Dark pool aggregation consolidates large, private trading venues to provide institutional investors with reduced market impact and enhanced price discovery, unlike exchange-driven liquidity that relies on visible order books and public market data. By leveraging dark pools, traders access hidden liquidity pools that can execute sizable orders without signaling intentions to the broader market, minimizing slippage and adverse price movements. Explore how integrating dark pool strategies with exchange liquidity can optimize execution and improve overall trading performance.

Why it is important

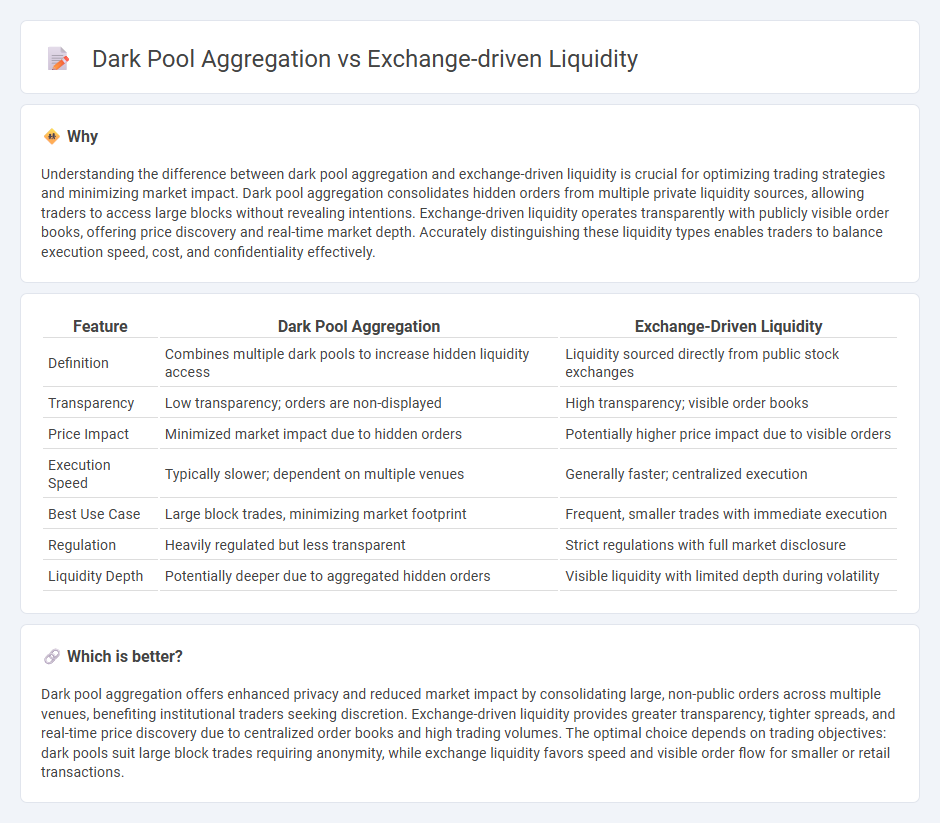

Understanding the difference between dark pool aggregation and exchange-driven liquidity is crucial for optimizing trading strategies and minimizing market impact. Dark pool aggregation consolidates hidden orders from multiple private liquidity sources, allowing traders to access large blocks without revealing intentions. Exchange-driven liquidity operates transparently with publicly visible order books, offering price discovery and real-time market depth. Accurately distinguishing these liquidity types enables traders to balance execution speed, cost, and confidentiality effectively.

Comparison Table

| Feature | Dark Pool Aggregation | Exchange-Driven Liquidity |

|---|---|---|

| Definition | Combines multiple dark pools to increase hidden liquidity access | Liquidity sourced directly from public stock exchanges |

| Transparency | Low transparency; orders are non-displayed | High transparency; visible order books |

| Price Impact | Minimized market impact due to hidden orders | Potentially higher price impact due to visible orders |

| Execution Speed | Typically slower; dependent on multiple venues | Generally faster; centralized execution |

| Best Use Case | Large block trades, minimizing market footprint | Frequent, smaller trades with immediate execution |

| Regulation | Heavily regulated but less transparent | Strict regulations with full market disclosure |

| Liquidity Depth | Potentially deeper due to aggregated hidden orders | Visible liquidity with limited depth during volatility |

Which is better?

Dark pool aggregation offers enhanced privacy and reduced market impact by consolidating large, non-public orders across multiple venues, benefiting institutional traders seeking discretion. Exchange-driven liquidity provides greater transparency, tighter spreads, and real-time price discovery due to centralized order books and high trading volumes. The optimal choice depends on trading objectives: dark pools suit large block trades requiring anonymity, while exchange liquidity favors speed and visible order flow for smaller or retail transactions.

Connection

Dark pool aggregation enhances trading efficiency by consolidating liquidity from multiple non-public venues, reducing market impact and slippage. Exchange-driven liquidity contributes transparent and regulated order flow, facilitating accurate price discovery and improved trade execution. The integration of dark pool aggregation with exchange liquidity creates a comprehensive liquidity spectrum, optimizing access for institutional and algorithmic traders.

Key Terms

Order Book

Exchange-driven liquidity relies on centralized order books where bids and offers are transparently matched, offering real-time price discovery and high market depth. Dark pool aggregation involves consolidating multiple non-transparent trading venues, which lack visible order books but provide large block trades with minimal market impact. Explore how these mechanisms affect market efficiency and trading strategies to deepen your understanding.

Market Transparency

Exchange-driven liquidity offers high market transparency by consolidating trades on regulated public platforms, allowing real-time price discovery and comprehensive order book visibility. Dark pool aggregation, while providing access to hidden liquidity and reducing market impact for large orders, lacks transparency due to the non-displayed nature of trades and limited pre-trade information. Explore the dynamics of these liquidity sources to understand their impact on market transparency and trading efficiency.

Execution Venue

Exchange-driven liquidity leverages transparent order books on regulated exchanges, enabling precise price discovery and immediate trade execution by matching buy and sell orders within the exchange's central marketplace. Dark pool aggregation consolidates liquidity from multiple private, non-transparent venues, minimizing market impact and signaling risk by routing large orders across various dark pools to optimize execution quality. Discover how selecting the right execution venue strategy can significantly enhance trading performance and reduce costs.

Source and External Links

Why is Liquidity Important for Exchanges? - Exchange-driven liquidity refers to the essential role that liquidity plays in enabling exchanges to facilitate trades quickly and efficiently with minimal price slippage, supporting high trade volumes, market stability, and attractiveness to users by maintaining tight bid-ask spreads and deep order books.

Crypto Liquidity Providers List and How to Choose the Best - In crypto markets, exchange-driven liquidity is created and maintained by liquidity providers--including market makers and automated liquidity pools--who ensure continuous trading by bridging buyers and sellers across fragmented ecosystems on both centralized and decentralized exchanges.

Enhancing Liquidity in Crypto Exchanges: Strategies and ... - Exchange-driven liquidity is the foundation of a healthy crypto exchange, characterized by deep order books and tight bid-ask spreads which enable seamless trade execution, reduce price volatility, and increase exchange profitability by attracting more traders and higher transaction volumes.

dowidth.com

dowidth.com