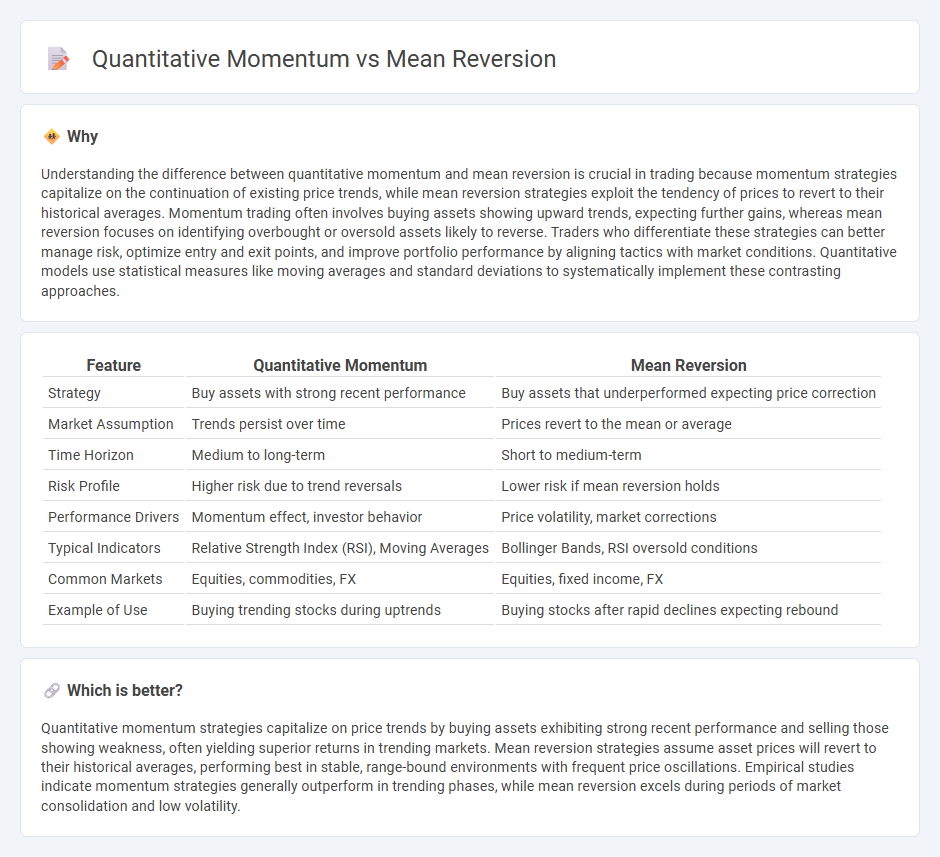

Understanding the difference between quantitative momentum and mean reversion is crucial in trading because momentum strategies capitalize on the continuation of existing price trends, while mean reversion strategies exploit the tendency of prices to revert to their historical averages. Momentum trading often involves buying assets showing upward trends, expecting further gains, whereas mean reversion focuses on identifying overbought or oversold assets likely to reverse. Traders who differentiate these strategies can better manage risk, optimize entry and exit points, and improve portfolio performance by aligning tactics with market conditions. Quantitative models use statistical measures like moving averages and standard deviations to systematically implement these contrasting approaches.

Comparison Table

| Feature | Quantitative Momentum | Mean Reversion |

|---|---|---|

| Strategy | Buy assets with strong recent performance | Buy assets that underperformed expecting price correction |

| Market Assumption | Trends persist over time | Prices revert to the mean or average |

| Time Horizon | Medium to long-term | Short to medium-term |

| Risk Profile | Higher risk due to trend reversals | Lower risk if mean reversion holds |

| Performance Drivers | Momentum effect, investor behavior | Price volatility, market corrections |

| Typical Indicators | Relative Strength Index (RSI), Moving Averages | Bollinger Bands, RSI oversold conditions |

| Common Markets | Equities, commodities, FX | Equities, fixed income, FX |

| Example of Use | Buying trending stocks during uptrends | Buying stocks after rapid declines expecting rebound |

Which is better?

Quantitative momentum strategies capitalize on price trends by buying assets exhibiting strong recent performance and selling those showing weakness, often yielding superior returns in trending markets. Mean reversion strategies assume asset prices will revert to their historical averages, performing best in stable, range-bound environments with frequent price oscillations. Empirical studies indicate momentum strategies generally outperform in trending phases, while mean reversion excels during periods of market consolidation and low volatility.

Connection

Quantitative momentum and mean reversion are connected through their analysis of price trends and market behavior, where momentum strategies exploit continued price movement, while mean reversion strategies capitalize on price corrections toward average values. Both approaches utilize statistical models and historical price data to identify trading signals, often applied in algorithmic trading for better risk management and performance. Combining momentum and mean reversion factors enhances portfolio diversification by balancing trend-following gains with reversal opportunities.

Key Terms

**Mean Reversion:**

Mean reversion strategies capitalize on the tendency of asset prices to revert to their historical average, making them effective in markets with cyclical price patterns and low volatility. These strategies often involve identifying overbought or oversold conditions using statistical measures such as Bollinger Bands, RSI, or moving averages to predict price corrections. Explore more to understand how mean reversion can enhance your portfolio's risk-adjusted returns compared to momentum-based approaches.

Reversion Level

Mean reversion strategies target securities that deviate significantly from their historical average price, betting on a return to the reversion level as a corrective movement. Quantitative momentum focuses on identifying trends by measuring the persistence of asset price movements beyond standard deviations but does not necessarily rely on a fixed reversion point. Explore advanced models to better understand how reversion levels and momentum interplay in market dynamics.

Z-Score

Z-Score is a pivotal metric in comparing mean reversion and quantitative momentum strategies, quantifying the deviation of an asset's price from its historical mean to identify trading opportunities. Mean reversion strategies rely on high absolute Z-Scores signaling potential price corrections, while quantitative momentum uses Z-Scores to capture persistent directional trends by assessing momentum strength relative to historical volatility. Explore the nuances of Z-Score applications to optimize your trading approach.

Source and External Links

Mean Reversion Strategies: Introduction, Trading, Strategies and More - Mean reversion is a financial theory where asset prices and historical returns tend to revert to their long-term average, and traders identify buy signals when prices fall below this mean and sell signals when prices rise above it.

Mean reversion (finance) - Wikipedia - Mean reversion assumes an asset's price will converge to its average price over time, making it a basis for trading strategies that buy when prices fall below the average and sell when prices rise above it.

Mean Reversion - Overview, Trading, Impact of Catalysts - Mean reversion theory implies asset prices gradually move towards the long-term mean, allowing traders to profit by buying under the mean and selling above it, factoring in catalysts that influence price movement.

dowidth.com

dowidth.com