Microstructure modeling analyzes the detailed processes and mechanics within financial markets, focusing on order flow, bid-ask spreads, and liquidity dynamics to provide insights into price formation and market behavior. Algorithmic execution strategies deploy automated trading systems that leverage quantitative models to optimize order placement, minimize market impact, and enhance trade efficiency in real-time. Explore further to understand how these approaches intersect and transform modern trading practices.

Why it is important

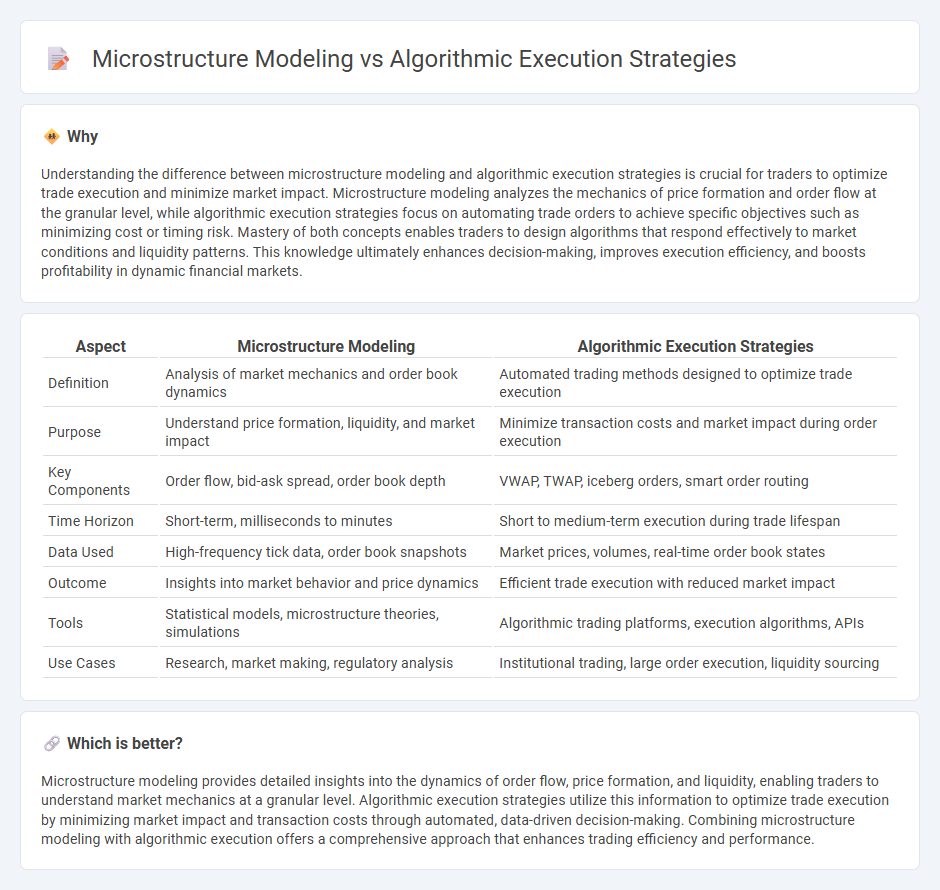

Understanding the difference between microstructure modeling and algorithmic execution strategies is crucial for traders to optimize trade execution and minimize market impact. Microstructure modeling analyzes the mechanics of price formation and order flow at the granular level, while algorithmic execution strategies focus on automating trade orders to achieve specific objectives such as minimizing cost or timing risk. Mastery of both concepts enables traders to design algorithms that respond effectively to market conditions and liquidity patterns. This knowledge ultimately enhances decision-making, improves execution efficiency, and boosts profitability in dynamic financial markets.

Comparison Table

| Aspect | Microstructure Modeling | Algorithmic Execution Strategies |

|---|---|---|

| Definition | Analysis of market mechanics and order book dynamics | Automated trading methods designed to optimize trade execution |

| Purpose | Understand price formation, liquidity, and market impact | Minimize transaction costs and market impact during order execution |

| Key Components | Order flow, bid-ask spread, order book depth | VWAP, TWAP, iceberg orders, smart order routing |

| Time Horizon | Short-term, milliseconds to minutes | Short to medium-term execution during trade lifespan |

| Data Used | High-frequency tick data, order book snapshots | Market prices, volumes, real-time order book states |

| Outcome | Insights into market behavior and price dynamics | Efficient trade execution with reduced market impact |

| Tools | Statistical models, microstructure theories, simulations | Algorithmic trading platforms, execution algorithms, APIs |

| Use Cases | Research, market making, regulatory analysis | Institutional trading, large order execution, liquidity sourcing |

Which is better?

Microstructure modeling provides detailed insights into the dynamics of order flow, price formation, and liquidity, enabling traders to understand market mechanics at a granular level. Algorithmic execution strategies utilize this information to optimize trade execution by minimizing market impact and transaction costs through automated, data-driven decision-making. Combining microstructure modeling with algorithmic execution offers a comprehensive approach that enhances trading efficiency and performance.

Connection

Microstructure modeling analyzes the detailed mechanics of order flows and price formation in financial markets, providing essential insights into liquidity, volatility, and trading costs. Algorithmic execution strategies leverage these models to optimize trade timing and order placement, minimizing market impact and slippage. By integrating microstructure dynamics, algorithmic trading algorithms enhance execution efficiency and adapt to real-time market conditions.

Key Terms

**Algorithmic Execution Strategies:**

Algorithmic execution strategies leverage pre-programmed trading algorithms to optimize order placement by minimizing market impact, reducing transaction costs, and managing timing risk. These strategies utilize real-time data analytics, historical market patterns, and predictive models to adapt execution tactics dynamically across different market conditions. Explore in-depth insights on how algorithmic execution enhances trade efficiency and capitalizes on market microstructure nuances.

VWAP (Volume Weighted Average Price)

Algorithmic execution strategies leverage VWAP as a benchmark to minimize market impact by slicing orders based on volume distribution over time. Microstructure modeling analyzes order flow, price formation, and liquidity dynamics to optimize VWAP-oriented executions in varying market conditions. Explore how integrating microstructure insights enhances VWAP-based algorithmic trading outcomes.

TWAP (Time Weighted Average Price)

Algorithmic execution strategies like TWAP optimize trade execution by slicing large orders into smaller intervals to minimize market impact and achieve price stability over time. Microstructure modeling analyzes market dynamics, including order book behavior and price formation, to understand how execution algorithms influence liquidity and volatility. Explore detailed comparisons between algorithmic strategies and microstructure models to enhance trading performance insights.

Source and External Links

Top 5 Algorithmic Trading Strategies | IG International - Describes key algorithmic execution strategies including trend following, arbitrage, mean reversion, index fund rebalancing, and market timing, each designed to systematically execute trades based on market data and patterns.

Execution Strategy - Quantra by QuantInsti - Defines execution strategies as those aiming to reduce market impact costs, classified into schedule-driven (e.g., TWAP, VWAP), opportunistic (dynamic timing), and evaluative approaches combining both.

Best Algo Trading Strategies 2025 - (Data-driven and backtested) - Provides examples and backtests of algorithmic trading strategies such as momentum (trend-following) and mean reversion, illustrating practical rule-based execution methods that manage entry and exit points.

dowidth.com

dowidth.com