Algorithmic arbitrage exploits price discrepancies across different markets or assets using automated systems to execute high-frequency trades with minimal risk. Trend following relies on technical analysis and algorithms to identify and capitalize on asset price movements by riding sustained market trends. Explore the core strategies and benefits of algorithmic arbitrage versus trend following to optimize your trading performance.

Why it is important

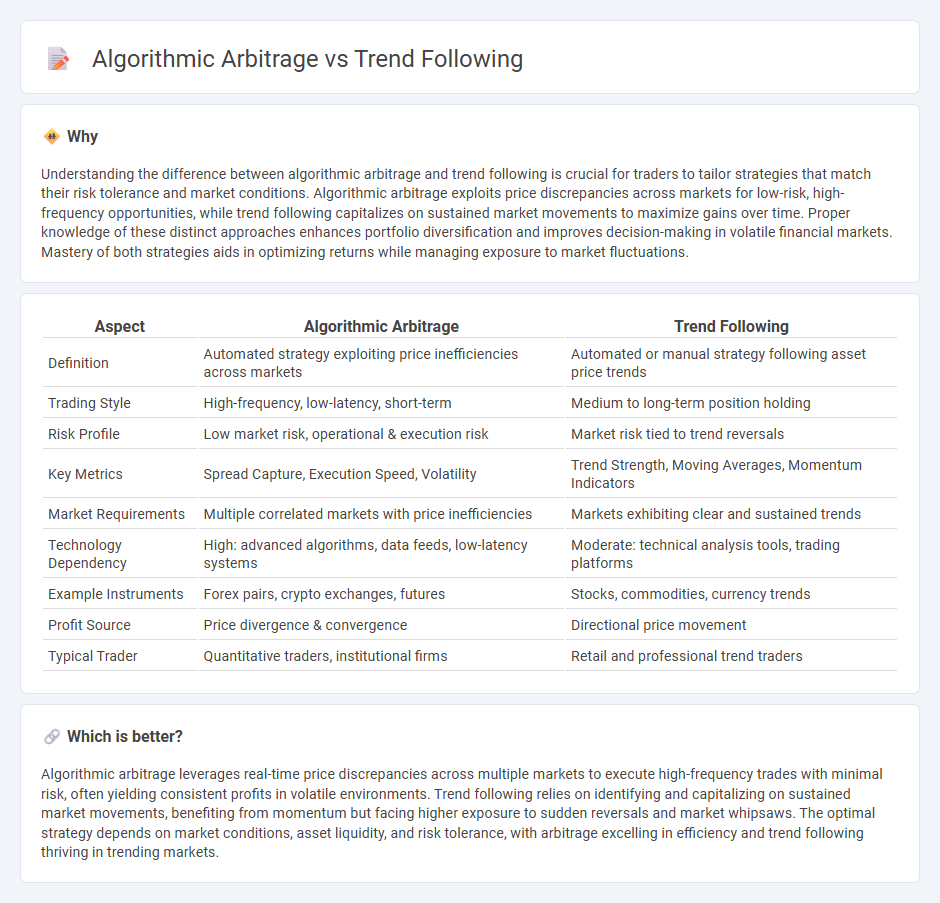

Understanding the difference between algorithmic arbitrage and trend following is crucial for traders to tailor strategies that match their risk tolerance and market conditions. Algorithmic arbitrage exploits price discrepancies across markets for low-risk, high-frequency opportunities, while trend following capitalizes on sustained market movements to maximize gains over time. Proper knowledge of these distinct approaches enhances portfolio diversification and improves decision-making in volatile financial markets. Mastery of both strategies aids in optimizing returns while managing exposure to market fluctuations.

Comparison Table

| Aspect | Algorithmic Arbitrage | Trend Following |

|---|---|---|

| Definition | Automated strategy exploiting price inefficiencies across markets | Automated or manual strategy following asset price trends |

| Trading Style | High-frequency, low-latency, short-term | Medium to long-term position holding |

| Risk Profile | Low market risk, operational & execution risk | Market risk tied to trend reversals |

| Key Metrics | Spread Capture, Execution Speed, Volatility | Trend Strength, Moving Averages, Momentum Indicators |

| Market Requirements | Multiple correlated markets with price inefficiencies | Markets exhibiting clear and sustained trends |

| Technology Dependency | High: advanced algorithms, data feeds, low-latency systems | Moderate: technical analysis tools, trading platforms |

| Example Instruments | Forex pairs, crypto exchanges, futures | Stocks, commodities, currency trends |

| Profit Source | Price divergence & convergence | Directional price movement |

| Typical Trader | Quantitative traders, institutional firms | Retail and professional trend traders |

Which is better?

Algorithmic arbitrage leverages real-time price discrepancies across multiple markets to execute high-frequency trades with minimal risk, often yielding consistent profits in volatile environments. Trend following relies on identifying and capitalizing on sustained market movements, benefiting from momentum but facing higher exposure to sudden reversals and market whipsaws. The optimal strategy depends on market conditions, asset liquidity, and risk tolerance, with arbitrage excelling in efficiency and trend following thriving in trending markets.

Connection

Algorithmic arbitrage exploits price discrepancies across markets using automated systems to execute trades rapidly, while trend following relies on algorithms to identify and capitalize on sustained price movements. Both strategies utilize quantitative models and real-time data analysis to optimize trade execution and risk management. The integration of these approaches enhances portfolio diversification and improves overall trading performance through complementary exploitation of market inefficiencies and momentum.

Key Terms

**Trend Following:**

Trend following employs systematic strategies to capitalize on persistent market directions by analyzing price momentum and moving averages, often leveraging tools like moving average crossovers and breakout patterns. This trading style emphasizes risk management through fixed stop-loss orders and position sizing to ride trends over medium to long-term horizons, typically in futures, forex, and equity markets. Explore how trend following can enhance portfolio performance and mitigate risks in dynamic markets.

Moving Average

Trend following strategies using Moving Averages capitalize on identifying sustained price directions by analyzing crossovers between short-term and long-term averages to signal entry and exit points. Algorithmic arbitrage exploits pricing inefficiencies across markets through automated systems, relying on rapid detection and execution rather than trend persistence. Explore deeper insights into how Moving Averages enhance both approaches for optimized trading performance.

Breakout

Breakout strategies in trend following capitalize on price movements breaking through resistance or support levels, signaling potential sustained trends. Algorithmic arbitrage focuses on exploiting price discrepancies across markets with automated systems, often relying less on breakout signals and more on rapid execution. Discover how breakout-based trend following can be optimized compared to algorithmic arbitrage techniques.

Source and External Links

Trend following - Wikipedia - Trend following is a trading strategy where traders buy assets during upward price trends and sell when the trend reverses, using techniques like moving averages and channel breakouts, aiming to ride price momentum rather than predict specific levels.

Trend Following Trading Strategies and Systems (Backtest Results) - Trend following strategies rely on technical analysis to enter trades aligned with prevailing market momentum, using tools like ATR channels and moving averages, emphasizing systematic rules, risk management, and adaptation to changing conditions.

Trend-Following Primer - Graham Capital Management - Trend-following is a major alternative investment approach using algorithmic models to identify and capitalize on price trends in various markets, offering diversification benefits and potential performance in both rising and falling markets.

dowidth.com

dowidth.com